AAR can decide place of supply also

Case Covered:

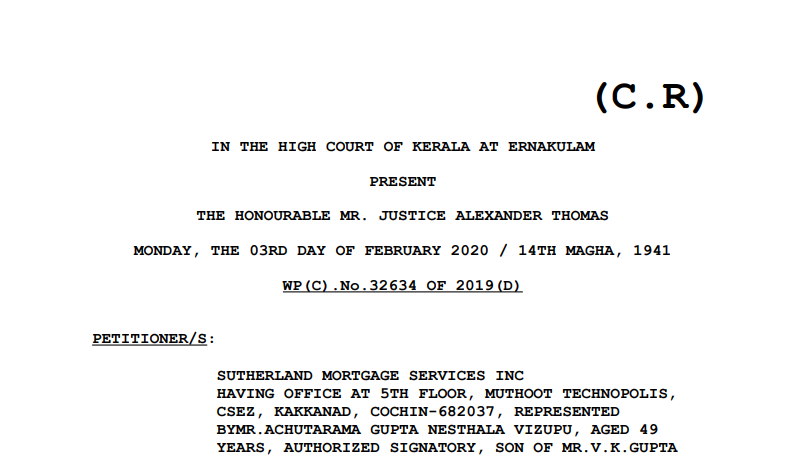

SUTHERLAND MORTGAGE SERVICES INC

Versus

THE PRINCIPAL COMMISSIONER

Read the full text of the case here.

Facts of the case:

The case projected in this Writ Petition (Civil) is as follows:-

The petitioner, M/s. Sutherland Mortgage Services Inc., now functioning in the office premises in the Cochin Special Economic Zone, is a branch office of its principal, M/s. Sutherland Mortgage Service Inc. USA. The petitioner is stated to be engaged in the business of providing information technology-enabled services such as mortgage orientation, primary servicing, special servicing, cash management, and analytics & reporting. It is stated the principal company, M/s. Sutherland Mortgage Service Inc. USA. is incorporated in the United States of America and, as per the applicable laws of that country, the principal company which is engaged in such mortgage business is prevented from outsourcing its work to any other third party. Therefore, by the compulsion of the US laws, the principal company has made an intracompany agreement with the petitioner, M/s. Southerland Mortgage Services Inc. (the latter being only the branch office of the former principal company) in order to provide services to customers outside India. It appears that the above intracompany agreement has been entered into only for the purpose of transfer pricing regulations and the petitioner, which is only a branch of the principal company, has no separate legal existence apart from the principal company and that the petitioner, which is only a branch, has no separate legal existence and that the legal entity is the principal company. That M/s.Sutherland Mortgage Services Inc. USA has also entered into an agreement with customers outside India for providing services from the USA and India branch. That the principal company incorporated in the USA is reimbursing the branch in India for the costs incurred to perform the services and the branches like the petitioner issue commercial invoice to the corporate head office in the USA. It is pointed out that the services are provided by the petitioner branch directly to the customers located outside India and that the petitioner branch is not providing those services to the head office in the USA and that therefore, those services would eminently qualify as ‘Exporter services” which is considered zero-rated supply as envisaged in Sec. 16 of the Integrated Goods & Services Tax Act, 2017 (IGST Act). On this premise, the petitioner has filed an Ext.P-1 application for an advanced ruling under Sec. 97 of the Central Goods & Services Tax, 2017 (CGST Act) and the Kerala Goods & Services Tax Act, 2017 read with Sec. 20 of the IGST Act, 2017, Rule 104 of the CGST Rules, 2017 and the Kerala GST Rules, 2017. The Advance Ruling authority as per the impugned Ext.P-2 order has held that the advance ruling as sought for in Ext.P-1 application cannot be granted as the issue of “determination of place of supply”, does not come within the permissible issues to be determined by the Advance Ruling Authority in terms of Sec. 97(2) of the CGST Act, 2017 and therefore the Advance Ruling Authority lacks jurisdiction to entertain Ext.P-1 application. It is pointed out that Sec. 100 of the CGST Act provides for a statutory appeal before the appellate authority concerned only if the impugned advance ruling is rendered under Sec. 98(4) of the CGST Act and not against the order of rejection as in the nature of Ext.P-2 herein, which has been purportedly issued under Sec. 98(2) of the CGST Act, wherein the plea for advance ruling is rejected at the threshold stage. The point on which advanced ruling has been sought for by the petitioner is on the following aspects:

“Whether supply of services by India Branch of Sutherland Mortgage Services Inc. The USA to the customers located outside India shall be liable to GST in the light of the intracompany agreement entered into by the said branch with the principal company incorporated in the USA.”

(It appears that Ext.P-1 application and the impugned Ext.P-2 order use the word, “Intercompany agreement” and now it appears that it is common ground that the said usage is a misnomer and the correct expression in that regard, in the context of the case of the petitioner should actually be “intracompany”, as the specific case of the petitioner is that the petitioner is only a branch of the principal company incorporated in the USA and that latter alone is the separate legal entity, whereas the former does not have any separate legal existence, as it is only a branch of the principal incorporated in the USA.).

Observations of the court:

Before parting with this case, it has to be borne in mind that India is at the cusp of great global changes and there cannot be any two opinions for anyone, who cherishes the best interests for this country, that with extreme hard work and industry, we have to progress economically, socially and in all spheres of our life. It has been in the consistent policies of the various Governments, both at the Union level and at the levels of the States concerned, that foreign investments, apart from domestic investments, are also highly needed for our economy, subject to the regulatory framework projected by laws. In cases like this, a foreign entity like the principal company, in this case, would like to have precision and certainty about tax liability so that they can accordingly modulate their future outlook and it goes without saying that the executive authorities concerned including the taxation authorities will have to take the correct perspective and in accordance with the legislative policy framed as per the wisdom of the Parliament and the State Legislatures to ensure that there are certainty and precision in taxation liability, etc. so that the domestic investors as well as foreign investors, will get more incentive to continue and increase their level of activities, for the overall better development and growth of our economy.

With these observations and directions, the above Writ Petition (Civil) stands finally disposed of.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.