Amendments In Foreign Trade Policy 2015-20

Table of Contents

- Amendments In Foreign Trade Policy 2015-20

- 1. Existing Foreign Trade Policy 2015-20 extended up to 31.03.2021:

- 2. Recognition as Pre-shipmentInspection Agency (PSIA):

- 3. Extension of the validity of RCMC:

- 4. Merchandise Exports from Indian Scheme (MEIS):

- 5. The validity of status certificate:

- 6. Service Exports from India Scheme (SEIS):

- 7. Advance Authorization Scheme:

- Extension of validity for import:

- Extension in export obligation period:

- 8. Duty-free Import Authorization (DFIA):

- 9. Export Promotion Capital Goods (EPCG) Scheme:

- Extension in validity for import:

- Extension in Export obligation period availed:

- 10. Rebate of State & central Levies & taxes (RoSCTL):

- 11. Export Oriented Units (EOUs), Electronics Hardware Technology Parks (EHTPs), Software Technology Parks (STPs) And Bio-Technology Parks (BTPs)

- 12. Transport And Marketing Assistance (TMA)

- RBI announced Extension of realization period of export proceeds:

- Download the copy:

Amendments In Foreign Trade Policy 2015-20

Important features and time limits that get extended vide Notification no. 57/2015- 20 dt.31st March 2020 and Public notice no.67/2015-20 dt.31st March 2020 are given hereunder: –

1. Existing Foreign Trade Policy 2015-20 extended up to 31.03.2021:

provisions relating to export and import of goods & export incentives under different schemes shall remain in force up to 31st March 2021 [Earlier this date was 31.03.2020] except Service Exports from India for which decision on the continuation will be taken by the Government subsequently.

2. Recognition as Pre-shipmentInspection Agency (PSIA):

any recognition which has extended validity up to 31st March 2020 or original validity up to 29th June 2020 would be deemed to be valid up to 30th June 2020.

3. Extension of the validity of RCMC:

Any person applying for any authorization to import/ export or any benefit or concession under FTP is required to take a Registration cum Membership Certificate (RCMC). In case the RCMC is expiring on or before 31st March 2020, the validity will be extended till 30th September 2020 to avail of any incentive/ authorization.

4. Merchandise Exports from Indian Scheme (MEIS):

Shipping bills where the Let Export (LEO) date falls during the period 01.02.2019 to 31.05.2019 application may be filed within a period of 15 months instead of 12 months.

5. The validity of status certificate:

Status Certificates issued under FTP 2015-20 shall be valid for a period of 5 years from the date on which application for recognition was filed or 31.03.2021 whichever is later.

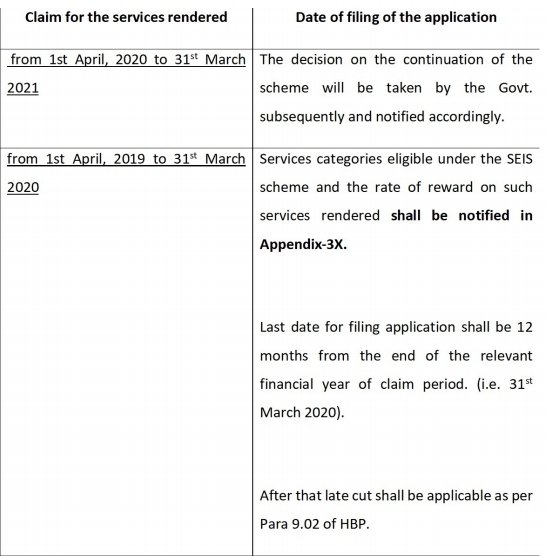

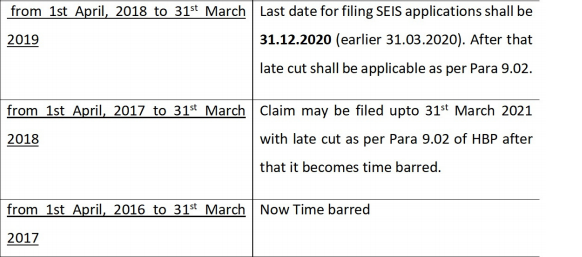

6. Service Exports from India Scheme (SEIS):

7. Advance Authorization Scheme:

Imports against Advance Authorization for physical exports are exempted from Integrated Tax (IGST) and Compensation Cess up to 31.03.2021 only. (earlier this date was 31.03.2020)

