GST Due Dates and Other Changes

Table of Contents

- GST Due Dates and Other Changes

- Relief in respect of due date on account of COVID-19

- Notification No 36/2020 – CT – Revised due date of GSTR 3B for May

- Due Date – 27.06.2020

- Due Date – 12.07.2020

- Due Date – 14.07.2020

- Amendment in Rule 36(4)

- Position before amendment

- Position after amendment

- Notification No 35/2020 – Central Tax

- The validity of E-way Bill

- Extension of time limit till 30th June

- Activities of Authority/Commission/Tribunal to which extension applies

- Activities of the taxable person to which extension applies

- Notification No 35/2020 – Central Tax

- Non-applicability of extension

- Other Amendment

- Notification 30/2020 – Central Tax

- Notification 34/2020 – Central Tax

- Download the copy:

GST Due Dates and Other Changes

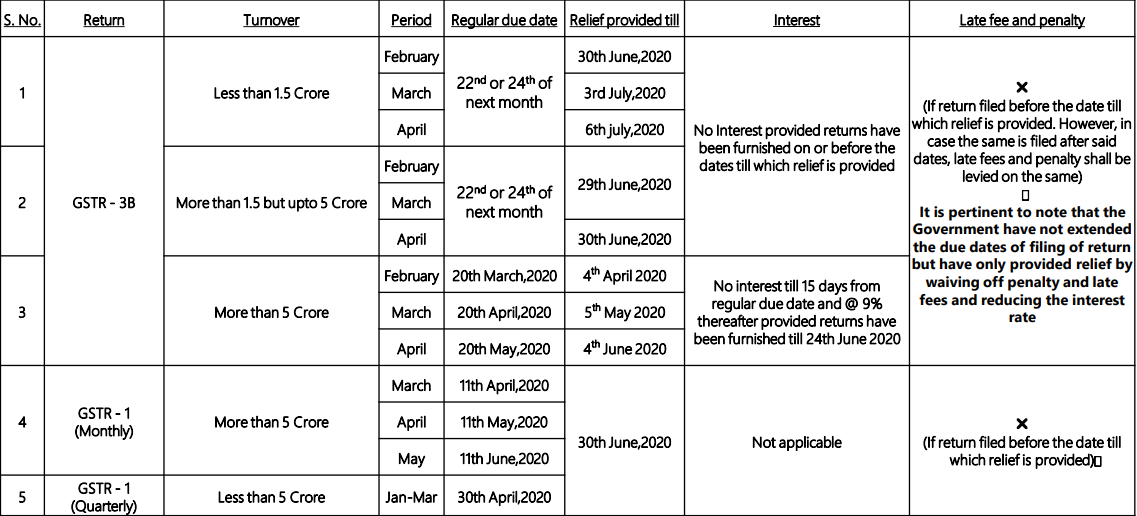

Relief in respect of due date on account of COVID-19

Taxpayers who are required to deduct tax at source, ISD, non-resident taxable person and the person required to collect tax at source have been allowed to furnish return/statement for March 2020 to May 2020 on or before 30.06.2020

