Salient features of the Finance Bill, 2020 and Vivad se Vishwas Scheme by CA Ved Jain

Table of Contents

DIRECT TAXES

INTRODUCTION

The Finance Minister presented her Second Budget on 1st February 2020. This budget was presented in the backdrop of the economic slowdown. The Indian economy which was supposed to grow at the rate of 6.8% during 2019-2020 has been projected to come down to a growth rate of 5.0%. Post presentation of the budget 2019-20, the Government announced various steps to give impetus to the economy which included a drastic reduction in the corporate tax rates, financial aid to affordable housing, setting up National Investment Infrastructure Fund, granting relief to MSME, etc. Despite all these measures, the challenge to the economy continues. The major challenge is that of unemployment.

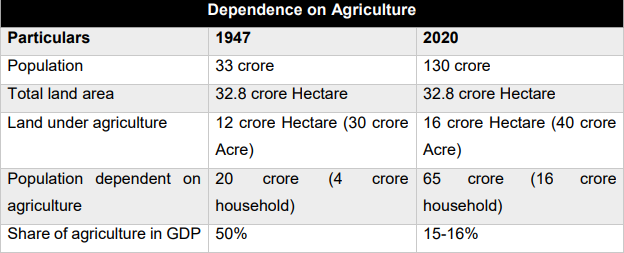

In the year 1947, when we attained independence we were a country of 33 crore population out of which about 60% i.e. 20 crores (about 4 crore households) were dependent on agriculture, the area under agriculture was about 12 crore hectares. Now we are a country of 130 crore population out of which about 50% i.e. 65 crores (16 crore households) are dependent on agriculture, the area of which is only about 16 crore hectares. Thus, during the last 72 years, the absolute number of people dependent on agriculture has increased by more than 3 times i.e. from 20 crores to 65 crores whereas the land under agriculture has increased just by 25% i.e. from 12 crore hectares to 16 crore hectares. The average landholding per household has gone down substantially from 3 hectares per household to 1 hectare per household. Further, the contribution of agriculture in today’s GDP is about 15-16%. Almost 50% of the population is dependent and surviving on 15% GDP only.

There is a need to develop a growth model for agriculture and at the same time reduce dependence on the agriculture of such a high percentage of the total population. This can be achieved when we put more focus on agriculture to improve productivity and create more jobs in other sectors so as to reduce dependence on agriculture. This dependence on agriculture can be reduced by creating avenues in the industry which can employ a large number of population. It is private investment that can give a push to the industry and create capacity, so as to generate jobs and also the demand. Thus, for achieving higher growth, investment is the key factor. The investment will happen when there is consumption. Consumption will increase when there is enough purchasing power. Purchasing power will increase when people have money. People will have money when they have jobs. Thus, investment and job creation have to go hand-in-hand. For promoting investment, it is imperative that the environment is conducive, infrastructure is good, tax rates are competitive and there is the ease of doing business. One of the most effective initiatives is the reduction in the corporate tax rate. In order to achieve tax efficiency and tax rate competitive, the Government has reduced tax rate of 15% for new companies set-up on or after 1st October 2019 for manufacturing or processing any article or thing in India. Further, tax rates were reduced for existing companies to 22% as against 30% and Minimum Alternative Tax was also abolished. The Revenue forgone consequent to the reduction in the corporate tax rate is about Rs.1,46,000/- crore. This additional money so saved by the Corporates will be available for investment. Taking into consideration of 1.3 Debt Equity Ratio, an approximate Rs.6,00,000/- crore which is equal to USD 85 bn investment should generate consequent to above measure every year. An equivalent amount of investment should flow from overseas considering the fact that the tax rates in India are the most competitive not only in South East Asia but across the world. The above measures will go a long way in generating jobs for the Indian youth. The jobs so created will, in turn, create demand and demand, in turn, will attract investment and so on. These measures are going to give a great impetus to the manufacturing in India and job creation and will go a long way in making India a global manufacturing hub.