Related Topic:

SECTIONWISE ANALYSIS – CUSTOMS AMENDMENTS

Extension of validity for import:

For all Advance Authorizations where the validity for import is expiring between the 01.02.2020 and 31.07.2020, the validity stands automatically extended by six months from the date of expiry. No separate amendment/endorsement is required on the authorization.

Extension in export obligation period:

For all Advance Authorizations where export obligation period expiring between the 01.02.2020 and 31.07.2020, the export obligation period stands automatically extended by six months from the date of expiry. No separate application with composition fees amendment is required for this purpose

Related Topic:

Update on Foreign Trade Policy 2015-20 w.e.f. 01st April 2020

8. Duty-free Import Authorization (DFIA):

All Duty-free Import Authorization (Transferable & Non-Transferable both DFIA) where the validity of import is expiring between 01.02.2020 and 31.07.2020 the validity stand automatically extended by further six months from the date of expiry.

9. Export Promotion Capital Goods (EPCG) Scheme:

Capital goods imported under EPCG Authorization for physical exports are exempt from IGST and Compensation Cess up to 31.3.2021.

Certificate of Installation of Capital Goods Authorization holder is required to submit an installation certificate within six months from the date of completion of import. However, in case the period of six months expires from 1st February 2020 to 31st July 2020, the period for submission of installation certificate extended by further 6 months from the original due date.

Related Topic:

Export Promotion Capital Goods (EPCG SCHEME) And Advance Authorizations (AA SCHEMES) Under GST

Extension in validity for import:

EPCG Authorization shall be valid for import for 18 months from the date of the issue of EPCG Authorization. “However, in case the validity expires between 01.02.2020 and 31.07.2020 the validity stands automatically extended by further six months from the date of expiry.

Extension in Block-wise Fulfillment of EO if the block-wise export obligation period expires during 01.02.2020 and 31.07.2020, such period is deemed to be automatically extended by further six months from the date of expiry.

Extension in Export obligation period availed:

If the export obligation period or extension in export obligation period is availed and it is expiring during 01.02.2020 and 31.07.2020, such period is deemed to be automatically extended by further SIX MONTH FROM THE DATE OF SUCH EXPIRY.

10. Rebate of State & central Levies & taxes (RoSCTL):

The last date of filing of the application for Duty Credit Scrip for Shipping Bills with LEO date from 07th March 2019 to 31st December 2019 shall be 31st December 2020 (Earlier the due date was 30th June 2020)

11. Export Oriented Units (EOUs), Electronics Hardware Technology Parks (EHTPs), Software Technology Parks (STPs) And Bio-Technology Parks (BTPs)

- All such Letter of Permissions/ Letter of Intents whose original or extended validity expires on or after 1st March 2020, may be deemed to be valid up to 31st December 2020.

- The imports or procurement from bonded warehouse in DTA or international exhibition held in India shall be without payment of integrated tax and compensation cess and such exemptions would be available up to 31.03.2021.

12. Transport And Marketing Assistance (TMA)

Application(s) for the claim of TMA is required to be filed on a quarterly basis i.e. for the shipments made in a particular quarter. Application to avail such claims for the quarter ending 31st March 2019 and 30th June 2019 may now be filed up to 30th September 2020.

RBI announced Extension of realization period of export proceeds:

Presently the value of the goods or software exports made by the exporters is required to be realized fully and repatriated to the country within a period of 9 months from the date of exports. In view of the disruption caused by the COVID-19 pandemic, the time period for realization and repatriation of export proceeds for exports made up to or on July 31, 2020, has been extended to 15 months from the date of export.