Overview on Changes in GSTR 9 & 9C

CBIC vide this notification, extended the due date of filing FORM GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Return) for the FY 2017-18 and FY 2018-19. Also, CBIC notified some amendments in both the forms for ease filing of returns. So, we have created an overview on chnages in GSTR 9 & 9C.

• For FY 2017-18, the due date for filing Form GSTR-9 & 9C is 31st December 2019. For FY 2018-19, the due date for filing Form GSTR-9 & 9C is 31st March 2020.

A. Amendments/changes in FORM GSTR-9 (FY 2017-18 and FY 2018-19) are as follows:

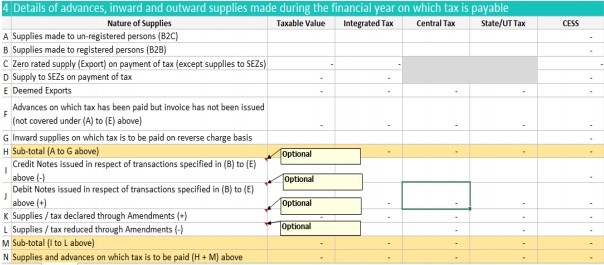

1. Details of Advances, inward and outward supplies: Table 4 Changes:

Reporting separate figures for current year amendments and DN/CN has been made optional. Net figures can be reported in Table 4.

Reporting separate figures for current year amendments and DN/CN has been made optional. Net figures can be reported in Table 4.

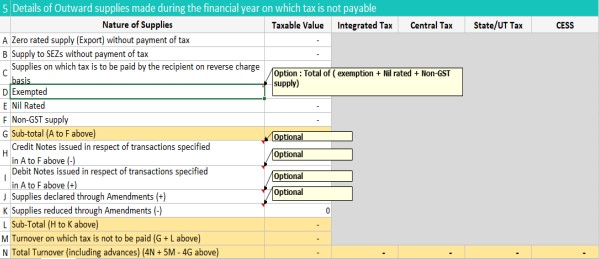

2. Outward Supplies Changes:

NIL supplies/Exempt supplies/Non- GST supply either report separately in respective field or report consolidated information for all these three heads in “exempted” (5D) row only.

Serial Number 5D,5E, 5F, 5H to 5K, (Para 4): Reporting separate figures for current year amendments and DN/CN has been made optional. Net figures can be reported in Table 5

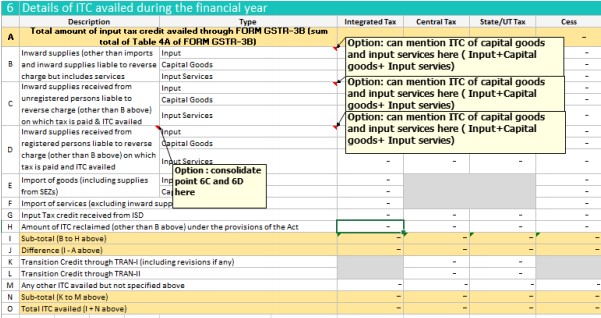

3. Changes in Input Tax Credit:

Serial No 6B to 6E (Para 5): ITC bifurcation as per Inputs/Capital Goods/ Input services can be reported together in “inputs” only. No bifurcation needed. To apply to RCM ITC

and import ITC as well. Also, there is an option to either report Table 6C and 6D separately or report the consolidated details of Table 6C and 6D in Table 6D only.

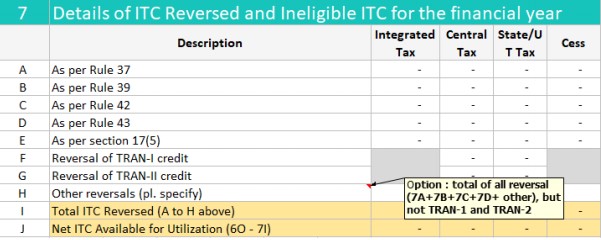

4. ITC Reversed and ineligible ITC changes

Serial No 7A to 7H (para 5):

There is an option either to fill details separately in their respective field or report entire amount of reversal in Table 7H only. Though TRAN-1 credit (table 7F) and TRAN2 credit (table 7G) are to be mandatorily reported.

