format of new return of GST: RET 01

Table of Contents

New return of GST:

GST new returns are introduced. New return system is simplified and easy. It has 3 parts. Anx 1, Anx 2 and RET 01. These anx are base for RET 01. The periodicity of return is monthly for the large taxpayer and quarterly for the large taxpayer. It’s prototype is available at GST portal. You need to know them before they are applicable.

When the new return of GST will be applicable?

New GST return will be applicable phases for the small and large taxpayer. Assessee having a turnover up to 5 Crore will be small taxpayers and above 5 crores will be large taxpayers.

Small Taxpayers:

GST return for the small taxpayer will be applicable from October 2019. They will start making payment via PMT 08. In January 2020 they will file first RET 01, which is quarterly for small taxpayers. First RET 01 will be filed for a period of October to December.

Large taxpayers:

In the case of large taxpayers, it will be applicable from November. They stop filing GSTR 3b. They will also file their first return in RET 01 in January 2020

What is the format of the new return of GST?

The new return will have the following parts:

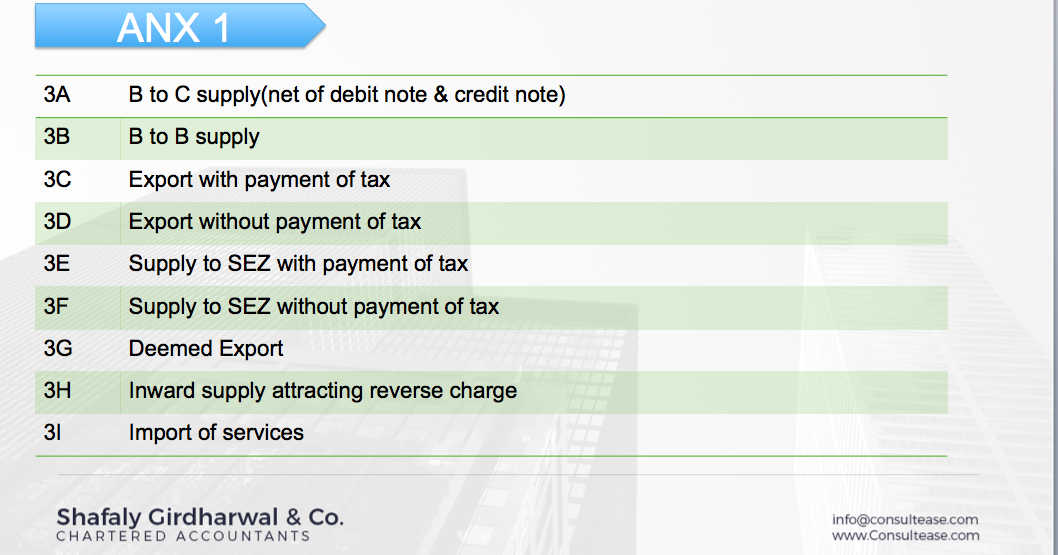

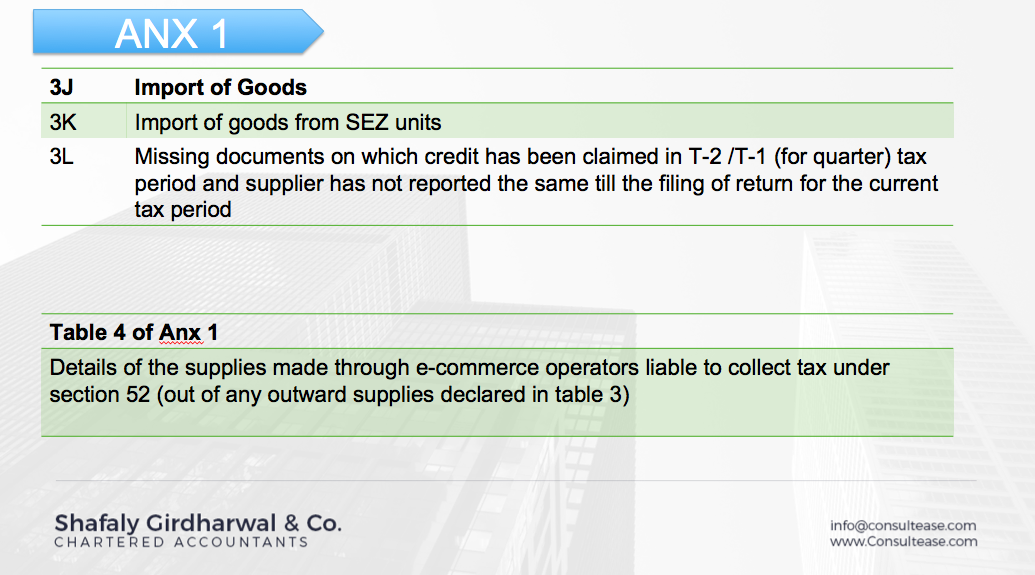

Anx 1 of new GST return :

This annex will contain the details related to the outward supply, RCM purchase and import. Please take caution it will include all amount liable for GST payment but not the advances. The amount advanced is also liable for GST but is a part of RET 01 and not of Annex 1. The content of Anx 1 is the following:

