No penalty can be imposed on partners, if penalty has been imposed on partnership firm:Awin Exim Company Versus Commissioner of Customs

Table of Contents

Case covered:

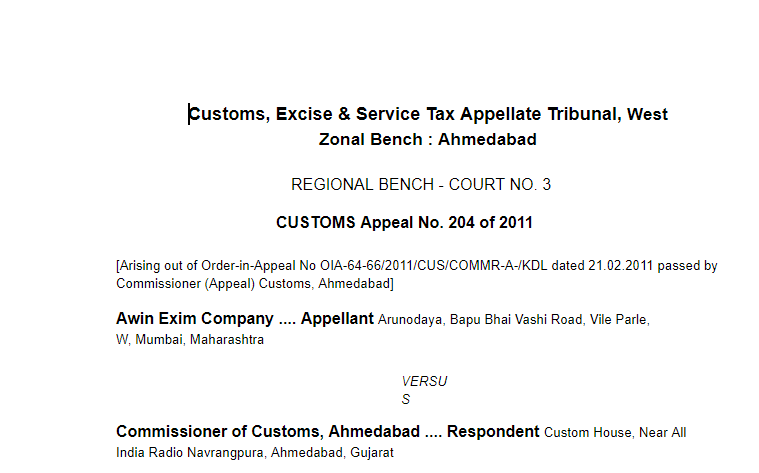

Awin Exim Company – Appellant Arunodaya, Bapu Bhai Vashi Road, Vile Parle, W, Mumbai, Maharashtra

VERSUS

Commissioner of Customs, Ahmedabad – Respondent Custom House, Near All India Radio Navrangpura, Ahmedabad, Gujarat

Facts of the case:

These appeals have been filed by M/s. Awin Exim Company, its partner Shri Satish Choudhary and by Shri Subhash Choudhary, Power of Attorney holder, against the change of classification and confiscation of goods imported by them and imposition of penalties.

Download the copy of the order:

Learned Counsel for the appellant pointed out that the goods have been confiscated and they are giving up their claim on the said goods. He pointed out that there is no duty involved as the goods were imported into SEZ and there was no restriction for import of such goods and therefore, there could not have been any intention to evade any duty. In these circumstances, the penalty imposed on the appellant M/s. Awin Exim Company, Shri Satish Choudhary and Shri Subhash Choudhary should be set-aside.

Learned Counsel further pointed out that since penalty has been imposed on M/s. Awin Exim Company, no penalty on its partner can be imposed in view of the decision of Hon’ble Gujarat High Court in the case of Commissioner of Central Excise vs. Jai Prakash Motwani – 2010 (258) ELT 204 (Guj.)

Learned Authorised Representative relied on the impugned order. He argued that there was a gap between the date of import and the initiation of the investigation. He argued that since the appellant had noticed some knitted fabrics along with woven fabrics, they should have taken up the issue with the supplier. He pointed out that failure to take the issue with the supplier meant that they were aware of the entire import of knitted fabrics along with woven fabrics.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.