Guide to CA Certificates in GST: ICAI

Table of Contents

Chapter I Certificate under Section 18(1)(a) of the CGST Act

Independent Practitioner’s Certificate under the State Goods and Services Tax Act, 2017 (in short “SGST Act”) and the Central Goods and Services Tax Act, 2017 (in short “CGST Act”) in terms of Section 18(1)(a) of the said Acts and Rule 40(1)(d) of the rules issued under such Acts

Appropriate Addressee

Name and Address of the Applicant

1. This Certificate is issued in accordance with the terms of our agreement dated ………….

2. M/s. __________________ (hereinafter referred to as the “Applicant’) is a registered person vide GSTIN…………… and is having its principal place of business at ____________________________________________________ in the State of ______. The Applicant has the following additional places of business in the State/s of _______________

(a) _______________________________________________

(b) _______________________________________________

The Registration of the principal place of business and the other places of business in the State of _____ is applied on _______ within the stipulated time of 30 days from the date of being liable to obtain registration.

3. In terms of Section 18(1) (a) of the CGST and SGST Acts, a person who has applied for registration under this Act within thirty days from the date on which he becomes liable to registration and has been granted such registration shall be entitled to take Input Tax Credit in respect of inputs held in stock and inputs contained in semifinished or finished goods held in stock on the day immediately preceding the date from which he becomes liable to pay tax under the SGST / CGST Acts, 2017 by declaring the same, electronically, on the common portal in Form GST ITC-01 (Hereinafter referred to as the Statement) The details furnished in the above statement shall be duly certified by a practicing chartered accountant or a cost accountant where the aggregate claim exceeds Rs. 2 Lakhs.

Management’s responsibility for the Statement:

4. The preparation of the statement and declarations in relation to the stock required in terms of the CGST and SGST Acts and Rules issued under the said Acts, is the responsibility of the Management of…………………………….. [Name of the Applicant] including the preparation and maintenance of all accounting and other relevant supporting records and documents. This responsibility includes the design, implementation, and maintenance of internal control relevant to the preparation and presentation of the statements and declaration (including physical verification of stock) and applying an appropriate basis of preparation; and making estimates that are reasonable in the circumstances.

Management is also responsible for ensuring that the Applicant complies with the requirements of the CGST / SGST Act and CGST /SGST Rules.

Practitioner’s responsibility:

5. Pursuant to the requirements of Section 18(1)(a) of the SGST / CGST Act read with Rule 40(1)(d) of the CGST / SGST Rules, 2017, it is our responsibility to examine the books of accounts and other relevant documents/records of the Applicant and to provide a reasonable assurance that the amounts declared in the Form GST ITC-01 have been accurately drawn from the books of accounts and other relevant documents/records of the Applicant and is claimed as input tax credit;

We conducted our examination of the Statement in accordance with the Guidance Note on Reports or Certificates for Special Purposes (Revised 2016) issued by the Institute of Chartered Accountants of India. The Guidance Note requires that we comply with the ethical requirements of the Code of Ethics issued by the Institute of Chartered Accountants of India.

We have complied with the relevant applicable requirements of the Standard on Quality Control (SQC) 1, Quality Control for Firms that Perform Audits and Reviews of Historical Financial Information, and Other Assurance and Related Services Engagements.

Opinion:

6. Based on our examination as above and the information and explanations given to us, in our opinion, subject to our remarks/comments in para 8 infra, the particulars declared by the Applicant provided in Appendix A are true and correct and in conformity with the books of accounts and other relevant documents/ records maintained under the CGST Act and the SGST Act.

