Do you need to pay GST on discount?

Introduction: relevance of 105/2019

There is a lot of hue and cry over the taxability of post-sale discounts in GST. Recently CBIC withdrawn their circular number 105/2019 dated 28-06-2019. The circular was about the taxability of the post-sale discount. A question was there, Do we need to pay GST on discount? It explained the difference between the post-sale discount and an incentive. Let us first compile the important provisions here:

- Section 15(3) of CGST Act

- Circular No. 92/11/2019-GST dated 7th March 2019

- Circular No. 105/24/2019-GST Dated the 28th June 2019

Basic provision u/s 15(3) of CGST Act

The base provision provides for the following conditions to reduce discount from the value of supply.

- If the discount is given before or at the time of supply:

It can be reduced from the value of supply if it is duly recorded on the invoice.

- If the discount is given after the supply:

- It should be established in terms of an agreement entered before the time of supply.

- It should be linked to the relevant invoices.

- ITC attributable to those invoices is reversed by the recipient of the supply.

Then two circulars tried to explain these provisions. A hue and cry were made especially for the 105/2019. Why? Two important paras of this circular tried to tax some transactions generally booked as a discount.

Discount for some promotional activity by dealer:

Let me explain it via an example.

Mr. A is a vendor and he sell goods related to Collage manufacturing. It is a general practice to run sales promotion schemes at the festive time. Collage limited offered Mr. That they will give an additional discount of 10% if they sell 100,000 additional units in Diwali season. Now Mr. A wanted to grab the offer. He put some hoardings in near by area. Shifted display of Collage lts products from backward to front of the showroom. He crossed the quantity and availed the quantity discount.

Is it a discount? Let me check. It was pre-decided via an agreement? Yes

It was based on quantity so it was a quantity discount. In fact, it can be allocated to the quantity to which it is assigned.

Do we have any problem with that? No

But this circular tried to create a deeming fiction. That is any additional activity is done by the seller, then the benefit passed on is not a discount but it is an incentive. What is an incentive? An amount passed on for achieving a target. It is paid as a token of appreciation. Can we offer a discount as an incentive or an incentive as a discount?

Let me reproduce the language of circular. It will make my point more clear.

In case the dealer is asked to take any further step or special instruction to boost the sale. It can be taken as a supply from the dealer to the supplier. So the discount which we were thinking of reducing from the value will become a fresh supply from the dealer to the supplier.

E.g.

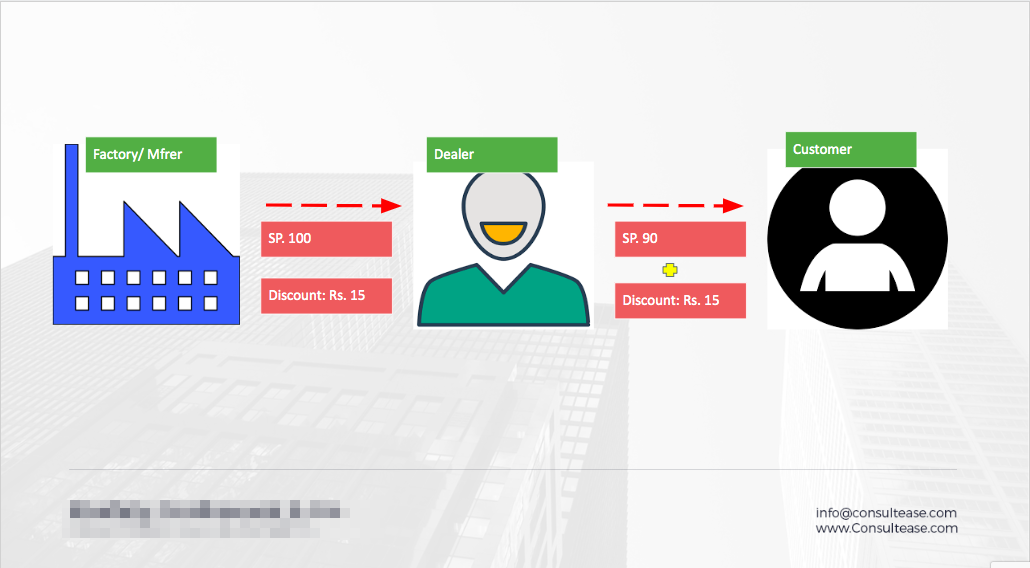

In our case let say sale price was Rs. 100. Now the additional discount of Rs. 10 on 1,00,000 units will be there. The treatments dealers are doing or expected by dealers are.

Sale : Rs. 100 * 100,000 = one hundred lacs

Discount: Rs.10 * 100,000= ten lacs

Net sale liable for GST= Ninety lacs.

What CBIC circular has clarified for quantity discount

Sale: supplier to dealer: Rs. one hundred lacs

Sale from dealer to supplier: Rs. 10 lacs

Tax will be on one hundred lac from supplier to dealer. On supply from dealer to supplier tax will be on Rs. ten lac.

If we see the ultimate impact will be almost the same. The net tax on the total transaction is on Rs. 90 lacs.

Still, there are some effects that may hurt some of the taxpayers. But still transaction can be clarified by making better arrangements. Both can follow this treatment. You need to remember that even if the circular is rescinded the provision of section 15(3) also supports this.

Discount for seeling at a lesser price added to the taxable value of a customer:

This was the most hazardous part of this circular. It created a fiction for a remote possibility. It rebutted the basic definition of supply itself. Fist of all sees the text itself.

Now let us take an example again. X Ltd sold cement bags to their distributor at Rs. 100. The distributor sell these bags to customers at Rs. 90. They were bearing a loss of Rs. 10. Then X ltd offered them a discount of Rs.20 for each bag sold. Now CBIC says via that circular that this 20 Rs is also the consideration received for sale to customers. The only thing is it is received from the manufacturer and not from the customer. The value for levy of tax on customers shall include this Rs. 20 also. The buyer can take the ITC if he is registered.

Now, this definitely created a deeming fiction to a remotely associated transaction. On the other hand, it was making an impact on the buyer. This practice is prevalent in the cement industry. Most of the buyers don’t get ITC of cement when they construct for self.

Taking back of this circular will relieve this transaction. Beneficial for the taxpayers. Thanks for the reading. You can post your issues on this topic at the following link.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.