RCM on GTA for freight or maal bhada

Table of Contents

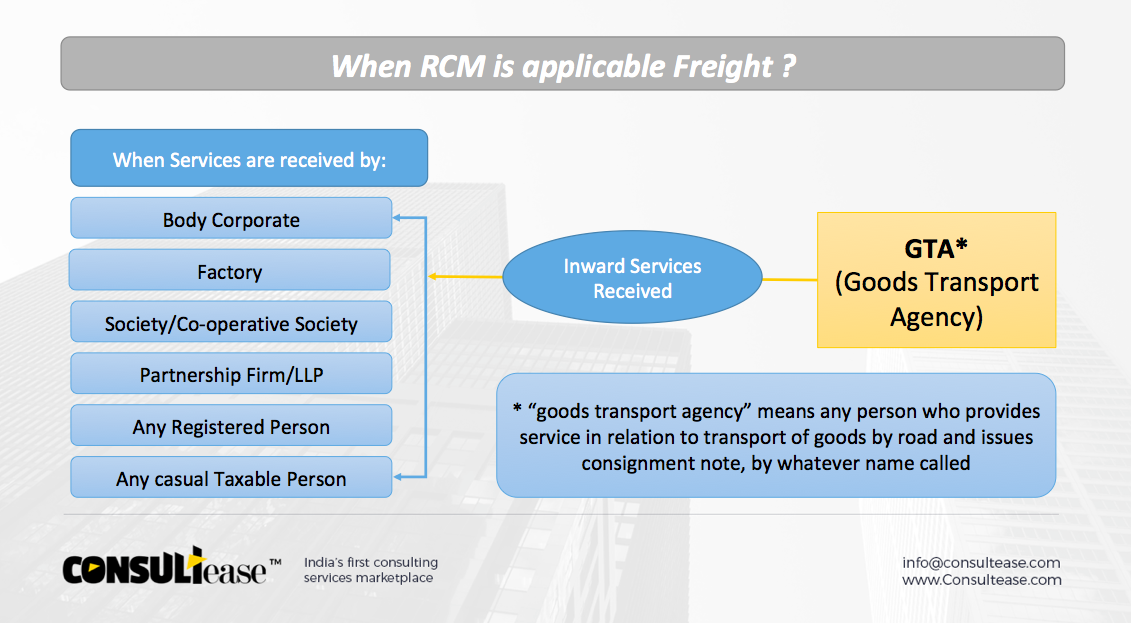

Who will be liable to pay tax on freight for services of GTA?

Recipient of services will be liable to pay tax in RCM @ 5%. GTA can also pay in forwarding charge @12%. In case they chose to pay in forwarding charge there is no need to pay in RCM on GTA. Here it is also important to know who is a GTA. It means a goods transport agency who transport goods for others and issue a consignment note. Notification no. 13/2017 lists the recipients who are covered in RCM. Each entry is discussed in detail in the article on this link. click on text.