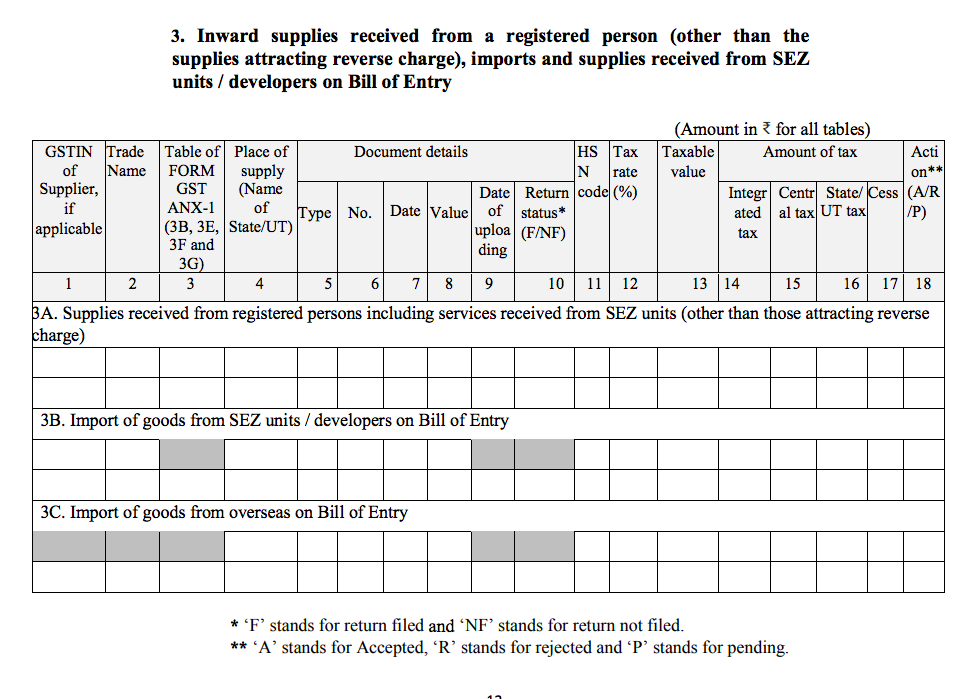

Anx 2 of new return of GST

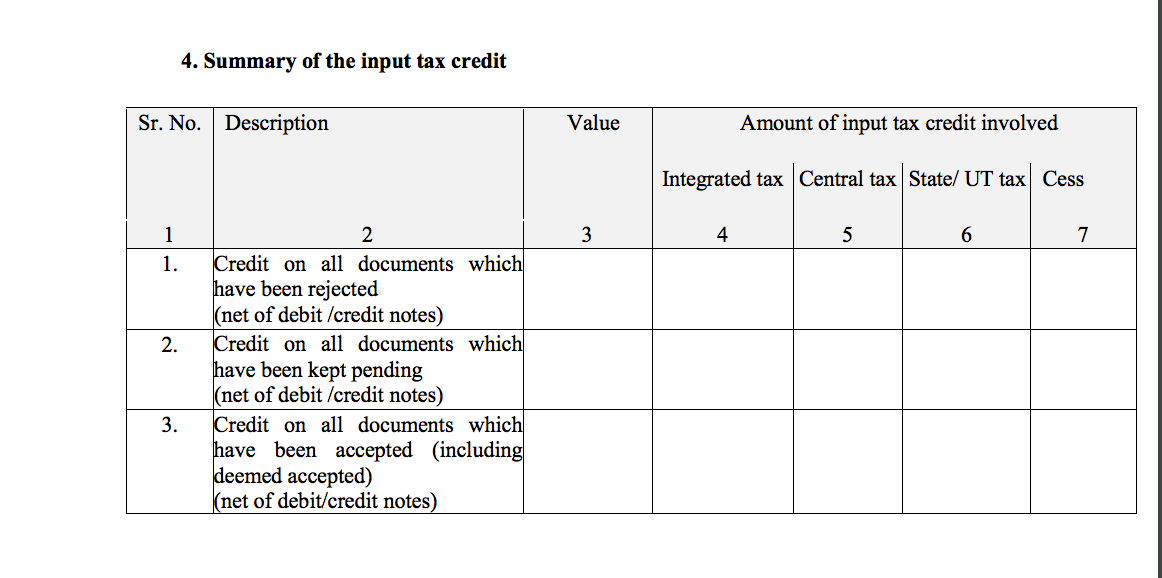

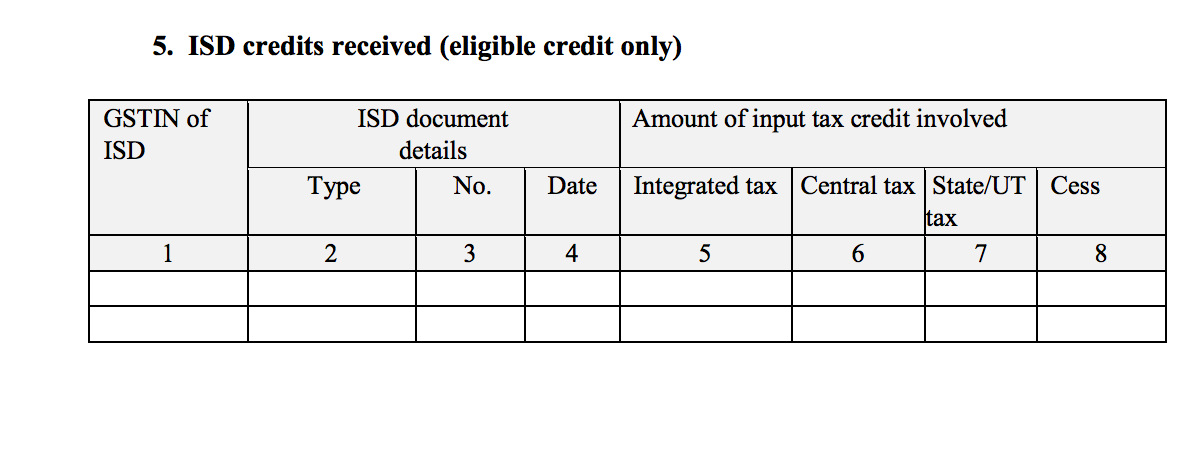

Anx 2 is for purchase and ITC. It has three tables. Table 3 is for inward supplies from registered person, import and SEZ inward supply. Out of this data, B 2 B invoices will be auto-populated. The recipient will have the right to accept, reject or keep pending. If the recipient is not taking any action, invoices will be deemed to be accepted.

Table 4 of annexure 2 covers the details related to involved ITC. This table has three parts:

- ITC pertaining to all rejected documents.

- ITCpertaining to all accepted documents.

- ITC pertaining to all accepted documents including the deemed accepted invoices.

All these three figures are equal to the entire auto populate invoice ITC.

`

What is Anx 1 in new GST return?

Anx 1 is a summary of outward supply and inward supply liable for RCM. Bills uploaded in anx 1 get auto-populated in Anx 2. These bills can be amended upto 10th of next month. Thus in new retrun amendment is also possible.

What is Annex 2 in the new GST return?

Anx 2 is a summary of inward supplies other than RCM.

What is RET 01 and what data it contains?

RET 01 is the main return of GST. It will be applicable at the end of 2019. First GST RET 01 will be applicable for Dec 2019. It will be filed in January.

RET 01 will contain four tables.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.