Download PPT on Introduction of New Returns Scheme

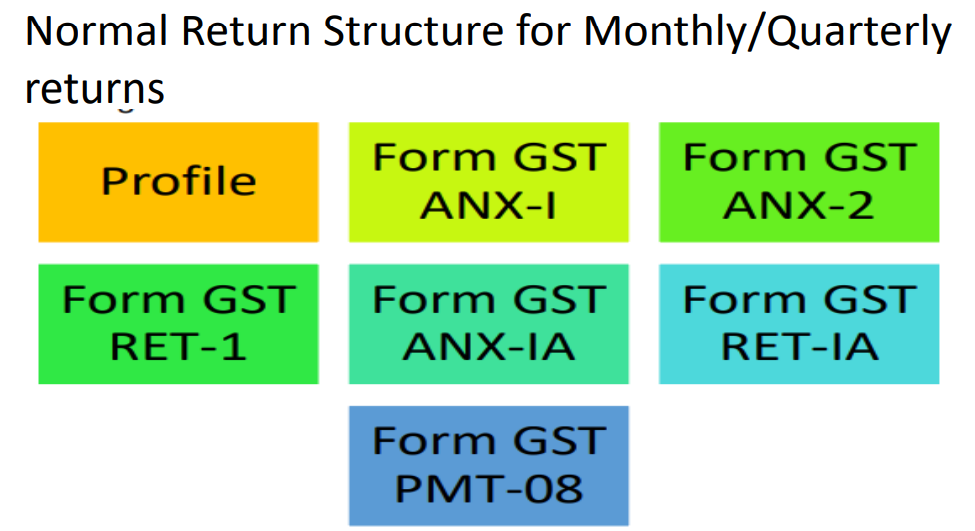

Introduction of New Returns Scheme:

A PPT by CA Vinamar Gupta. In this PPT he has covered the provisions related to new return of GST.

You can download it from the following link.

3rd Revised PPT on New Returns Scheme-CA Vinamar Gupta (1)

