Get ready for GST audit by department

Introduction:

In a recent communication plan for GST audit by the department is rolled out. The taxpayer is not getting out of annual return and GST audit by a professional dilemma. Section 65 & 66 of CGST Act gives deptt a right for audit. This audit will be in addition to the normal audit. Criteria for this activity is set by the letter. Thus following is the audit plan by depatment.

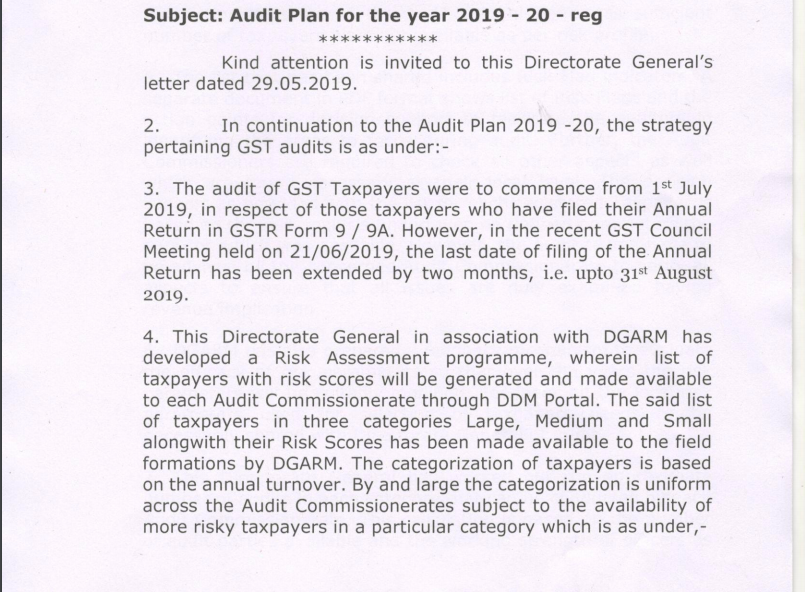

Audit Plan 2019 – 20 Letter

Criteria for taxpayers for GST audit by department:

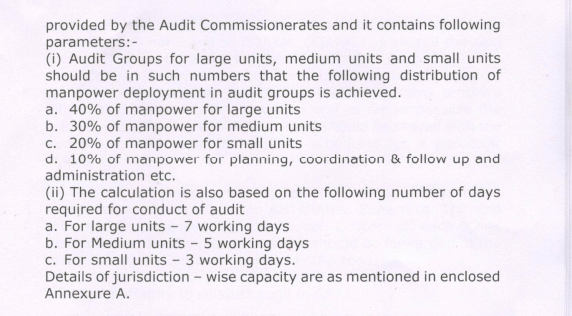

All taxpayers are divided into three categories. Small, medium and large. Allocation workforce will be as per the catagory.

i) All except the below two are large.

ii) Medium – taxpayers with turnover between Rs.10/7.5 to 40/30 crores.

iii) Small – taxpayers with turnover below Rs. 7.5/10 crores.

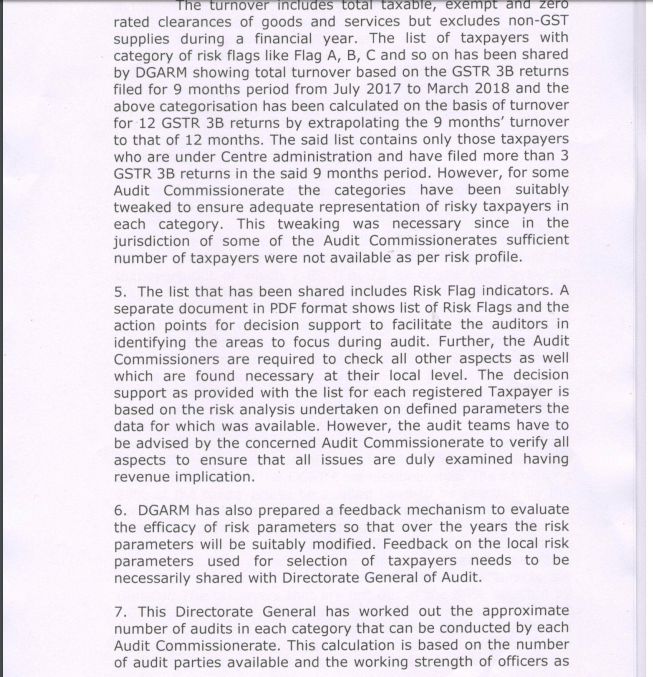

The turnover for this purpose will include the non-taxable and exempted turnover also. But it will exclude the non GST supply. It will be a turnover of 9 months. From July 2017 to March 2018. The list of taxayers with risk flags is shared with the concerned officers.

