Download order of M/s HCL Learning Limited Vs. CCGST Noida

M/s HCL Learning Limited Vs. CCGST Noida

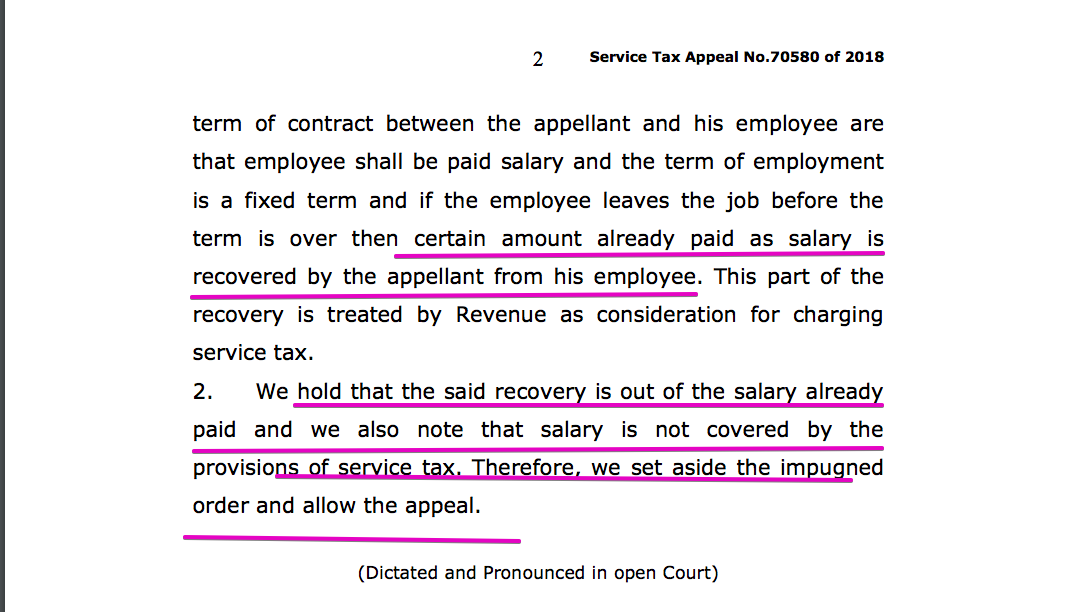

This is one of the important case. It clarified that there will be no GST liability on Notice pay. It is observed by CESTAT Allahabad, in case of M/s HCL Learning Limited Vs. CCGST Noida.

“employee shall be paid salary and the term of employment is a fixed term and if the employee leaves the job before the term is over then certain amount already paid as salary is recovered by the appellant from his employee. This part of the recovery is treated by Revenue as consideration for charging service tax. 2. We hold that the said recovery is out of the salary already paid and we also note that salary is not covered by the provisions of service tax. Therefore, we set aside the impugned order and allow the appeal.”

CESTAT Allahabad passed favorable order on notice pay

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.