Download IT & GST Ready Reckoner PDF

We have prepared the IT & GST Ready Reckoner, in which all the basic concepts of Income Tax and GST will be covered. IT & GST Ready Reckoner is created to make the work easy for professionals. Following are the topics covered in the IT & GST Ready Reckoner:

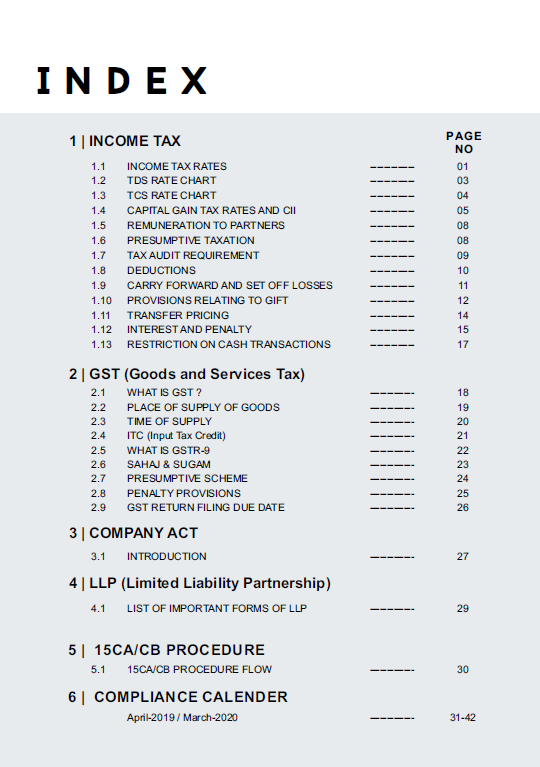

Table of Contents

1. Income Tax

1.1 INCOME TAX RATES

1.2 TDS RATE CHART

1.3 TCS RATE CHART

1.4 CAPITAL GAIN TAX RATES AND CII

1.5 REMUNERATION TO PARTNERS

1.6 PRESUMPTIVE TAXATION

1.7 TAX AUDIT REQUIREMENT

1.8 DEDUCTIONS

1.9 CARRY FORWARD AND SET OFF LOSSES

1.10 PROVISIONS RELATING TO GIFT

1.11 TRANSFER PRICING

1.12 INTEREST AND PENALTY

1.13 RESTRICTION ON CASH TRANSACTIONS

2. GST (Goods and Services Tax)

2.1 WHAT IS GST ?

2.2 PLACE OF SUPPLY OF GOODS

2.3 TIME OF SUPPLY

2.4 ITC (Input Tax Credit)

2.5 WHAT IS GSTR-9

2.6 SAHAJ & SUGAM

2.7 PRESUMPTIVE SCHEME

2.8 PENALTY PROVISIONS

2.9 GST RETURN FILING DUE DATE

3. Company Act

3.1 INTRODUCTION

4. LLP (Limited Liability Partnership)

4.1 LIST OF IMPORTANT FORMS OF LLP

5. 15CA/CB PROCEDURE

5.1 15CA/CB PROCEDURE FLOW

6. COMPLIANCE CALENDER

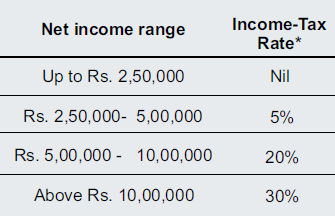

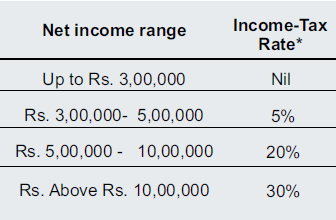

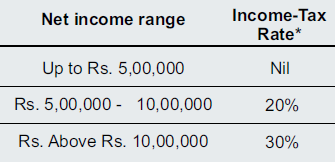

1.1 Income Tax Slab Rate for AY 2020 – 21

Individual (resident or non‐resident), who is of the age of less than 60 years on the last day of the relevant previous year:

Resident Senior Citizen, i.e., every individual, being a resident in India, who is of the age of 60 years or more but less than 80 years at any time during the previous year:

Resident Super Senior Citizen, i.e., every individual, being a resident in India, who is of the age of 80 years or more at any time during the previous year:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.