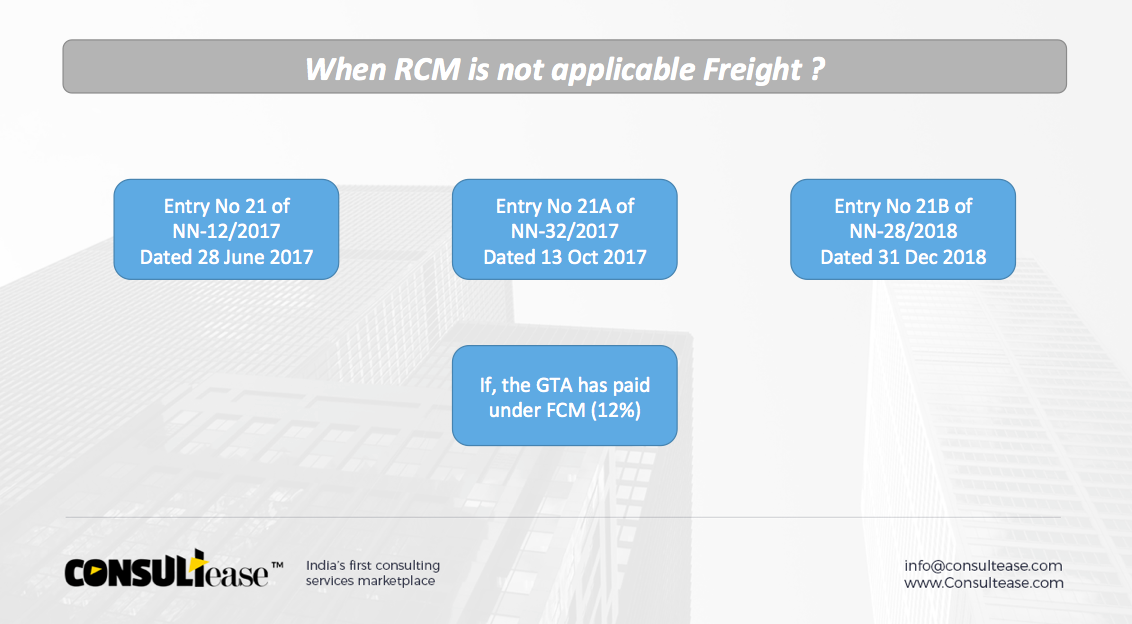

When RCM on GTA for freight or maal bhada is not applicable?

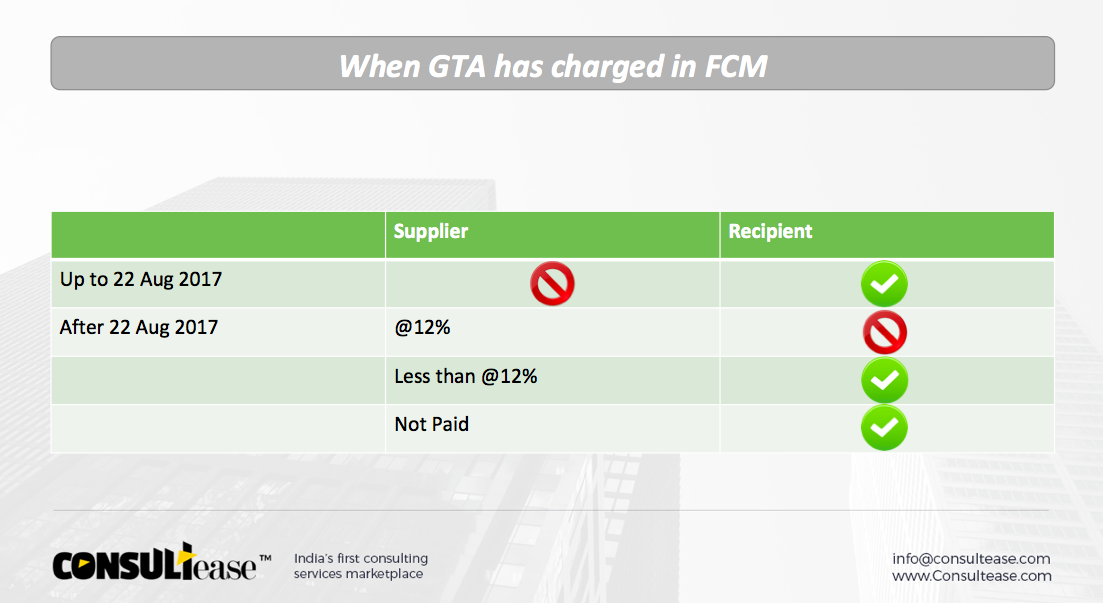

There are some exemptions from RCM. We have list them for easy reference. Notification 12/2017 exempts some of the cases. In these cases, transportation or maal bhada is itself exempted so there is no need to pay in RCM too. Transporter can pay in forwarding charge also. In this case, tax is payable but RCM is still not applicable. Take care to note that in case transporter is paying tax at a lower rate RCM is still applicable. Following are the entries covering exemptions for GTA. Thus check on the bill first for a forward charge.

