TN High Court Judgment. Form ‘C’ can not be denied for Inter state purchases of Petroleum products and Liquor & other Spirits.

Table of Contents

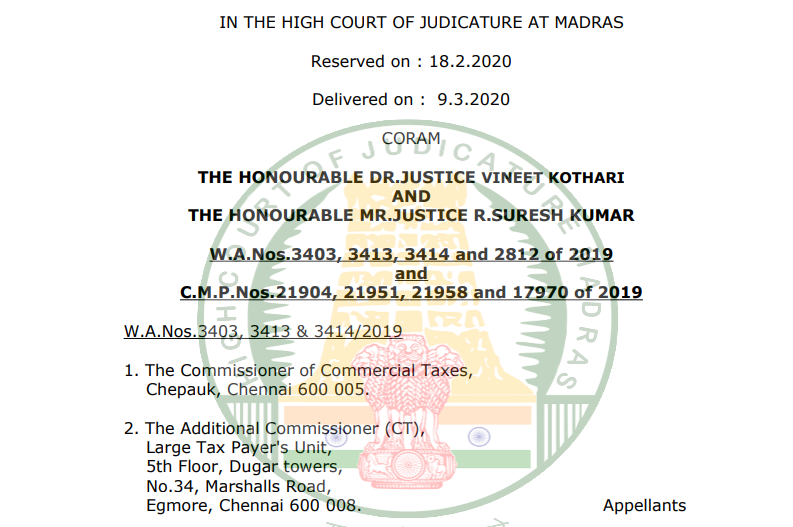

Case Covered:

The Commissioner of Commercial Taxes

Versus

The Ramco Cements Ltd.

Facts of the case:

The Commissioner of Commercial Taxes has filed this intra-court Writ Appeals aggrieved by the order and judgement of the learned Single Judge dated 26.10.2018, whereby the learned Single Judge allowed the Writ Petitions filed by the Assessees, M/s. Ramco Cements Limited and another and quashed the impugned communication dated 31st May 2018 issued by the Commissioner of Commercial Taxes, Chepauk, Chennai and consequential Notices issued to the Assessees seeking to deny the benefit of purchases of HSD Diesel, Natural Gas in the course of Inter-State Trade or Commerce against the Declaration of ‘C’ forms of the CST Act, 1956 at the concessional rate of 2%.

Observations of the court:

In fact, though this Court has raised a specific query to the learned Additional Advocate General as to how the above decisions rendered by the various High Courts are not applicable to the present facts and circumstances, especially when the issue is one and the same, she is not in a position to convince this Court in any manner and make any distinction on the facts and circumstances of the present case before this Court and the cases dealt with by other Courts.

The learned Additional Advocate General contended that these writ petitions are not maintainable as against internal communication. I have already found that the letter dated 31.05.2018 cannot be brushed aside as simple internal communication, as the finding/conclusion made therein by the Commissioner of Commercial Taxes directly affects the rights of the petitioners conferred under Section 8(3)(b) of CST Act. Therefore, the petitioners are entitled to question the said communication dated 31.05.2018. Even otherwise, it is to be seen that such communication was issued by the Commissioner of Commercial Taxes without hearing the petitioners. Therefore, the unilateral decision arrived by the Commissioner of Commercial Taxes undoubtedly violates the principles of natural justice. Likewise, the other two communications are also in violation of the principles of natural justice and therefore, the petitioners are entitled to challenge those communications as well. No doubt, under normal circumstances, this Court would remit the matter back to the respondents for reconsidering the issue after hearing the petitioners. I do not think that such remand is required in these cases under the facts and circumstances as discussed supra, more particularly, when the fact remains that Section 8(3)(b) has not been amended and based on which, the petitioners are entitled to avail the benefit under the said provision, while they purchase the petroleum products by way of interstate sale against ‘C’ declaration forms.”

Judgement of the court:

Consequently, we are of the opinion that the Writ Appeals filed by the Revenue have no merits and deserve to be dismissed and respectfully agreeing with the views expressed by other High Courts and confirming the view of the learned Single Judge in the impugned Judgment in Appeal before us we dismiss the present Writ Appeals filed by the State. No order as to costs. Consequently, the connected Miscellaneous Petitions are also dismissed.

The Appellant State and the Revenue Authorities are directed not to restrict the use of ‘C’ Forms for the inter-State purchases of six commodities by the Respondent/Assessees and other registered Dealers at concessional rate of tax and they are further directed to permit Online downloading of such Declaration in ‘C’ Forms to such Dealers. The Circular letter of the Commissioner dated 31.5.2018 stands quashed and set aside along with the consequential Notices and Proceedings initiated against all the Assessees throughout the State of Tamil Nadu.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.