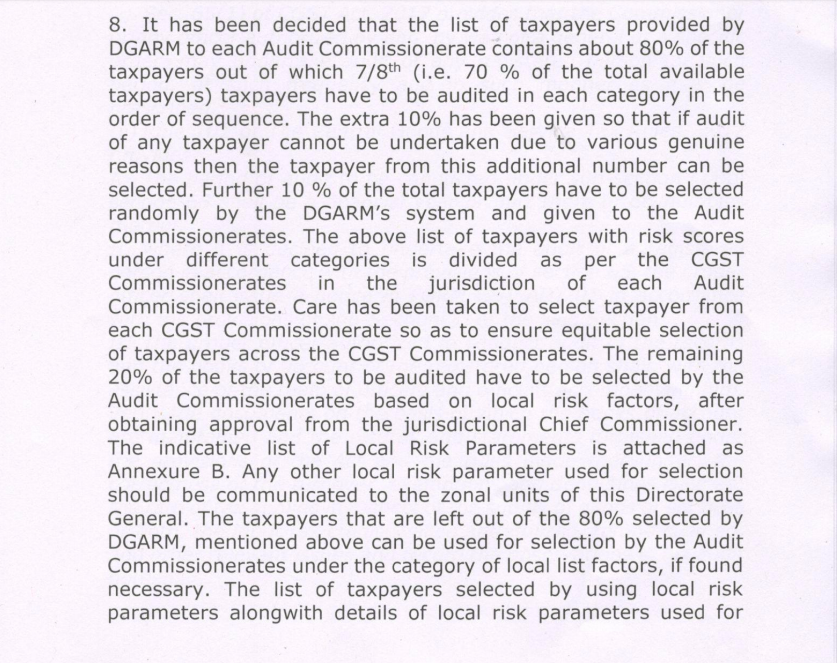

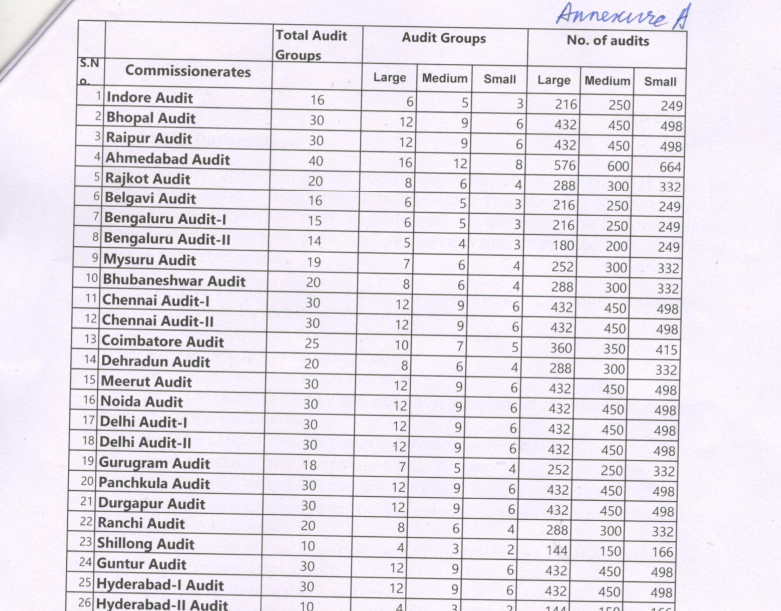

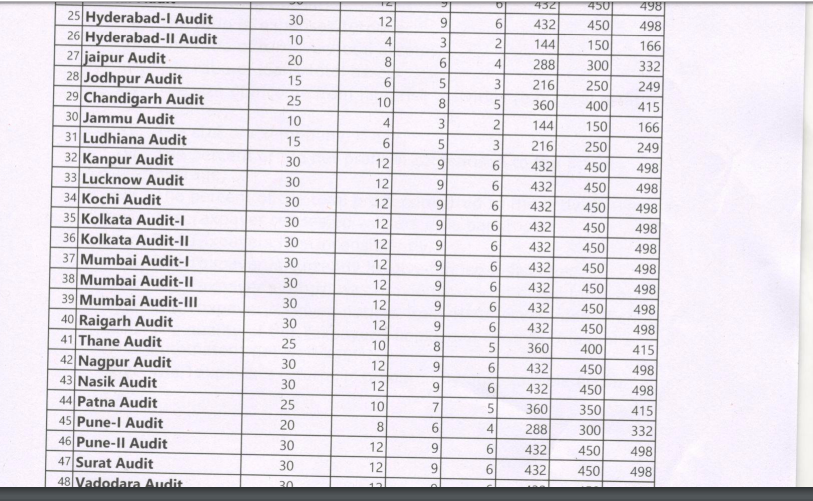

allocation of auditees to each commissionerates:

The allocation of assessee will be made in a rationale basis. The allocation of the workforce will be as per the number of auditees.

