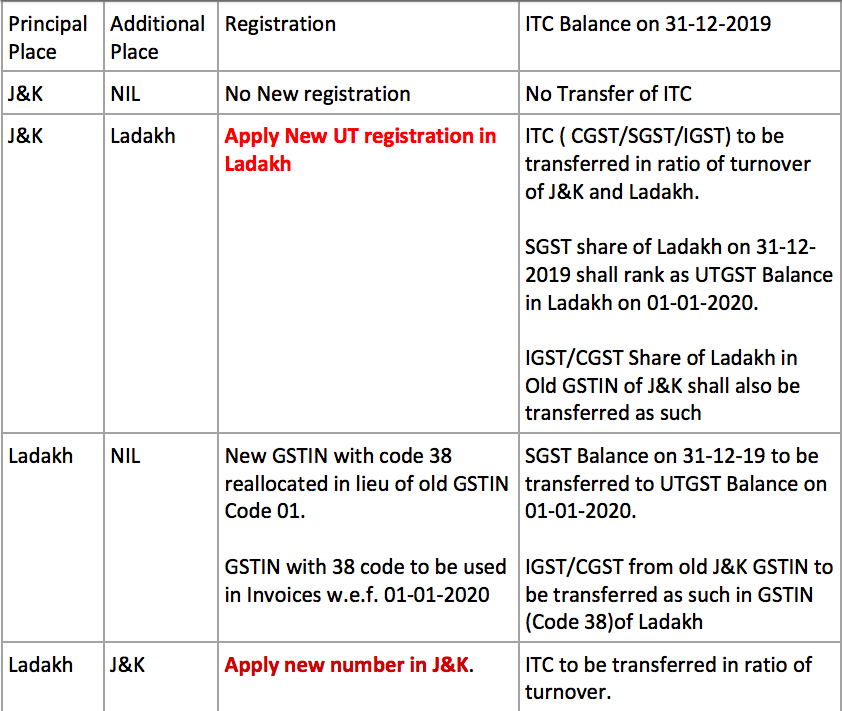

Impact of Changes on 01-01-2020 on GST in J&K and Ladakh

Impact of Changes on 01-01-2020 on GST in J&K and Ladakh:

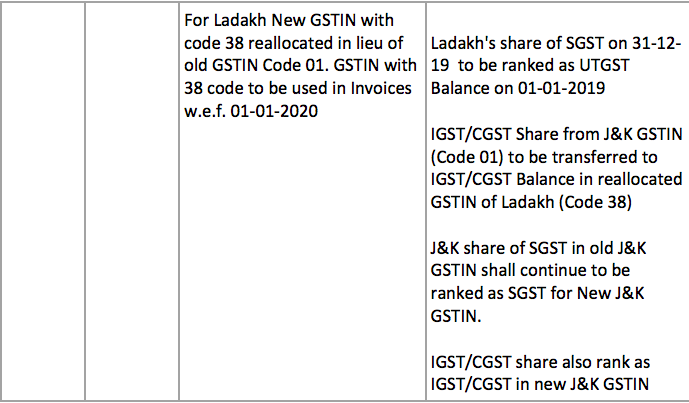

Note: 1. Jurisdictional tax officer of transferor and transferee state should should be informed about transfer of ITC along with copy of ITC and the amount of adjustment made with in one month from obtaining new registration. 2. For reallocated numbers transfer may be made through reduction in GSTR 3B Table 4B.2 of December 2019 and adding ITC to new GSTIN GSTR 3B Table 4A.5 of January 2020 3. Where new number is applied in J&K or Ladakh as above, transfer may be made through ITC-02 4. Compulsory registration provisions u/s 24(i) shall apply for inter transfers between J&K and Ladakh. 5. The Notification 62/2019 and 3/2020 are silent about period for which turnover to be considered for apportioning ITC Balance between J&K and Ladakh GSTINs. Last Nine months turnover i.e. from 01-04-19 till 31-12-2019 may be used as suggestive turnover for such apportionment. Alternately last 30 months turnover from 01-07-2017 to 31-12-2019 may be used for such apportionment. However if due to some later clarification if there is change in proportion, the consequential impact shall have to be routed through adjustment in GSTR-3B till 20th October 2020 having regard to the provision of section 16(4). Excess allocation shall be reversed in such case entailing interest liability also.

CA Vinamar Gupta

CA Vinamar Gupta

Amritsar, India