Discount to be added in value: Santosh Distributor AAR

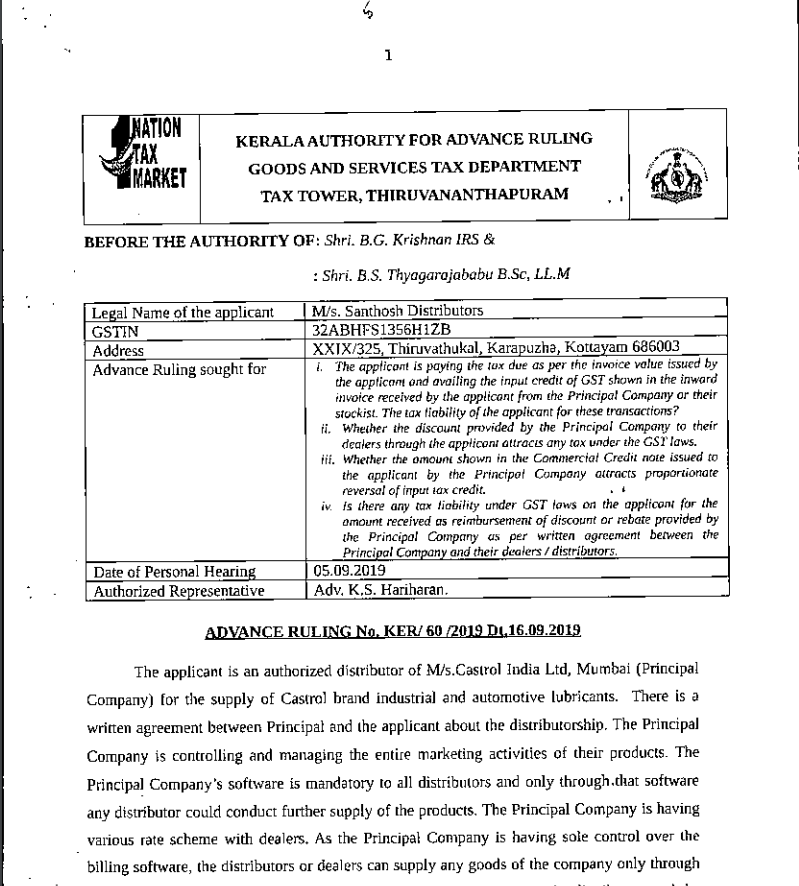

In an application filed before AAR under GST, Kerala by Santosh Distributor reported in 2020 (32) G.S.T.L 105:

Facts of the Case:

1. Applicant is authorized distributor of M/s Castrol India Ltd

2. Castrol India managing entire marketing activities of their products

3. Billing is done by the applicant using M/s Castrol India Billing Software

4. Invoice issued by the applicant based on various rate scheme pre-fixed by M/s Castrol India.

5. Invoice is generated after deducting discount as per pre fixed scheme

6. Such Discounts are being reimbursed by M/s Castrol India by financial credit notes

7. Distributor bound to supply products as per the Invoice Value

Ruling

Supplier is not eligible to reduce the tax liability as the conditions laid down in Section 15(3) is not satisfied. Hence Applicant eligible to claim credit of tax as per invoice subject to payment of value of supply as reduced by commercial credit notes plus the amount of original tax charged by supplier.

Applicant is not liable to reverse the ITC attributable to the commercial credit notes received by him from the supplier

Held additional discount reimbursed by the suppliers of goods to the distributor is liable to be added to the consideration payable by the customer to the distributor to arrive at the value of supply u/s 15 of CGST Act, 2017

Applicant is liable to pay GST at the applicable rate on the amount received as reimbursement of discount received from Principal Company

OBSERVATION: Adverse Part of Decision: Discounts has been taxed double- One at the time of reimbursement from the supplier and second time the discount to be added in the Invoice for charging tax from customer.

AAR Santosh Distributor

This AAR will have a wide impact on valuation in these kinds of cases related to valuation and ITC . Please send your feedback via comment. let us discuss it in detail.

CA Rachit Agarwal

CA Rachit Agarwal