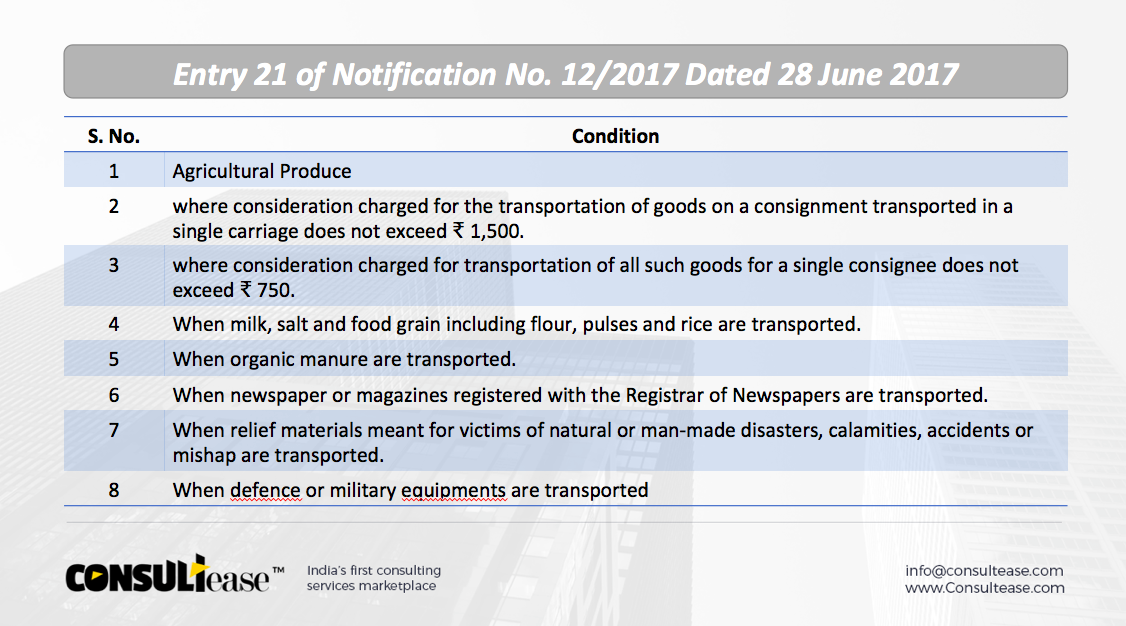

Transportation of some articles covered in entry no. 21 of 12/2017 is exempted.