The Finance Minister announced various steps in this budget 2020-21 to prop-up the economy which includes many amendments through Finance Bill, 2020 to Income Tax Act. The Finance Bill, 2020 has 104 clauses proposing amendments to the various provisions of the Income Tax Act. In addition, thereto, the Finance Minister has announced a scheme known as `Vivad se Vishwas’ and consequently introduced Direct Tax Vivad se Vishwas Bill, 2020. The proposed amendments in the Finance Bill, 2020 relating to direct taxes and the Vivad se Vishwas are analyzed below. Unless otherwise stated, all the amendments are to be effective from April 1, 2021, i.e. the assessment year 2021-22 relating to the income of the financial year 2020-21 starting from 1st April 2020.

A. TAX RATES

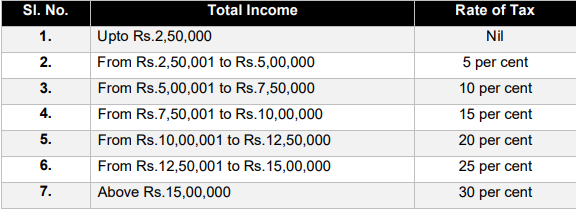

1. Alternative Tax Rates Slab for Individuals and HUF

The Finance Minister has proposed reduced tax rates in respect of an individual and HUF who opts not to claim any exemption or deduction by introducing a new Section 115BAC. As per the proposal, the tax rate applicable shall be as under, if an individual and HUFexercises an option to not to claim various exemptions or deductions provided otherwise under the Act:-

Any individual or HUF who exercises such option shall not be eligible to claim various exemptions or deductions available under the Act including the following:-

(i) Standard deduction of Rs.50,000

(ii) Leave Travel Allowance under Section 10(5)

(iii) House Rent Allowance under Section 10(13A)

(iv) Certain allowances under Section 10(14) as will be prescribed

(v) Deduction of interest up to Rs.2,00,000/- allowable under Section 24(b) in respect of the self-occupied property.

(vi) Deduction of 1/3rd of family pension allowable under Section 57(iia)

(vii) All deductions allowed under Chapter VI-A (except the deduction under Section 80 CCD (2) and Section 80 JJAA ) including of Rs.1,50,000/- under Section 80C in respect of contribution to provident fund, life insurance premium and deduction of Rs.50,000/- as a contribution to NPS under Section 80CCD (1B).

(viii) Allowance for Minor Child Income allowable under Section 10(32) on clubbing of minor income

In addition to the above, the following deductions/exemptions allowed while computing income of business or profession shall also not be available.

(ix) Exemption for SEZ Unit under Section 10AA

(x) Additional initial depreciation in respect of plant and machinery under Section 32(1)(iia)

(xi) Investment allowance in respect of new plant and machinery in notified backward areas under Section 32AD

\(xii) Tea/Coffee/Rubber development benefit under Section 33AB

(xiii) Site restoration benefit under Section 33ABA

(xiv) Various deductions for donation for expenditure on scientific research or social sciences research under section 35(1)(ii), section 35(1)(iia), section 35(1)(iiia) or under section 34(2AA)

(xv) Accelerated capital deduction for specified businesses under Section 35AD

(xvi) Expenditure on agricultural extension project under Section 35CCC

Ongoing through the above, it is to be noted that deduction available to salaried employees such as the standard deduction of Rs. 50,000 under section 16, deduction on account of leave travel allowance under section 10(5), deduction on account of house rent allowance under section 10(13A) shall not be available in case the individual opts to pay tax at rates prescribed under section 115BAC. Moreover, it may be relevant to point out that all the deductions under Chapter VI-A other than deduction under section 80JJAA will not be eligible which means deduction of Rs.1,50,000/- in respect of long term savings like life insurance scheme contribution to PF, PPF, and NPS, NSC, long term fixed deposits, etc. shall also not be available. Deduction on account of the donation under section 80G, deduction on account of interest on loan taken for higher education under section 80E, deduction on account of interest on saving bank account of Rs.10,000/- under Section 80TTA shall also not be available. Further, deduction in respect of income of minor child up to Rs. 1,500 under section 10(32), deduction of interest up to Rs. 2,00,000 on Home loan under section 24(b) in respect of self-occupied house, deduction under section 80EEA of interest on the home loan, deduction under section 57(iia) of 1/3rd of Family Pension are amongst other commonly availed deductions that shall also not be available under this option.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.