late payment penalty is not interest: Maha AAR & AAAR

Table of Contents

Introduction:

AAAR of Maharastra held the decision of AAR. The case of Bajaj finance limited was taken to AAAR. late payment penalty does not interest, held by AAR. It is confirmed by AAAR.

Facts of the case:

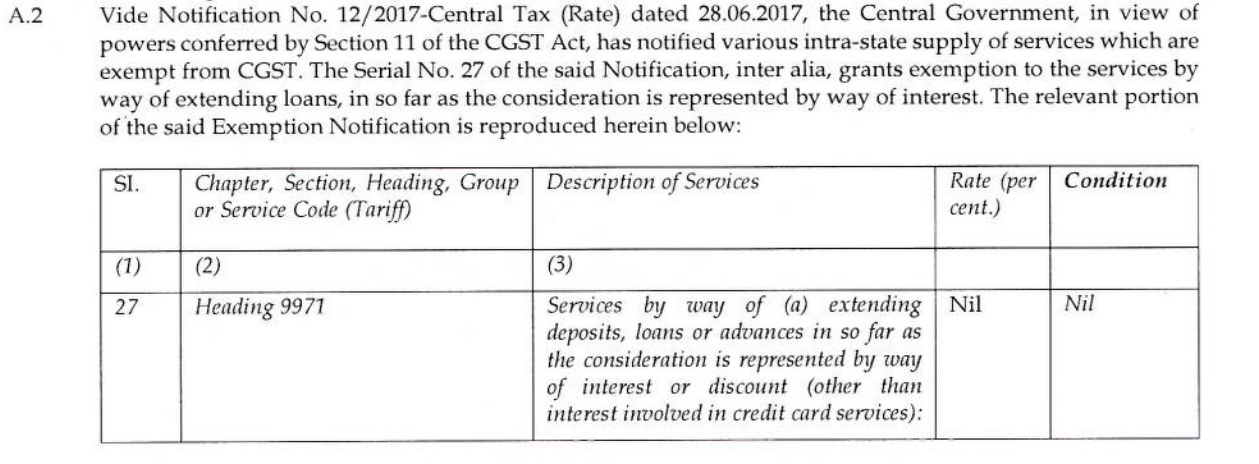

In this case, the applicant is a non-banking financial company. He was engaged in the services of lending money. In case of default in payment, they re charging penal interest apart from the normal interest. Notification no. 12/2017 covering the list of services exempted from GST. Entry no.27 covers the interest. The question raise, in this case, was about the applicability of this entry. Whether the penal interest falls in this entry? If it falls in this entry it will be exempted. Otherwise, it is taxable. The applicant is of view that the penal interest is in nature of additional interest. Thus not liable for GST. The entry of 12/2017 is reproduced by the applicant.

Observation of AAR as upheld by AAAR:

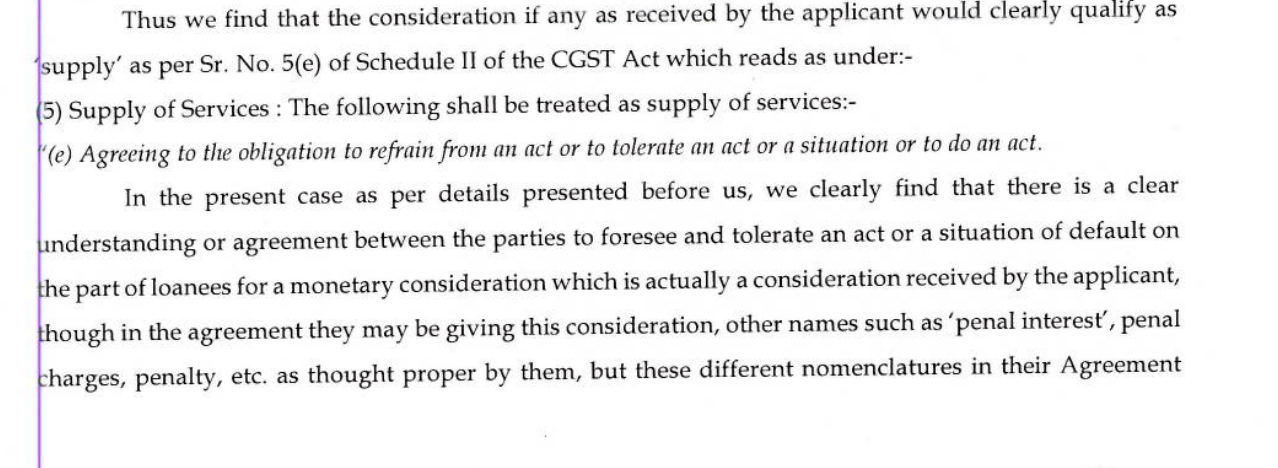

The AR observed that it is not a collection in the nature of interest. It is a case of tolerating the act of another party. This case is covered by entry no. 5e of schedule II of CGST Act. It was held by authority that this is taxable under GST at a residuary rate of 18% as it is a supply not falling in the exemption. Important extraxt of decision is reproduced here.

The matter was taken to the appellate authority of advanced ruling. The same was affirmed by AAAR of Maharastra state. The decision of AAR is correct and the penal interest is a supply under entry 5(e) of schedule II. It is not an additional interest. Orders of both of the authorities are attached here. You can download and read them for a detailed understanding of the facts. This decision is going to affect many other industries also.

Download the Copy of AAR, below:

Download the order of AAAR, below:

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.