The Direct Tax Vivad Se Vishwas Scheme Finance Bill 2020

Table of Contents

The Direct Tax Vivad Se Vishwas Scheme Finance Bill 2020

Objective

•The intention was to resolve the disputed tax dues filed at all various adjudication levels due to the pendency of appeals at various appellate levels in India.

• If an application is filed and accepted then it would provide immunity from levy interest and penalties under the provisions of the Income Tax Act.

•It is a kind of Amnesty scheme.

Definitions

•Section 2(1) (a) “appellant” means the person or the income-tax authority or both who has filed an appeal before the appellate forum and such appeal is pending on the specified date;

•Section 2(1) (b) “appellate forum” means the Supreme Court or the High Court or the Income Tax Appellate Tribunal or the Commissioner (Appeals);

•Section 2(1) (c) “declarant” means a person who files declaration under section 4;

•Section 2(1) (d) ; “declaration” means the declaration filed under section 4;

•Section 2(1) (e) “designated authority” means an officer, not below the rank of a Commissioner of Income-tax notified by the Principal Chief Commissioner for the purposes of this Act;

•Section 2(1) (f) “disputed fee” means the fee determined under the provisions of the Income-tax Act, 1961 in respect of which appeal has been filed by the appellant;

•Section 2(1) (g) “disputed income”, in relation to an assessment year, means the whole or so much of the total income as is relatable to the disputed tax;

•Section 2(1) (h) “disputed interest” means the interest determined in any case under the provisions of the Income-tax Act, 1961, where —

(i) such interest is not charged or chargeable on disputed tax;

(ii) an appeal has been filed by the appellant in respect of such interest;

•Section 2(1) (i) “disputed penalty” means the penalty determined in any case under the provisions of the Income-tax Act, 1961, where —

(i) such penalty is not levied or leviable in respect of disputed income or disputed tax, as the case may be;

(ii) an appeal has been filed by the appellant in respect of such penalty;

•Section 2(1) (j) “disputed tax “in relation to an assessment year, means—

(i) tax determined under the Income-tax Act, 1961 in accordance with the following formula—

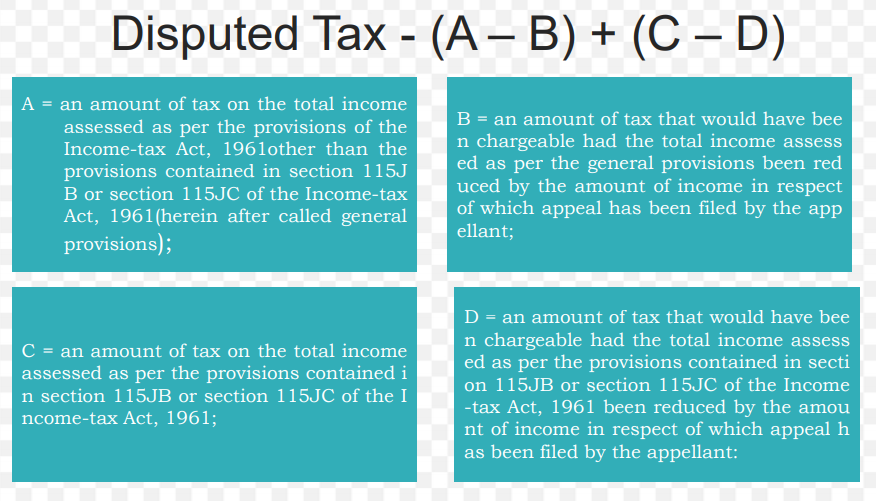

(A – B) + (C – D)where,

Section 2(1) (j) “disputed tax “ ( contd) – Provisos

Provided that where the amount of income in respect of which appeal has been filed by the appellant is considered under the provisions contained in section 115JB or section 115JC of the Income-tax Act, 1961 and under general provisions, such amount shall not be reduced from total income assess ed while determining the amount under item D:

Provided further that in a case where the provisions contained in section 1 15JB or section 115JC of the Income-TaxAct, 1961 are not applicable, the item (C – D) in the formula shall be ignored:

Section 2(1) (j) “disputed tax “ ( contd) – Provisos

Provided also that in a case where the amount of income, in respect of which appeal has been filed by the appellant, has the effect of reducing the loss declared in the return or converting that loss into income, the amount of disputed tax shall be determined in accordance with the formula specified in sub-clause (i) with the modification that the amount to be determined for item (A – B) in that formula shall be the amount of tax that would have bee n chargeable on the income in respect of which appeal has been filed by the appellant had such income been the total income;

Download the copy:

Nitin Bhuta

Nitin Bhuta

Presently, he is actively involved with limited scale of doing Audits, Direct & Indirect Taxation, Management Advisory as well as handling of litigation matters, etc. of Corporate as Well as Non-Corporate persons. Presently, he is actively involved vetting out of drafted legal documents pertaining to business arrangements from the tax compliance perspective.