GST Council is formed without having constitution power–

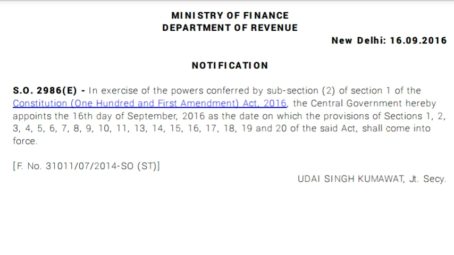

All the provisions of The Constitution (101st Amendment) Act, 2016 comes into effect from 16/09/2016. Section 1 is also effective w.e.f. 16/09/16, which gives power to the Central Government to issue notification for effecting the various provisions of the said Act. Now, when Section 1 itself has come into force w.e.f. 16/09/16, I am wondering under which power the Central Government issued notification on 10/09/2016 for bringing into force Section 12 of the Act w.e.f. 12/09/2016. It is pertinent to mention that Section 12 has inserted Article 279A in the Constitution which has conferred powers to the President to constitute GST Council and using the same, the President has already constituted GST Council w.e.f. 15/09/2016.

Does it mean GST Council is formed without having constitution power and is therefore void ab initio?

Does it mean GST Council is formed without having constitution power and is therefore void ab initio?

For any query please mail at servicetaxexpert@yahoo.com