Court denied granting interim relief in West Delhi GST Scam

Case Covered:

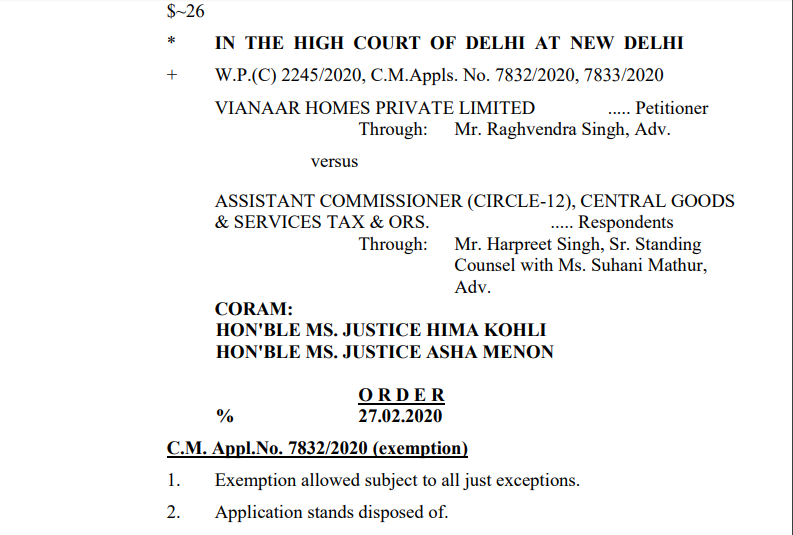

VIANAAR HOMES PRIVATE LIMITED

VERSUS

ASSISTANT COMMISSIONER (CIRCLE-12), CENTRAL GOODS & SERVICES TAX & ORS.

Facts of the case:

The present petition has been placed before this Bench on an urgent basis, as the roster Bench is not available.

The petitioner seeks issuance of a writ of certiorari, for quashing the notice/letter dated 01.11.2019, issued by the respondent No.1 intimating that they propose to conduct an audit/verification of documents/records for the financial years 2014-15 to 2016-17 or for the period since last audited, “in terms of Rule 5(A) of Service Tax Rules, 1994, read with Section 174(2)(e) of the Central Goods and Services Tax Act, 2017”

Mr. Raghvendra Singh, learned counsel for the petitioner, submits that on 21.01.2020, respondents No.2 to 4 had visited the business premises of the petitioner and directed the production of documents and information in terms of the impugned letter. They had also sought additional information pertaining to several group companies of the petitioner. Thereafter, the respondents No.2 to 4 visited the business premises of the petitioner on 17.02.2020 and 24.02.2020 and had directed the production of several additional documents/information, as set out in paras 6 and 7 of the writ petition. Aggrieved by the said action, the present petition has been filed.

Observations of the court:

Having heard learned counsel for the parties, prima facie, we are of the view that no interim relief of nature as prayed for, can be granted without calling for a reply by the respondent. We are also not persuaded to come to the aid of the petitioner right away for the reason that it has taken almost three months reckoned from 01.11.2019, to approach the court for relief and that too at the nick of the time.

Issue notice. Learned counsel for the respondent accepts notice. Reply be filed within two days.

List for consideration before the roster Bench on 04.03.2020

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.