THE TERMINATED EMPLOYEES (WELFARE) BILL, 2020

Table of Contents

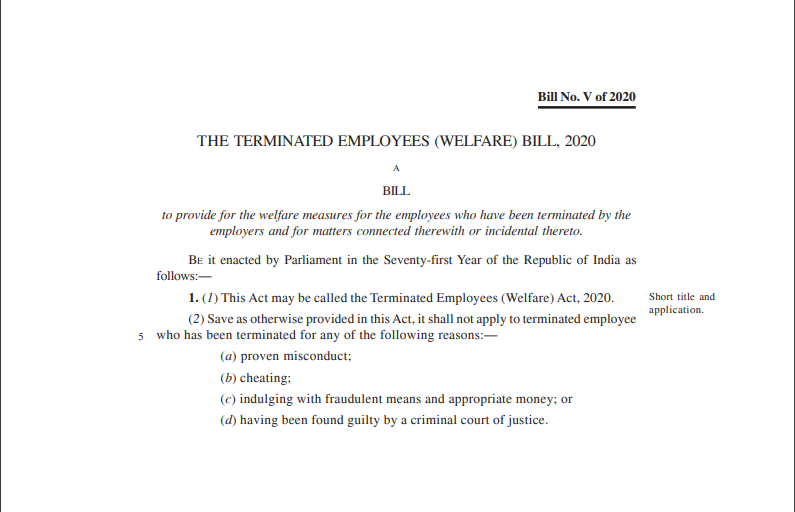

THE TERMINATED EMPLOYEES (WELFARE) BILL, 2020

A Bill to provide for the welfare measures for the employees who have been terminated by the employers and for matters connected therewith or incidental thereto.

Section 1. Short, Title and Application.

(1) This Act may be called the Terminated Employees (Welfare) Act, 2020.

(2) Save as otherwise provided in this Act, it shall not apply to a terminated employee who has been terminated for any of the following reasons:—

(a) proven misconduct;

(b) cheating;

(c) indulging with fraudulent means and appropriate money; or

(d) having been found guilty by a criminal court of justice.

Section 2. Definitions.

In this Act, unless the context otherwise requires:—

(a) ”employer” means the owner or the director of any establishment or any organization which is not owned by the Central Government or a State Government or which is not the undertaking controlled by the Central Government or a State Government or funded by the Central Government or a State Government but includes the owner or director of a private establishment where not less than ten persons are employed;

(b) “fund” means the corpus fund established under section 5; and

(c) “terminated employee” means any employee who was employed by any employer, whether on regular or temporary capacity or casual in nature or on contract and whose services have been terminated by such employer.

Related Topic:

10 Major Changes in CARO, 2020 vs CARO, 2016 in Fastrack Summary Mode

Section 3. Benefits to a terminated employee.

(1) An employee whose employment is terminated for the reasons for the winding up of the organization or the establishment due to:—

(i) economic slowdown; or

(ii) change in technology in the respective field; or

(iii) the owner or director managing the affairs of the establishment becoming insolvent; or

(iv) the orders of any court; or

(v) incurring losses and unable to carry on the business; or

(vi) the change in Government policy;

shall be entitled to such unemployment compensation health insurance benefits or any other benefits as may be prescribed by the Central Government, if such benefits are not part of the employee-employer agreement, for nine months or till the time he gets employed elsewhere, whichever is earlier.

Explanation I—The period of nine months shall include the notice period to be served by the employer before termination.

Explanation II—The unemployment compensation shall be admissible if the employer does not provide any severance package to the terminated employee or the severance package is less than the compensation provided under this Act.

(2) The unemployment compensation shall not be less than sixty percent. of the gross salary of the terminated employee or as per the terms of the employee-employer agreement, whichever is higher and it shall be borne by the employer.

(3) The health insurance benefit shall continue until the period as specified in sub-section (1) with the same terms and conditions which prevailed during his employment.

(4) A terminated employee shall be entitled to the terminal benefits on the cessation of employment like provident fund, gratuity, leave encashment, etc.

(5) The benefits notified under sub-section (1) shall be paid to the terminated employee from the month following the month on which termination is communicated to the employee or completion of the notice period, if any, whichever is earlier.

(6) If due to any reason, the employer is not able to pay the benefits within one month from the date of the termination of the employment, the employer shall pay to the terminated employee an interest at the rate of twelve percent. per month for such a delay.

(7) Nothing in this Act shall apply to any terminated employee if benefits admissible under the employee-employer agreement, are higher than the benefits prescribed under this Act.

Section 4. Corpus fund for the welfare of terminated employees.

(1) Every employer shall create a corpus fund to which at least five percent of the net profit of the organization shall be credited, which shall be used for the welfare of terminated employees.

(2) Every employer shall be entitled to solicit a contribution from any organization, individual or trust for the purpose of maintaining the fund, in such manner as may be, prescribed.

(3) Without prejudice to the generality of the provision contained in sub-section (1), the fund shall also be utilized for the following purposes, namely:—

(a) payment of expenditure in connection with the education of the children of the terminated employees; and

(b) medical facilities, free of cost, in such a manner as may be prescribed.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.