Upholds levy of GST on members contribution to society.

Table of Contents

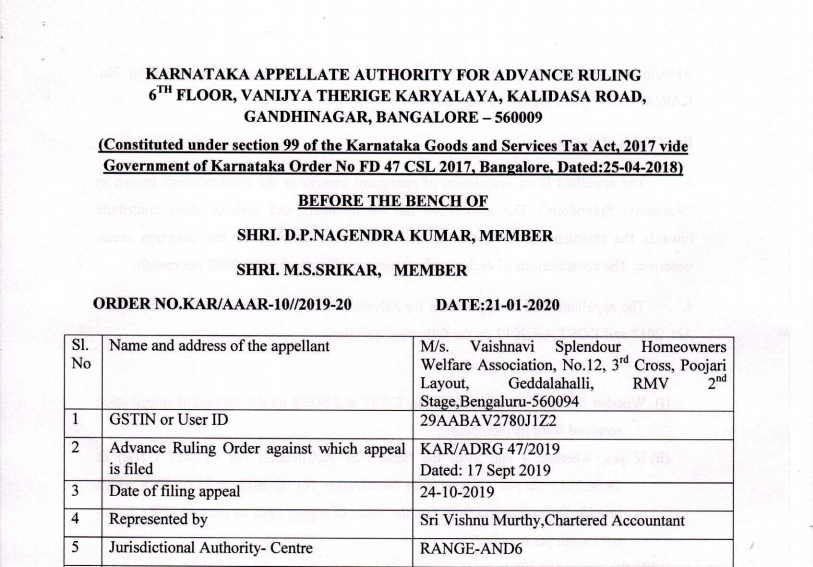

Case Covered:

M/s. Vaishnavi Splendour Homeowners Welfare Association

Facts of the case:

The appellant is an association of apartment owners in the condominium known as ”Vaishnavi Splendour”. The association has 88 members and each of them contributes towards the maintenance of common areas/ facilities, lightings in common areas, water, etc. The contribution of each member works out to more than Rs.7500 per month.

The appellant filed an application for advance ruling under Section 98 of the CGST Act, 2017 and KGST Act, 2017 on the following questions:

(i) Whether the applicant is liable to pay CGST and SGST on the amount of contribution received from its members?

(ii) If yes, whether it can avail the benefit of Notification No. 12/2017 CT(R) dt 28.06.2017 (Sl.No 77) read with Notification No 02/2018 dt 25.01.2018 which provide for exempting from tax, the value of supply up to an amount of 7500/- per month per member?

(iii) If the answer to (ii) is ‘yes’, whether it is required to restrict its claim of the input tax credit?

(iv) Whether the applicant is liable to pay CGST/SGST on amounts which it collects from its members for setting up a corpus fund?

Observations:

We have gone through the records of the case and considered the submissions made by the appellant in their ground of appeal, at the time of personal hearing as well as in their additional submissions.

These are the two issues to be decided by us, viz: Whether the activities of the association of the apartment owners are liable to tax under GST as supply? If so, whether in terms of entry No. 77 of the Notification No. 12/2017-Central Tax (Rate) dated 28.06.2017 as amended by the Notification No.02/2018-Central Tax (Rate) dated 25.01.2018, the contribution received by the association from its members are liable to tax only in excess of the amount of Rs.7500 per month per member.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.