Format of FORM SVLDRS-4 in PDF

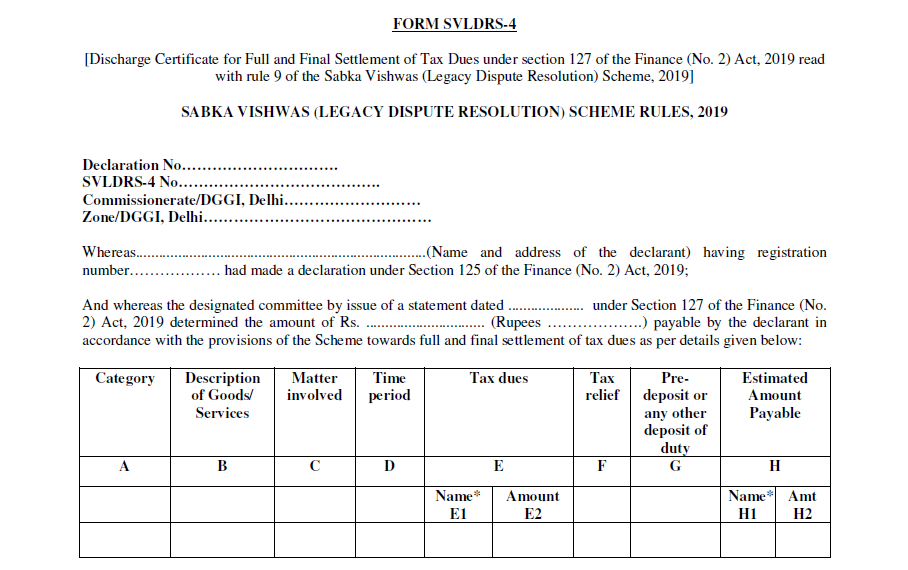

FORM SVLDRS-4

FORM SVLDRS-4

[Discharge Certificate for Full and Final Settlement of Tax Dues under section 127 of the Finance (No. 2) Act, 2019 read with rule 9 of the Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019]

SABKA VISHWAS (LEGACY DISPUTE RESOLUTION) SCHEME RULES, 2019

Declaration No………………………….

SVLDRS-4 No………………………………….

Commissionerate/DGGI, Delhi………………………

Zone/DGGI, Delhi………………………………………

Whereas………………………………………………………………….(Name and address of the declarant) having registration number……………… had made a declaration under Section 125 of the Finance (No. 2) Act, 2019;

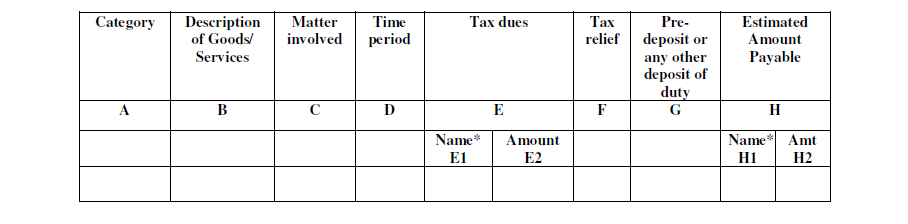

And whereas the designated committee by issue of a statement dated ……………….. under Section 127 of the Finance (No. 2) Act, 2019 determined the amount of Rs. …………………………. (Rupees ……………….) payable by the declarant in accordance with the provisions of the Scheme towards full and final settlement of tax dues as per details given below:

And whereas the declarant has paid Rs. ………………………………………… (Rupees ……………….) being the amount payable determined by the designated committee under section 126 of the Finance (No. 2) Act, 2019;

And whereas the declarant had filed an appeal before the ………………….. (mention the name of the Commissioner (Appeal) or the CESTAT (Branch name) against any order in respect of the tax dues and whereas the said appeal is deemed to be withdrawn in accordance with the provisions contained in sub-section (6) of section 127 of the Finance (No. 2) Act, 2019;

OR

And whereas the declarant had filed a writ petition/appeal/reference before …………………..(mention the name of the High Court) High Court or the Supreme Court against any order in respect of the tax dues and the declarant has withdrawn the said writ petition/appeal/reference and furnished proof of such withdrawal in accordance with the provisions contained in sub-section (7) of section 127 of the Finance (No. 2) Act, 2019;

Now, therefore, in exercise of the powers conferred by sub-section (8) of section 127 of the Finance (No. 2) Act, 2019, the designated committee hereby issues this Discharge Certificate to the said declarant:-

(a) certifying the receipt of payment from the declarant towards full and final settlement of the tax dues

determined in the Statement No…………dated………….in accordance with the Declaration

no………dated……..made by the aforesaid declarant;

(b) discharging the declarant from the payment of any further duty, interest or penalty with respect to the

aforesaid matter;

(c) granting immunity, subject to the provisions contained in the Scheme, from instituting any proceeding

for prosecution for any offence under the Central Excise Act 1944/ Chapter V of the Finance Act 1994/–

———- Cess Act —-) or from the imposition of penalty under the said enactment, in respect of the

aforesaid matter; and

(d) The provisions of sections 129 and 131 of the Finance (No.2) Act 2019 will be applicable with respect to this Discharge Certificate.

Members of the Designated Committee

1. Name: 2. Name:

Designation: Designation:

(This is a computer generated print. There is no need for a signature)

Place……………………….

Date………………………..

To

1. The Declarant

2. Adjudicating Officer

3. Commissioner of Central Excise, Service Tax and CGST (jurisdictional)

4. Chief Commissioner of Central Excise, Service Tax and CGST / Pr. Director General, DGGI

5. Concerned Appellate Forum

NB: Delete whatever is not applicable.

Download the Format of the FORM SVLDRS-4, below:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.