GST Applicability on the supply of Ancillary Services in relation to the supply of Electricity

Table of Contents

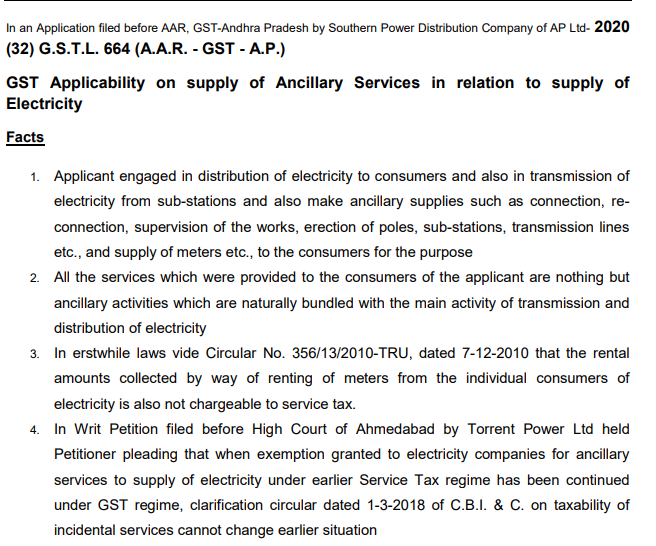

Case covered:

Southern Power Distribution Company of AP Ltd.

Facts of the case:

1. Applicant engaged in the distribution of electricity to consumers and also in the transmission of electricity from sub-stations and also make ancillary supplies such as connection, reconnection, supervision of the works, erection of poles, sub-stations, transmission lines, etc., and supply of meters, etc., to the consumers for the purpose.

2. All the services which were provided to the consumers of the applicant are nothing but ancillary activities that are naturally bundled with the main activity of transmission and distribution of electricity.

3. In erstwhile laws vide Circular No. 356/13/2010-TRU, dated 7-12-2010 that the rental amounts collected by way of renting of meters from the individual consumers of electricity is also not chargeable to service tax.

4. In Writ Petition filed before High Court of Ahmedabad by Torrent Power Ltd held Petitioner pleading that when exemption granted to electricity companies for ancillary services to supply of electricity under earlier Service Tax regime has been continued under GST regime, clarification circular dated 1-3-2018 of C.B.I. & C. on the taxability of incidental services cannot change the earlier situation.

Download the copy:

Order:

1. An appeal against the decision of the High Court of Ahmedabad in the case of Torrent Power Ltd vs Union of India has been filed before the Hon’ble Supreme Court of India.

2. Electricity is a continuous supply while the ancillary services other than rental charges are not continuous supplies.

3. Ancillary services are provided by the Discom at the specific request of the consumer and are not provided by the Discom in its normal course of business to all consumers.

4. The services such as testing of meters and goods such as the electricity meters may be supplied much before the supply of electricity takes place, hence they are not supplied in conjunction with each other.

5. Labour charges for shifting of meters or shifting of service lines, which may or may not be asked for by the consumers or supplied by the Discoms and are thus not naturally bundled.

6. Circular No. 131/3/2010-S.T., dated 7-12-2010 it is noticed that the said clarification was issued in the context of the positive list service tax regime. This clarification lost its relevance in the negative list where each service was subject to service tax unless included in the negative list of services or exempted.

7. The service of installation of electricity meter and consequent collection of hire charges for the meter may have nexus with the supply of electricity but is not naturally bundled with the supply of electricity.

8. The contention that the supplies in question should be exempted because the supply of electricity is an exempt supply, cannot be a basis to state that the levy on such supplies is ultra vires the Article 265 of the Constitution of India.

9. For a supply to be considered as a composite supply, its constituent supplies should be so integrated with each other that one is not supplied in the ordinary course of business without or independent of the other.

10. Works referred by APSPDCL are for business purpose and the benefit of Concessional Rate of 12% (6% under Central tax and 6% State tax) are any other concessional rate is NOT available to the applicant as the activity of the applicant cannot be said that the same is not for commercial purpose.

CA Rachit Agarwal

CA Rachit Agarwal