10% Pre deposit under MVAT referred to larger bench

Facts of the case: Pre deposit under MVAT

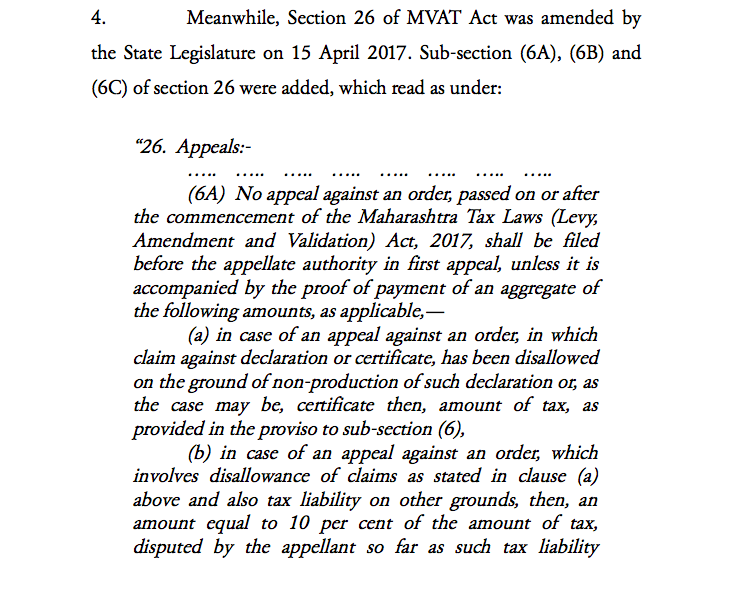

The petitioners are aggrieved by the refusal of registration of their appeals filed under the Maharashtra Value Added Tax Act since they have not deposited the ten percent of the disputed amount now mandated under the amended provision of Section 26 of the Act. They have challenged the validity of the amended provisions and the legislative competence of the State.Pre deposit under MVAT is challanged in this petition.

Observation of honourable Judges:

As a result, we direct the Registry to place papers and proceedings of the present two writ petitions before the learned Chief Justice to obtain suitable directions to place the following questions of law for the opinion of the Larger Bench of this Court:

(a) Whether the State of Maharashtra has legislative competence to enact the Maharashtra Tax Laws (Levy, Amendment and Validation) Act, 2017 and the Maharashtra Tax Laws (Amendment and ::: Uploaded on – 06/11/2019 ::: Downloaded on – 15/11/2019 11:25:51 ::: skn 32 WP 2883.2018.doc Validation) Act, 2019 to amend the provisions of the Maharashtra Value Added Tax Act, 2002 to incorporate mandatory pre-deposit for filing appeals against the assessment orders pertaining to all the goods after 16 September 2016 that is post 101 Constitutional Amendment Act, 2016?

(b) Whether Explanation to section 26 of the MVAT Act introduced with effect from 15 April 2017 by the Maharashtra Tax Laws (Amendment and Validation) Act, 2019 takes away the right of the assessee to file an appeal without statutory deposit in respect of orders passed for the assessment years prior to 15 April 2017 and whether the Explanation nullifies the decision of the Division Bench of this Court (Nagpur Bench) in the case of Anshul Impex Pvt. Ltd. v. State of Maharashtra in Sales Tax Appeal No.2/2018?

(c) Whether the decision of the Division Bench in the case of Anshul Impex Pvt. Ltd. v. State of Maharashtra laying down that right of filing appeal accrues on the date of order of assessment and requirement of mandatory pre-deposit introduced by way of amendment does not apply to the orders passed in the assessment years prior to 15 April 2017, is a correct proposition since the right of appeal can be made conditional by the Legislature with express indication and, therefore, the decision in the case of Anshul Impex Pvt. Ltd. v. State of Maharashtra requires reconsideration by the Larger Bench?

You can download full judgement here:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.