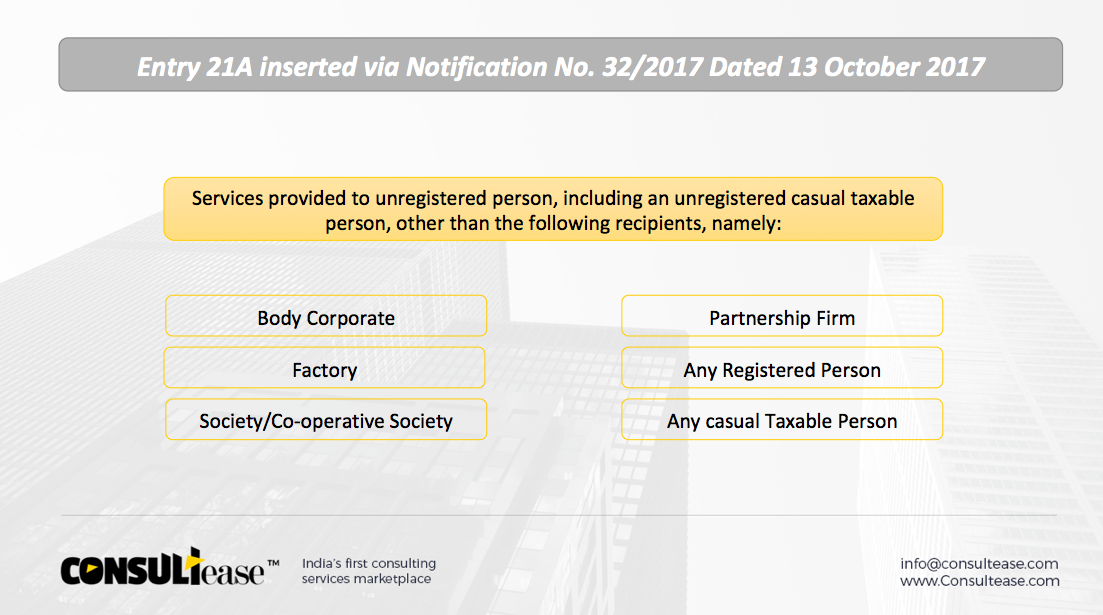

Entry 21A inserted via Notification No. 32/2017 Dated 13 October 2017

These entries are following.

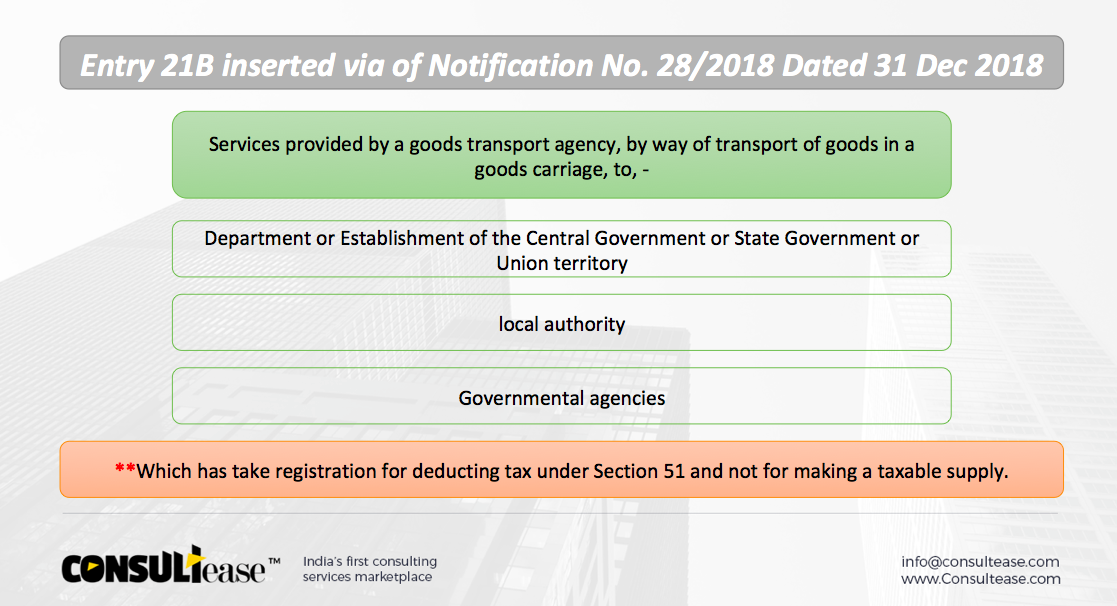

Entry 21B inserted via of Notification No. 28/2018 Dated 31 Dec 2018

When GTA has charged in FCM

Examples:

These are the cases when RCM is not applicable. Let us try to understand this concept with some examples now.

- Mr. A sold some goods to Mr. Z. He arranged transportation of goods via Mr. T. Goods are picked from the place of Mr A and dropped at the place of Mr. Z. Who is liable to pay tax on this transaction?

Case1: Mr. T charge tax @12% in forward charge. In this case no need to pay RCM. Freight is billed to Mr. A. He will be eligible to take ITC of freight. Mt T is also eligible to utilise his ITC for this payment.

Case 2: Bill is raised in name of Mr. Z. In this case Mr. Z is eligible for ITC.

Case 3: Mr T is not charging in forward charge. In this case Mr. A or Mr. Z as per bill raised. Thus recipient is important.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.