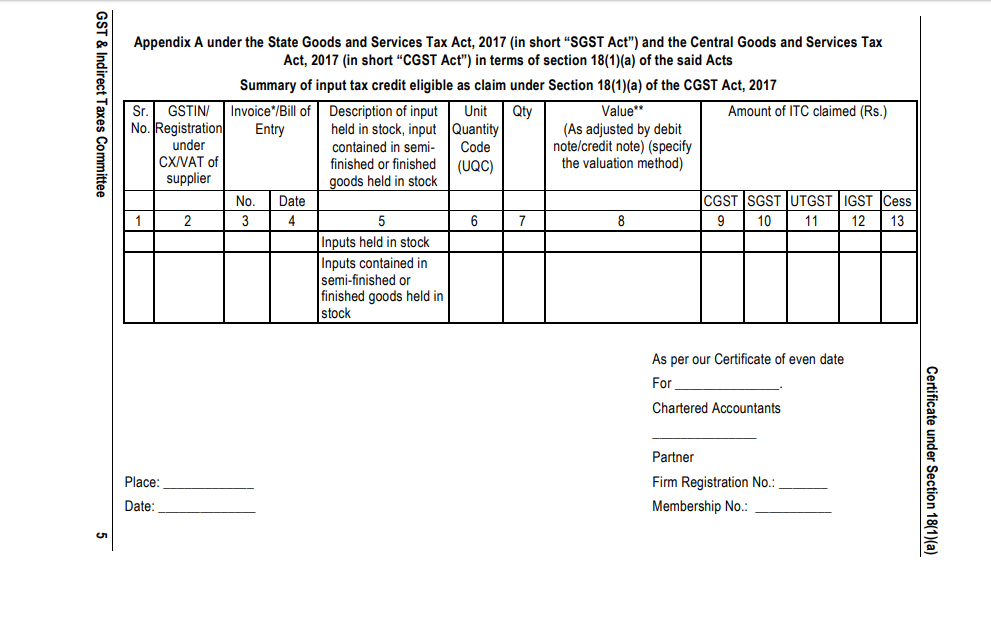

7. The relevant details of inputs held in stock and inputs contained in semi-finished or finished goods held in stock as at ____________ (that is the day immediately preceding the date from which he becomes liable to pay tax under the SGST / CGST Acts, 2017) and the corresponding input tax credit is provided as Appendix A.

8. Remarks/comments (Refer Para 6 supra):

(a) Management has conducted physical verification on …….. method and based on review of the observations in that exercise and the treatment of those observations in the books of accounts, it is found that inputs stated to be held in stock on the date immediately preceding …….., the date on which Management stated to be liable to pay tax under SGST / CGST Act, are verifiable and free of observable differences except to the extent of ……….

(b) Based on the same exercise subject to derivative data in respect of inputs contained in verified quantities of semi-finished or finished goods held in stock on that date and as certified by Management are also verifiable and free of observable differences except to the extent of ……

Restriction on Use

9. This certificate is addressed and provided to the …….. of the Applicant solely for the purpose of submission to (name of the authority) pursuant to the requirements of Section 18(1)(a) of the SGST / CGST Act read with Rule 40(1)(d) of the CGST / SGST Rules, 2017 and should not be used by any other person or for any other purpose. Accordingly, we do not accept or assume any liability or duty of care for any other purpose or to any other person to whom this certificate is shown or into whose hands it may come without our prior consent in writing.

For XYZ and Co.

Chartered Accountants

Firm’s Registration Number

Place of Signature: _____________

Date: ______________

Signature

(Name of the Member Signing the Certificate)

(Designation)

Membership Number:______

UDIN______

Checkpoints for the Chartered Accountant –

(i) Verify registration particulars with the Registration Certificate.

(ii) Do not take responsibility for filing the respective statutory form prescribed as the same is the responsibility of Management. Auditor’s responsibility is to issue the above certificate and attest to the information in Appendix A of the certificate.

(iii) Check the books and records and other relevant documents and registers relating to quantity and value of inputs lying in stock and inputs contained in semi-finished or finished goods on the date immediately preceding the date from which he becomes liable to pay tax under the SGST / CGST Acts, 2017. The eligibility of such credits also needs to be checked under Section 16 and Section 17 of the CGST / SGST Acts, 2017.

(iv) Check the basis of ‘derived’ data of equivalent units of inputs contained in semi-finished and finished goods in stock.

(v) Statement of bills of entry/tax invoices attributed by Management to be the goods in stock that are not be older than 1 year on the day on which the Applicant is liable to pay tax (Section 18(2) of the CGST / SGST Acts, 2017) may be collected from the Management and subjected to audit verification tests. The tax invoice must be the one containing the prescribed particulars (Section 16(2) of the CGST / SGST Acts, 2017 to be read with Rule 46 of the CGST / SGST Rules, 2017).

(vi) Ensure that the debit notes/credit notes, if any, are recorded/accounted against the vendor invoice which is forming part of the closing inventory.

(vii) This certificate is required to be issued only if the aggregate value of the claim on account of SGST / CGST / UTGST and IGST exceeds rupees two lakhs (Rule 40 (1)(d) of the CGST / SGST Rules, 2017)

(viii) This certificate is to be suitably modified wherever applicable. The names of the registered persons, dates, addresses, etc. are only illustrative and need to be modified in each case. Any resemblance to any person/place is purely unintentional. For example: – If Physical Verification of stock is not carried out then, suitably qualified.

(ix) Ensure that the certificate issued is in accordance with the Guidance note on Reports and Certificates for special purpose issued by the ICAI.

(x) Ensure that a letter of representation is taken from the management for the details and information provided by them.

(xi) No ITC must be availed in respect of capital goods and input services and the Certificate must be issued only for ITC for inputs.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.