41/2019 CT: late fees for R-1,6 waived off in some areas

Late fees of GSTR 1 & 6 is waived off:

CBIC via its notification no. 41/2019 dated 31/8/2019 has waived off the late fees. This benefit is available only if the return is filed upto 20th September.

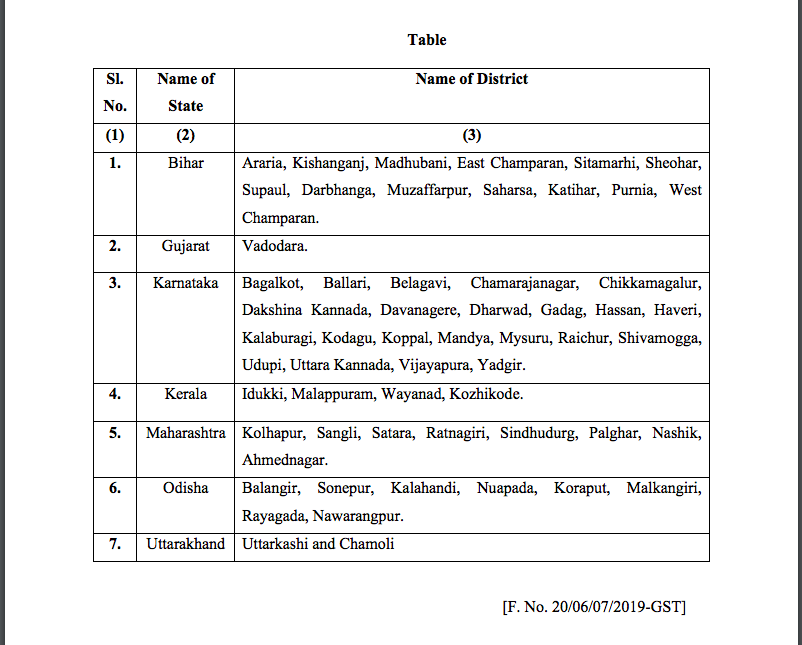

Following areas are covered by the

exemption.

(i) the registered persons whose principal place of business is in the district mentioned in column (3) of the Table below, of the State as mentioned in column (2) of the said Table, having aggregate turnover of more than 1.5 crore rupees in the preceding financial year or the current financial year, who have furnished, electronically through the common portal, details of outward supplies in FORM GSTR-1 of the Central Goods and Services Tax Rules, 2017, for the month of July, 2019, on or before the 20th September, 2019;

(ii) the registered persons whose principal place of business is in the State of Jammu and Kashmir, having aggregate turnover of more than 1.5 crore rupees in the preceding financial year or the current financial year, who have furnished, electronically through the common portal, details of outward supplies in FORM GSTR-1 of the Central Goods and Services Tax Rules, 2017, for the month of July, 2019, on or before the 20th September, 2019;

(iii)the Input Service Distributors whose principal place of business is in the district mentioned in column (3) of the above said Table, of the State as mentioned in column (2) of the said Table, who have furnished, electronically through the common portal, return in FORM GSTR-6 of the Central Goods and Services Tax Rules, 2017, for the month of July, 2019, on or before the 20th September, 2019;

(iv)the Input Service Distributors whose principal place of business is in the State of Jammu and Kashmir, who have furnished, electronically through the common portal,return in FORM GSTR-6 of the Central Goods and Services Tax Rules, 2017, for the month of July, 2019, on or before the 20th September, 2019.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.