New Returns under GST

Table of Contents

GST Returns – Phase I

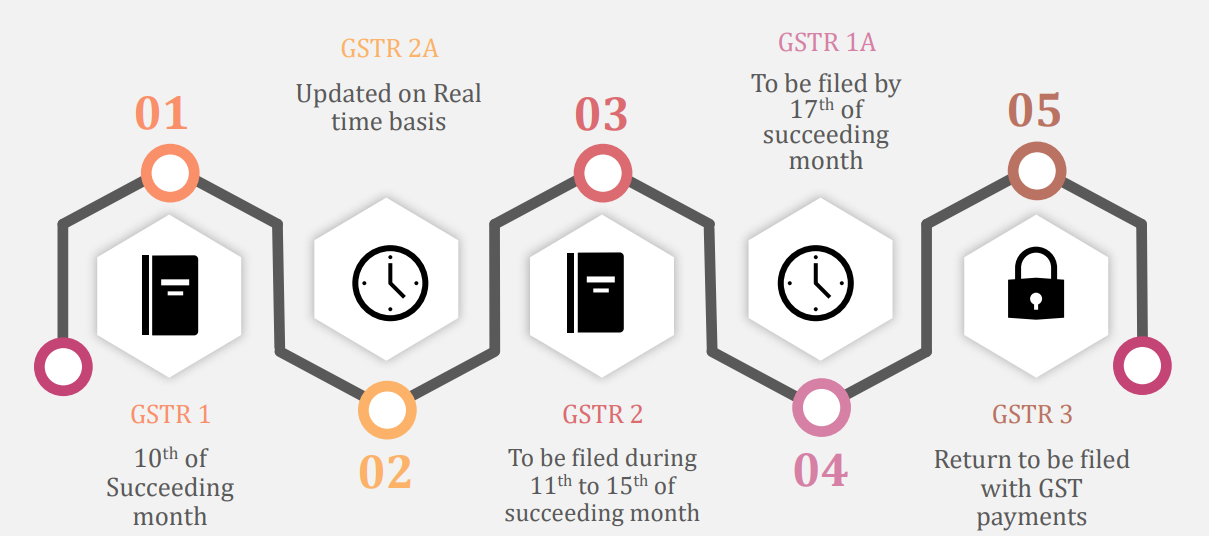

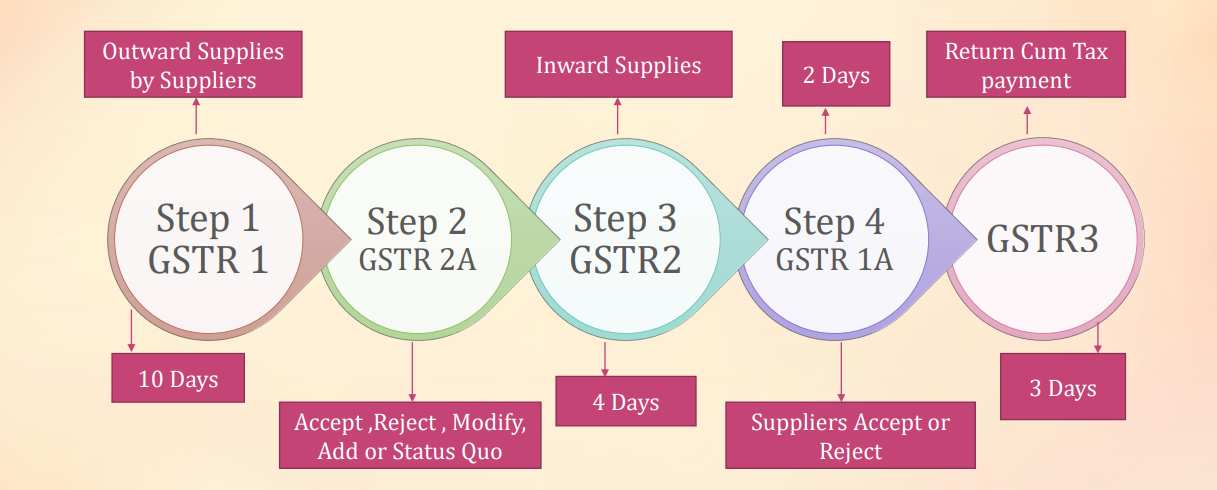

Original GST Returns Filing Schema

Original Schema of GST Returns

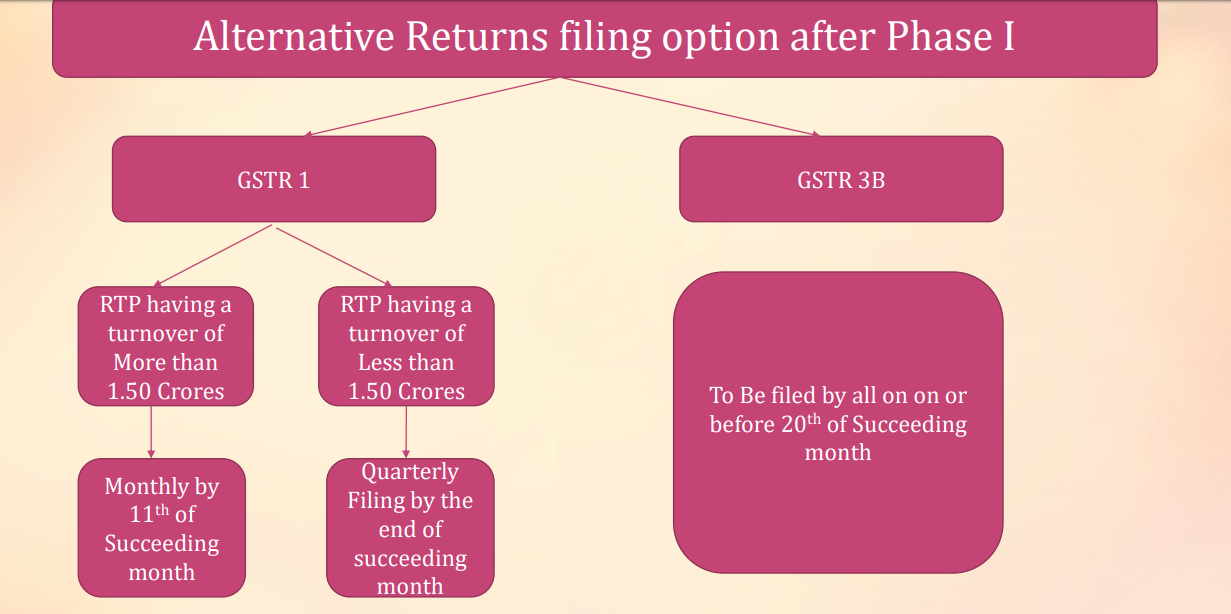

GST Returns – Phase II

Alternative Returns filing option after Phase I

Advantages of New GST Returns

• Invoice updating can be done on a real-time basis and ITC can be claimed accordingly.

• With data getting auto-populated, OTL and ITC can be reviewed by the stakeholders.

• Matching Tool would be provided to match purchase register with Inward Supply annexure in Form GST ANX -2.

• Detection of Fraud Invoices and recovery can be done in the quickest possible manner.

• It would discourage the practice of non-filing of GST returns as Buyers will decide not to do business, such suppliers.

Features of New GST Return

ITC entitlement to Recipient only in respect of Invoices uploaded by Supplier till 10th of Succeeding month and any invoice uploaded after 10th by the supplier, Recipient will get the ITC in the subsequent month only but Supplier will pay GST in the same month but working capital of Recipient would be affected due to loss of ITC claim during the same month.

Supplier uploads invoice in the subsequent months in such a scenario system will auto calculate the interest payable on such an invoice reported by the Supplier as per the applicable rate of interest.

If Supplier is a monthly filer who uploads in the invoices in GST ANX -1 but does not file two returns from 10th of ( M +3 ) onwards but even though invoices are auto-populated in recipient GST ANX -2 but No ITC entitlement on invoices uploaded in GST ANX -1 for the month ( M +2 ) & Onwards.

If Supplier is a Quarterly filer who uploads in the invoices in GST ANX -1 but does not file two returns from 10th of ( M +3 ) onwards but even though invoices are auto-populated in recipient GST ANX -2 but No ITC entitlement on invoices uploaded in GST ANX -1 for the quarter ( Q +1 ) & Onwards.

Download the copy:

Nitin Bhuta

Nitin Bhuta

Presently, he is actively involved with limited scale of doing Audits, Direct & Indirect Taxation, Management Advisory as well as handling of litigation matters, etc. of Corporate as Well as Non-Corporate persons. Presently, he is actively involved vetting out of drafted legal documents pertaining to business arrangements from the tax compliance perspective.