Guide to file GSTR 9

As per provision of GST Registered Taxpayer is required to File Annual Return (GSTR 9) once in a financial year on or before the 31st December following the end of the financial year and shall furnish in electronically through the common portal either directly or through a Facilitation Centre notified by the commissioner.

- The Due Date for filing annual Return 2017-2018 has been further extended to 31st August 2019 vide Sixth Removal of difficulties Order No.6/2019 CT dated 28.06.19

- Refer : Act: Section 44(1)

- Refer : Rules: Rule 80

- Notification No.39/2018 Central Tax Date 4th September 2018

- In this regard, GSTR9 has been Amend Notification No.74/2018 Central Tax Date 31st December 2018 And Further Amended Notn.31/2019 Dt 28.06.19 S.No.24

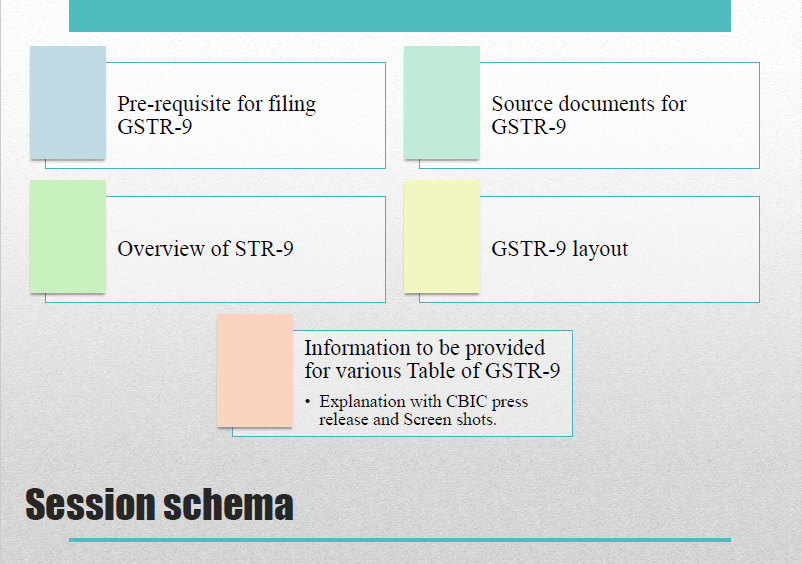

Before filing GSTR-9 please read

- CBIC Press release dated 04-06-2019

- CBIC Press release dated03-07-2019

The primary data source for declaration in annual return: ( CBIC Press Release 03-07-2019)

- “Information in FORM GSTR-1, FORM GSTR-3B and books of accounts should be synchronous and the values should match across different forms and the books of accounts.

- If the same does not match, there can be broadly two scenarios, either tax was not paid to the Government or tax was paid in excess.

- In the first case, the same shall be declared in the annual return and tax should be paid and in the latter, all information may be declared in the annual return and refund (if eligible) may be applied through FORM GST RFD-01A.

- Further, no input tax credit can be reversed or availed through the annual return.

- If taxpayers find themselves liable for reversing any input tax credit, they may do the same through FORM GST DRC-03 separately.

Sources of information for filling up GSTR-9

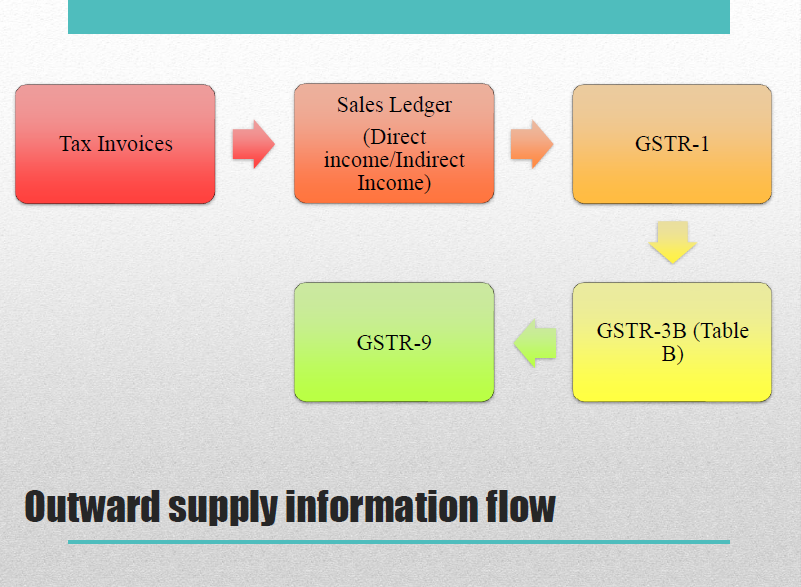

Outward supply

- Tax Invoices

- Bill of Supply

- Revised invoices

- Credit and Debit notes for Outward supply

- Vouchers for Advance receipts

- Refund Vouchers

Inward supply

- Tax Invoices Bill of Supply

- Revised invoices

- Credit and Debit notes for inward supply

- Vouchers for Advance receipts

- Vouchers for RCM payments

Download the full ppt on Guide to File GSTR 9, by clicking the below image: