If AO has accepted the sale, the entire purchase can’t be disallowed

Case covered:

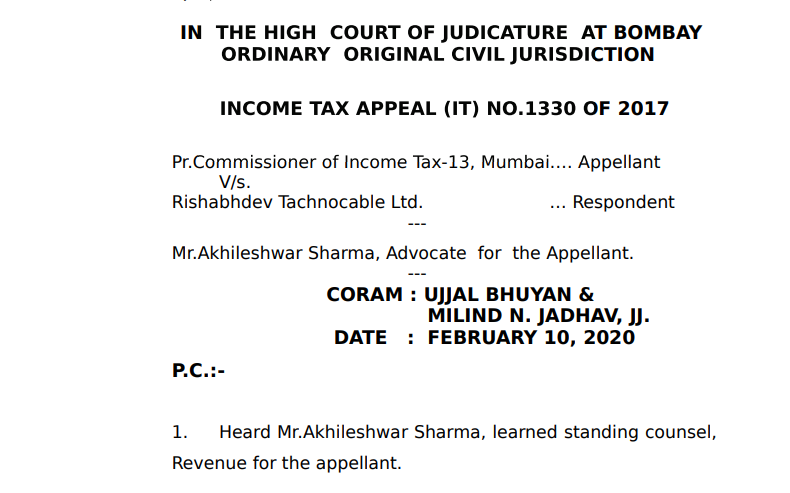

Pr.Commissioner of Income Tax

Versus

Rishabhdev Tachnocable Ltd.

Facts of the case:

This appeal has been preferred by the Revenue under Section 260A of the Income Tax Act, 1961 (briefly “the Act” hereinafter) against the order dated 3rd November 2016 passed by the Income Tax Appellate Tribunal, “D” Bench, Mumbai (briefly “the Tribunal” hereinafter) in Income Tax Appeal No.7773/Mum/2014 for the assessment year 2010- 11.

Observations of the court:

On thorough consideration of the matter, we do not find any error or infirmity in the view taken by the Tribunal. The lower appellate authorities had enhanced the quantum of purchases much beyond that of the Assessing Officer i.e., from Rs.24,18,06,385.00 to Rs.65,65,30,470.00 but having found that the purchases corresponded to sales which were reflected in the returns of the assessee in sales tax proceedings and in addition, were also recorded in the books of accounts with payments made through account payee cheques, the purchases were accepted by the two appellate authorities and following judicial dictum decided to add the profit percentage on such purchases to the income of the assessee. While the CIT (A) had assessed profit at 2% which was added to the income of the assessee, Tribunal made further addition of 3% profit, thereby protecting the interest of the Revenue. We have also considered the two decisions relied upon by learned standing counsel and we find that facts of the present case are clearly distinguishable from the facts of those two cases to warrant the application of the legal principles enunciated in the two cited decisions.

In Bholanath Polyfab Limited (supra), Gujarat High Court was also confronted with a similar issue. In that case, Tribunal was of the opinion that the purchases might have been made from bogus parties but the purchases themselves were not bogus. Considering the fact situation, Tribunal was of the opinion that not the entire amount of purchases but the profit margin embedded in such amount would be subjected to tax. Gujarat High Court upheld the finding of the Tribunal. It was held that whether the purchases were bogus or whether the parties from whom such purchases were allegedly made were bogus was essentially a question of fact. When the Tribunal had concluded that the assessee did make the purchase, as a natural corollary, not the entire amount covered by such purchase but the profit element embedded therein would be subject to tax.

We are in respectful agreement with the view expressed by the Gujarat High Court.

Thus, we do not find any merit in this appeal. No substantial question of law arises from the order passed by the Tribunal. Consequently, the appeal is dismissed. However, there shall be no order as to cost.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.