Download the PDF of “Overview on changes in GSTR 9 & 9C” below:

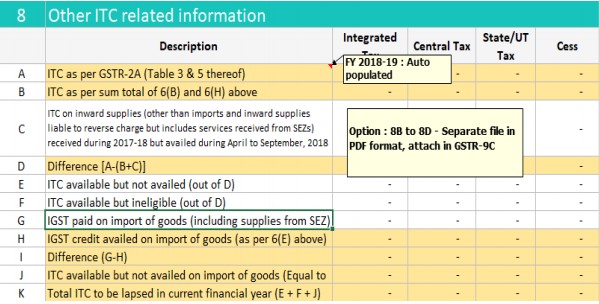

5. Other ITC (Table 8) changes:

Serial Number 8A:

For FY 2018-19, it may be noted that FORM GSTR-2A generated as on 1st November 2019 shall be auto-populated in this table. For FY 2017-18 and FY 2018-19, the registered person shall have an option to fill figures in a separate file (PDF format) and could be uploaded as an attachment to 9C (without CA certification).

Serial Number 8B to 8D

For FY 2017-18 and FY 2018-19, the registered person shall have an option to fill figures in a separate file (PDF format) and could be uploaded as an attachment to 9C (without CA certification)

Serial Number 8C:

For FY 2018-19, aggregated value on ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during 2018-19 but availed during April to September 2019, will be mentioned.

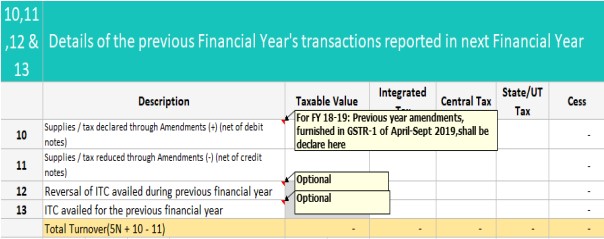

6. Previous Financial Year Transactions

Serial 10 & 11: For FY 2018-19, details of additional or amendments to any supplies, declared in returns of previous financial year but such amendments were furnished in FORM GSTR-1 of April to September 219, shall be declared here.

Serial 12 & 13: For FY 2017-18 and 2018-19, the registered person shall have an option to fill this table.

7. Demands and Refunds, supplies from composition taxpayer, HSN Summary)

Serial Number 15,16,17,18: For FY 2017-18 and 2018-19, the registered person shall have an option to fill this table.

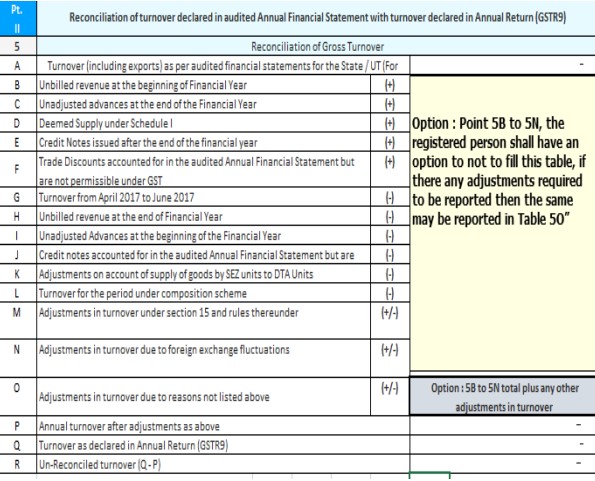

B. Amendments/changes in FORM GSTR-9C (FY 2017-18 and FY 2018-19) are as follows:

1. True and fair is to be reported by auditor instead of true and correct.

2. Cash Flow statement is made optional.

3. Turnover details

Serial No 5B to 5N: For FY 2017-18 and 2018-19, the registered person shall have an option to not to fill this table, if there any adjustments required to be reported then the same may be reported in Table 5O”

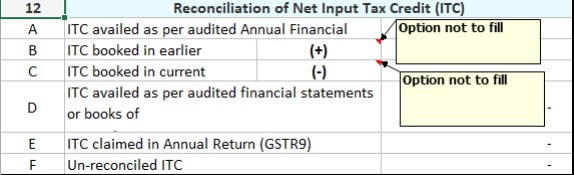

4. Reconciliation of ITC

Serial number 12B and 12C: For FY 2017-18 and 2018-19, the registered person shall have an option to not fill this table.

5. Reconciliation of ITC declared in Annual Return (GSTR9) with ITC availed on expenses as per audited Annual Financial Statement or books of account

Serial Number 14: For FY 2017-18 and 2018-19, the registered person shall have an option to not fill this table

Download the PDF on ” Overview on Changes in GSTR 9 & 9C”, below:

CA Ranjan Mehta

CA Ranjan Mehta

CA Ranjan Mehta is a Fellow Chartered Accountant of Institute of Chartered Accountants of India and currently proprietor of M/s Ranjan Mehta & Associates. His area of specialization includes Indirect taxes specially GST, Excise, VAT and Service Tax. He is a faculty for GST. He has presented more than 100 papers on GST at various levels of ICAI, trade bodies, corporate seminars.