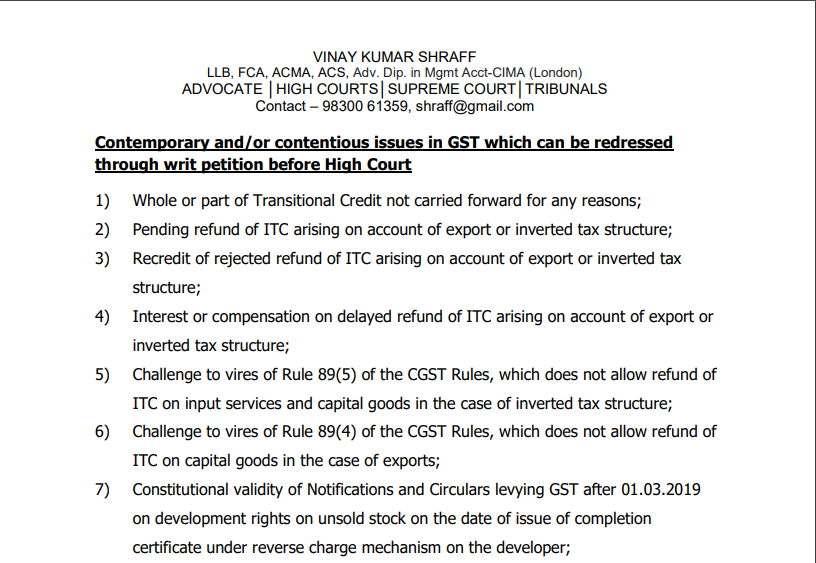

Contemporary and/or contentious issues in GST which can be redressed through a writ petition before High Court

Contemporary and/or contentious issues in GST which can be redressed through a writ petition before High Court

1) Whole or part of Transitional Credit was not carried forward for any reasons;

2) Pending refund of ITC arising on account of the export or inverted tax structure;

3) Recredit of rejected refund of ITC arising on account of the export or inverted tax structure;

4) Interest or compensation on delayed refund of ITC arising on account of the export or inverted tax structure;

5) Challenge to vires of Rule 89(5) of the CGST Rules, which does not allow refund of ITC on input services and capital goods in the case of inverted tax structure;

6) Challenge to vires of Rule 89(4) of the CGST Rules, which does not allow refund of ITC on capital goods in the case of exports;

7) The constitutional validity of Notifications and Circulars levying GST after 01.03.2019 on development rights on unsold stock on the date of issue of completion certificate under reverse charge mechanism on the developer;

8) The constitutional validity of Notifications and Circulars levying GST on development rights prior to 01.03.2019 on the landowner;

9) Any issues arising out of technical glitches on the common portal.

10) The constitutional validity of Section 16(2)(c) of the CGST Act which seeks to deny ITC to a buyer of goods or services, if the tax charged in respect of the supply of goods or services has not been actually paid to the Government by the supplier of goods or services;

11) Constitutional validity and vires of Section 43A(4) of the CGST Act and Rule 36(4) of the CGST Rules, to the extent that it seeks to restrict ITC available to a buyer of goods or services to the extent of 10% of the eligible credit, if invoices are not uploaded by the suppliers on the portal;

12) ITC blocked on the portal by the department for non-payment of tax or non-filing of return by the supplier;

13) The demand for interest on gross liability for late filing of GSTR 3B returns;

14) The constitutional validity of the levy of GST on ocean freight under reverse charge mechanism;

15) The constitutional validity of Section 28 of the Central Goods and Services Tax (Amendment) Act, 2018 which seeks to retrospectively disallow the transition and carry forward of CENVAT Credit of EC, SHEC, and KKC into the GST regime.

16) Freezing of bank accounts in the course of any inquiry/investigation proceedings.

17) Notice demanding reversal of ITC for availing credit after the date prescribed in Section 16 of the CGST Act.

18) Seizure/confiscation of goods or conveyances and levy of penalty and /or fine in lieu of confiscation without following due process of law.

19) Anticipatory bail/bail in the course of any inquiry/investigation proceedings.

Download the copy:

Adv. Vinay Shraff

Adv. Vinay Shraff

Arguing Counsel

Kolkata, India

Practicing as an arguing counsel at the Supreme Court of India, HighCourts, and Tribunals. Vinay Shraff practice as a counsel & advisor in the field of Indirect Taxation, International Taxation, FEMA, Foreign Trade Policy, Corporate insolvency Laws.