Invoice value be the open market value for supply between distinct persons.

Table of Contents

Case covered:

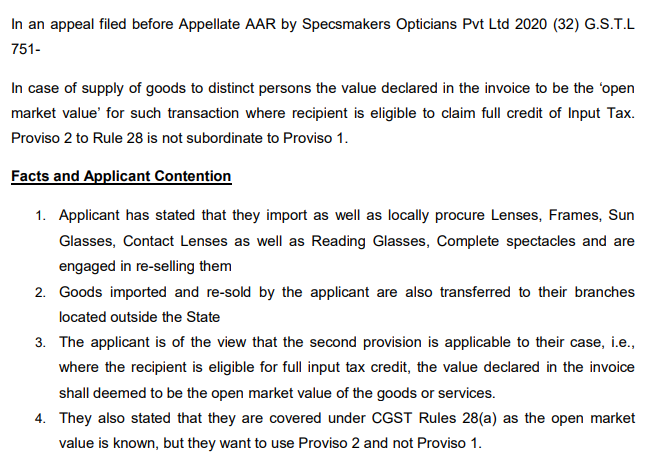

Specsmakers Opticians Pvt Ltd.

Facts of the case:

1. The applicant has stated that they import as well as locally procure Lenses, Frames, Sun Glasses, Contact Lenses as well as Reading Glasses, Complete spectacles and are engaged in re-selling them.

2. Goods imported and re-sold by the applicant are also transferred to their branches located outside the State.

3. The applicant is of the view that the second provision is applicable to their case, i.e., where the recipient is eligible for the full input tax credit, the value declared in the invoice shall be deemed to be the open market value of the goods or services.

4. They also stated that they are covered under CGST Rules 28(a) as the open market value is known, but they want to use Proviso 2 and not Proviso 1.

5. They stated that both Provisoes should not be read together and are independent.

6. It is only with the intention to avoid blocking of capital/funds, the legislature has provided a situation, where when the distinct person is eligible to take full input tax credit and is going to make further supply, then, in respect of initial supply, it is not necessary to adopt only open market value and pay higher tax and block such tax amounts.

7. AAR has held that both provisos are to be read together and not independently, i.e. the applicant cannot choose whichever proviso is favorable to them. if a taxpayer can skip all the provisions under Rule 28(a) to (c), in spite of them being specifically mentioned as the value which “shall” be adopted, then in no scenario will any taxpayer ever use Rule 28(a) to (c).

Held:

1. That the rules are to be applied seriatim

2. It is evident that when an ‘Open Market Value’ is available, sub-rule (b) and (c) of Rule 28 may not be applicable but the same is not the case in respect of the provisos

3. Law provides the taxpayer an option to adopt 90% of the price charged as value to be adopted initially (i.e., supply between distinct persons) and in the alternative, in case of full Input tax is available to the recipient as credit, the invoice value is declared as ‘Open market value’.

4. There is nothing to show that the second proviso is subordinate to the first. It independently deals with a scenario where the recipient is eligible for the full input tax credit.

5. We hold that when the supply is to the distinct person of the appellant and the recipient is eligible for the full input tax credit, the second proviso provides the value declared in the invoice to be the ‘open market value’ for such transaction.

Download the copy:

CA Rachit Agarwal

CA Rachit Agarwal