For detailed audit plan following annexures will be helpful.

For detailed audit plan following annexures will be helpful.

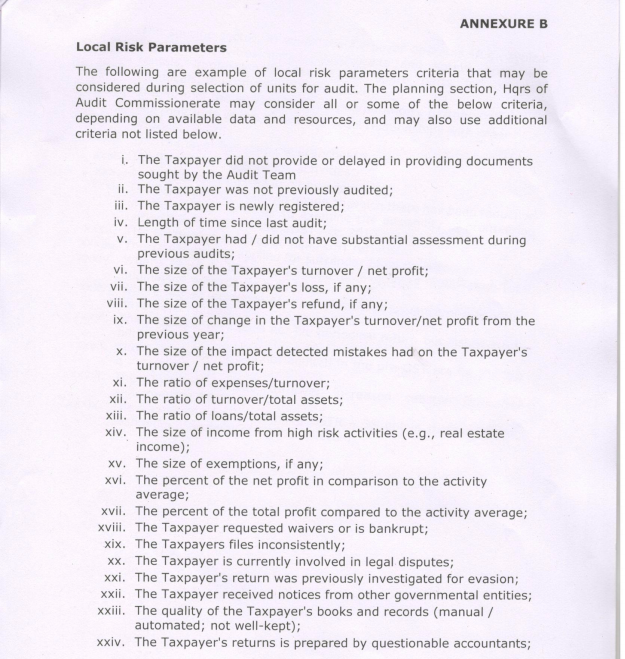

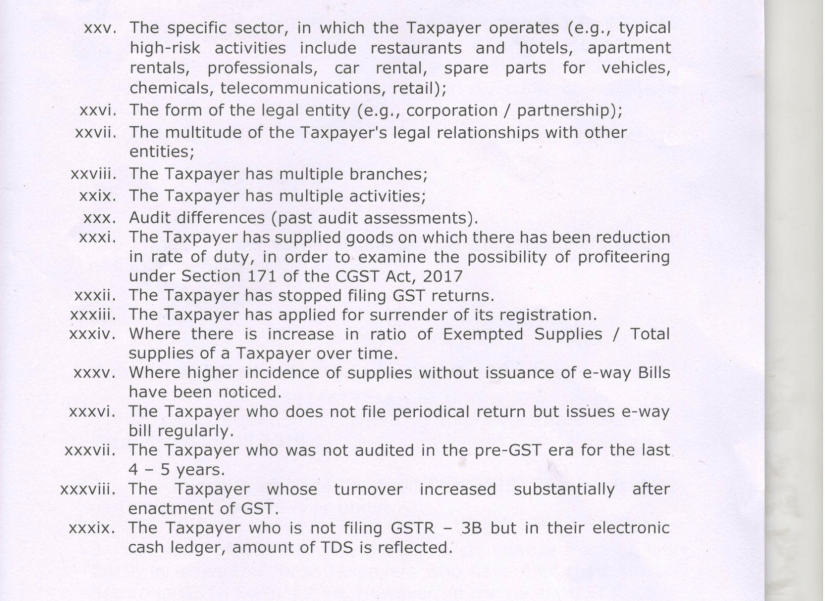

Risk assessment:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.