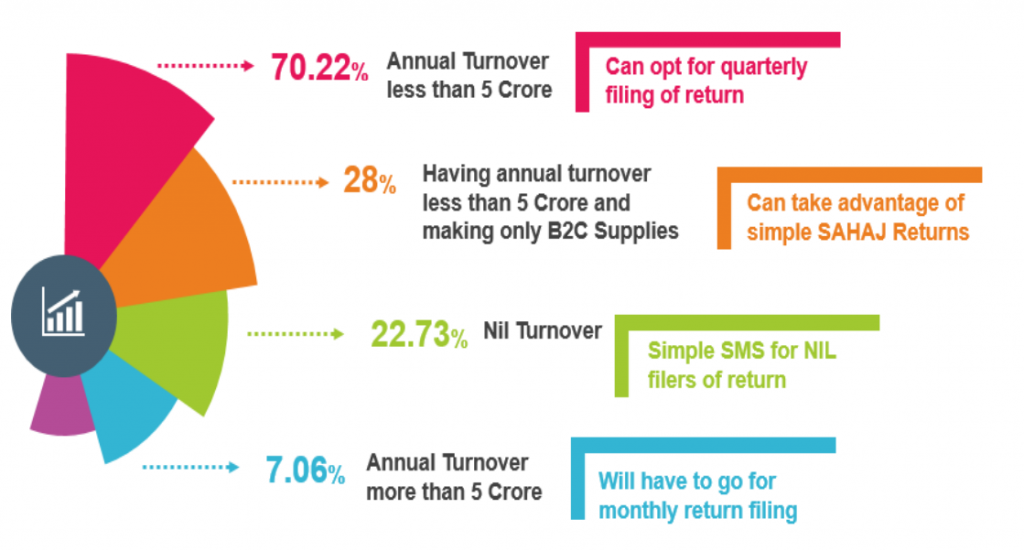

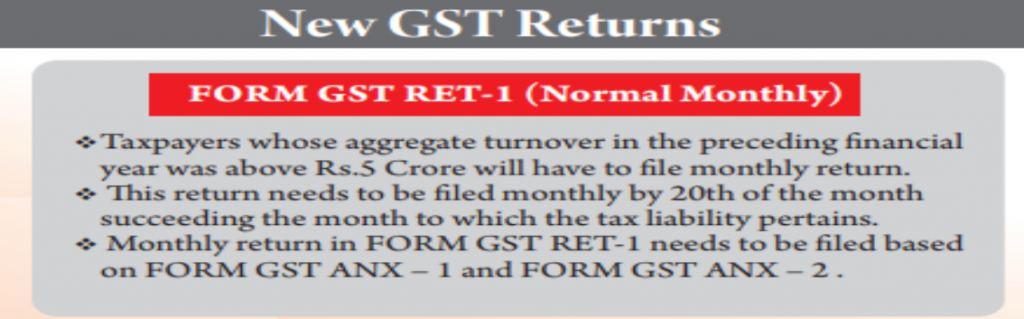

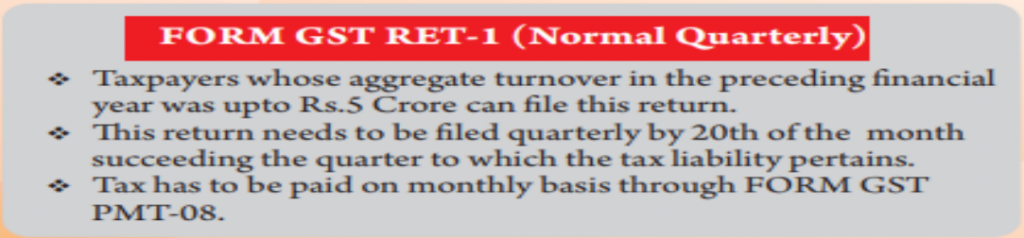

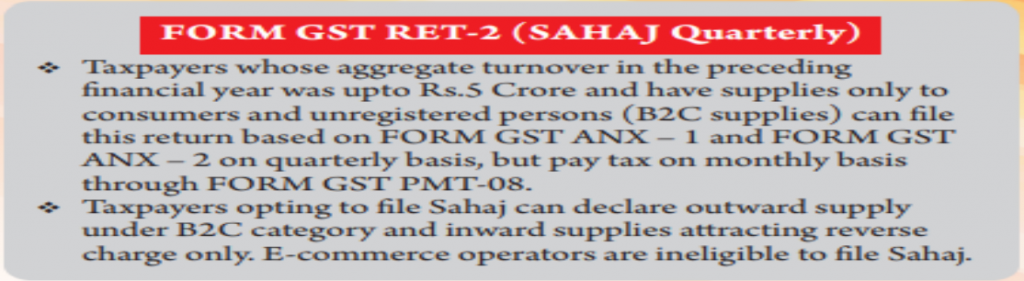

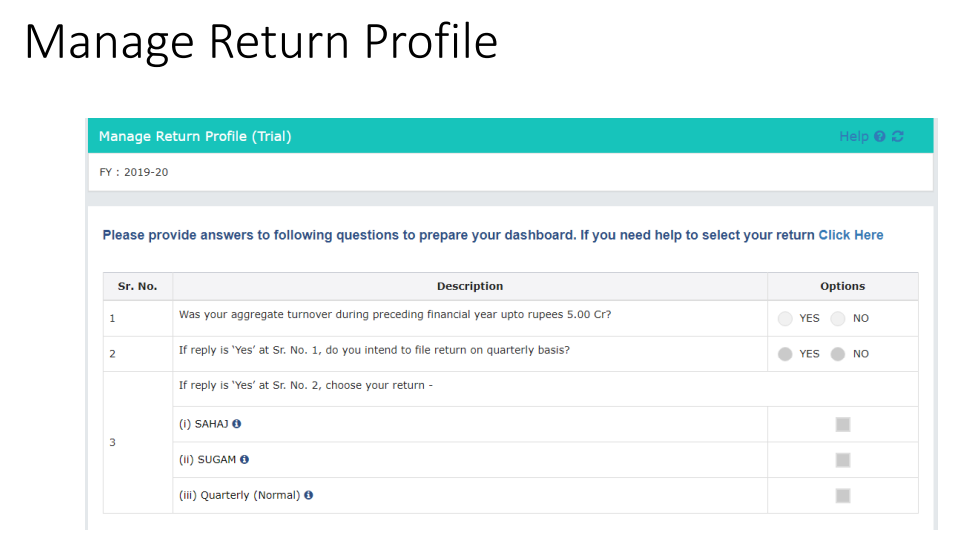

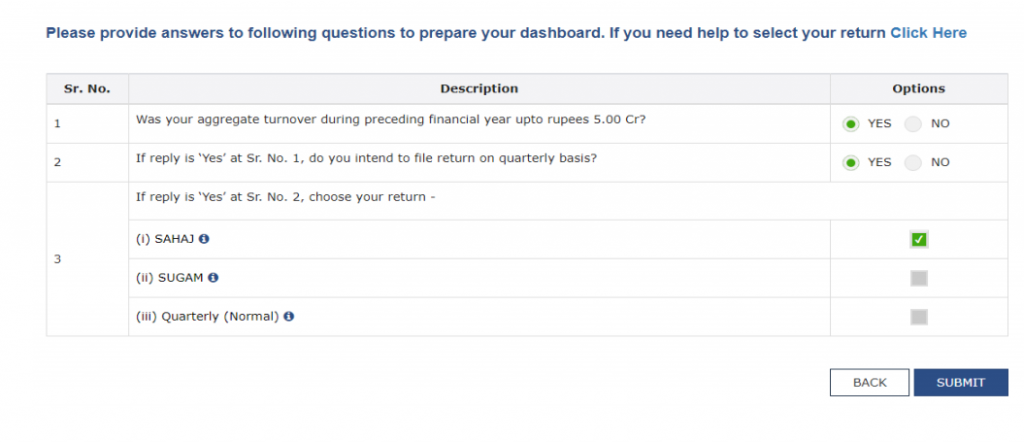

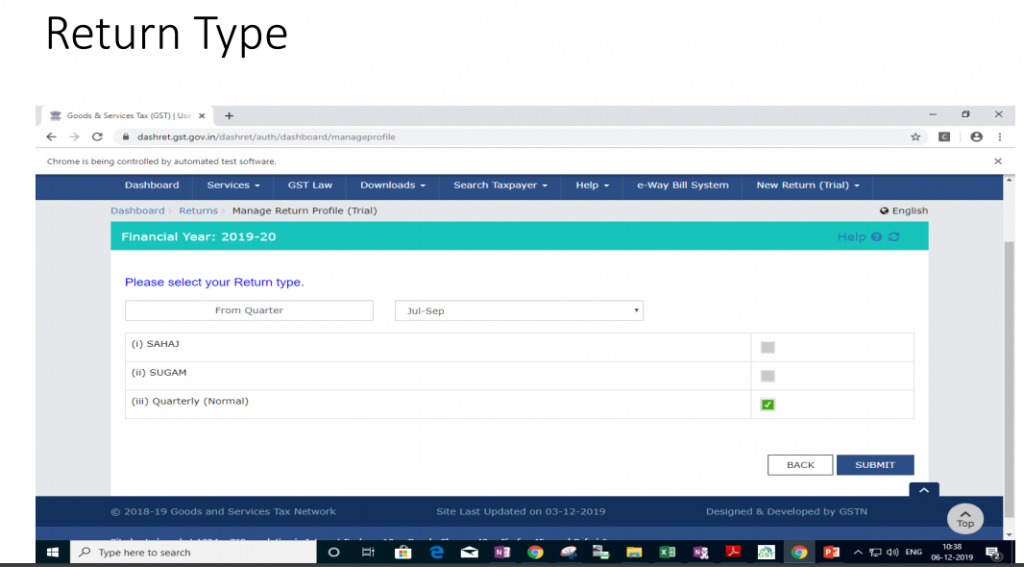

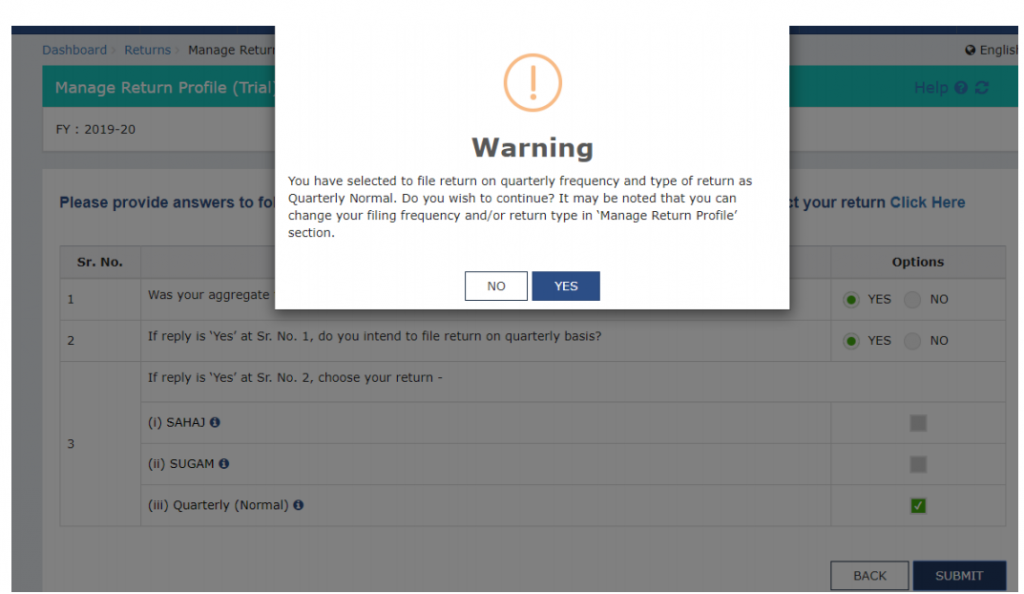

Periodicity/Turnover Defaults

• Periodicity of filing return will be deemed to be monthly for all taxpayers unless quarterly filing of the return is opted for.

• Change in periodicity of the return filing (from quarterly to monthly and vice versa) would be allowed only once at the time of filing the first return by a taxpayer.

• The periodicity of the return filing will remain unchanged during the next financial year unless changed before filing the first return of that year. • For newly registered taxpayers, turnover will be considered as zero and hence they will have the option to file monthly, Sahaj, Sugam or Quarterly (Normal) return

CA Vinamar Gupta

CA Vinamar Gupta

Amritsar, India