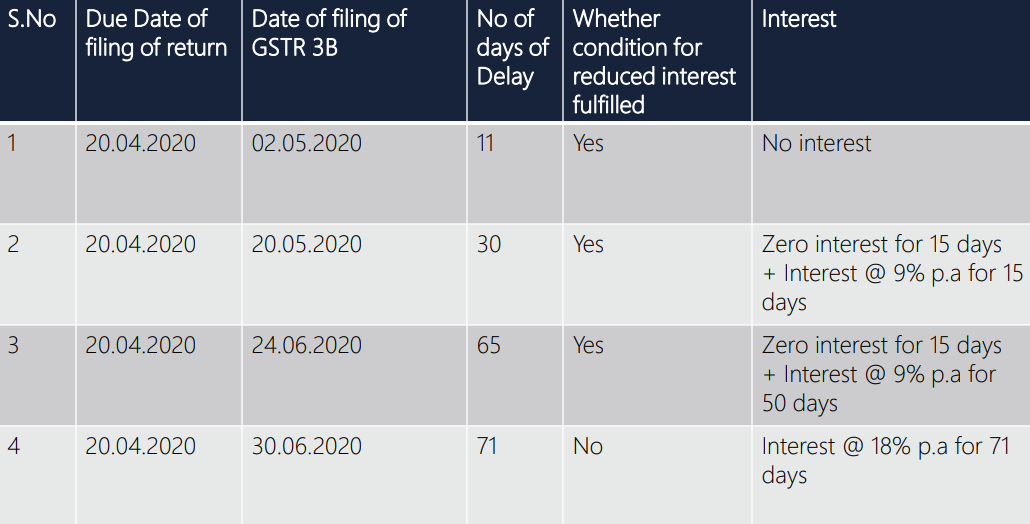

Illustration explaining revised interest rate for taxpayers with an aggregate turnover of more than 5 crores – Circular 136/6/2020 – GST

Notification No 36/2020 – CT – Revised due date of GSTR 3B for May

Due Date – 27.06.2020

• A registered person with an aggregate turnover > Rs. 5 crores

Due Date – 12.07.2020

• Aggregate turnover < Rs. 5 crores

• States Covered – Chhattisgarh, MP, Gujarat, Maharashtra, Karnataka, Goa, Kerala, TN, Telangana, Andhra Pradesh, Daman &Diu and Dadra and Nagar Haveli, Puducherry, Andaman, and Nicobar Island and Lakshadweep

Due Date – 14.07.2020

• Aggregate Turnover < Rs. 5 Crores

• States Covered – HP, Punjab, Uttarakhand, Haryana, Rajasthan, UP, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, WB, Jharkhand, Odisha, J&K, Ladakh, Chandigarh, and Delhi

Amendment in Rule 36(4)

Position before amendment

• The registered person shall be required to claim ITC to the extent of 110% of eligible ITC getting reflected in GSTR 2A of the tax period.

• The taxpayer was required to calculate the amount as per the above provision for every tax period before the filing of GSTR 3B.

Position after amendment

• Cumulative calculation of ITC allowed for the period of February, March, April, May, July and August 2020. Therefore, for the returns furnished in the said tax period, the condition of Rule 36(4) not applicable.

• GSTR 3B for September 2020 to be furnished after adjustment of cumulative ITC calculated for the said months.

Notification No 35/2020 – Central Tax

The validity of E-way Bill

• Where e-way bill expires between 20.03.2020 and 15.04.2020, validity deemed to have been extended till 30.04.2020

Extension of time limit till 30th June

• For completion or compliance of any action due date of which falls between 20th March 2020 to 29th June 2020

Activities of Authority/Commission/Tribunal to which extension applies

• Completion of proceedings, Passing of any order, Issuance of Notice, Intimation, Notification, Sanction or approvals.

Activities of the taxable person to which extension applies

• Filing of appeal, reply, application, furnishing of any report, document return, statement, records.

Notification No 35/2020 – Central Tax

Non-applicability of extension

• E-Way bill

• Time and Value of Supply

• GSTR 3B except for Return of TDS deductor, input service distributor, Non-resident taxable person. These people can furnish a return for March 2020, April 2020 and May 2020 on or before 30.06.2020

• Registration requirement

• Lapse of composition scheme on exceeding the turnover limit

• Provisions of the casual taxable person and non-resident taxable person in relation to registration

• Tax invoice

• GSTR 1

• Levy of late fees

• Interest on delayed payment of tax

• Power to arrest

• Liability of partners of the firm to pay tax

• Penalty

• Detention, seizure, and release of goods and conveyance in transit

Other Amendment

Notification 30/2020 – Central Tax

• Intimation in respect of opting to pay tax under the composition scheme for the FY 2020-21 can be filed till 30.06.2020 in Form GST CMP-02.

• Statement in Form GST ITC-03 in relation to above intimation to be filed up to 31.07.2020

Notification 34/2020 – Central Tax

• A registered person availing the benefit provided under Notification 2/2019 – Central Tax (Rate) shall be required to furnish details of self-assessed tax in Form GST CMP-08 for the quarter ending March 2020 by 07.07.2020

• The yearly return for 19-20 shall be required to be filed in Form GSTR 4 by the above persons till 15.07.2020

Download the copy:

CA Tushar Aggarwal

CA Tushar Aggarwal