Top 15 issues faced by Taxpayers

Table of Contents

- Top 15 issues faced by Taxpayers

- Question 1 GST on salary paid to directors – Clay Crafts India Pvt Ltd?

- Question 2 RCM liability for FY 19-20 paid after Sept-20, ITC eligible?

- Question 3 Points for undertaking GST Audit?

- Few Clarifications issued by Department

- Reason for difference between Table 8A of GSTR 9 and GSTR 2A

- Legal Audit

- Download the copy:

Top 15 issues faced by Taxpayers

Question 1 GST on salary paid to directors – Clay Crafts India Pvt Ltd?

Applicability of RCM on the director’s salary

- RCM Notification requires a company to pay tax for the services provided by the director

- Schedule III – Services by an employee to the employer in the course of employment shall not be treated as supply

- Rajasthan AAR – Clay Crafts India Pvt Ltd – Directors are not employees and tax on salary given to them shall be paid under RCM

- The doctrine of Parimateria applicable – Definition to be taken from the most relevant Act, which is Companies Act, 2013

- Ruling applicable only on applicant who sought the said ruling

- Factors for determining employer-employee relationship as laid down by Hon’ble Supreme Court in Nilgiri Cooperative Market Society Ltd vs State of Tamil Nadu, 2004

- who is the appointing authority

- Who is the paymaster

- Who can dismiss

- How long alternative service lasts

- The extent of control and supervision

- The nature of job i.e. whether professional or skilled work

- Nature of establishment

- Right to reject

Question 2 RCM liability for FY 19-20 paid after Sept-20, ITC eligible?

Availability of credit of tax paid under RCM after filing of September Return

Section 16(4) – A registered person shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services after the due date of furnishing of the return under section 39 for the month of September following the end of financial year to which such invoice or invoice relating to such debit note pertains or furnishing of the relevant annual return, whichever is earlier.

Section 31(3)(f) – A registered person liable section 9(3) and 9(4) shall issue an invoice in respect of goods or services received from unregistered supplier on the date of receipt of goods or services.

Self invoice not covered under Section 16(4), hence time limit not applicable?

Question 3 Points for undertaking GST Audit?

Outward and Inward Reconcilliations

GSTR 9 –Annual Return

Outward Details

- Table 4: Details of Outward supplies & Inward Supplies on which tax is payable

- Table 5: Details of Outward supplies on which tax is not payable

- Table 10 & 11: Supplies/tax declared/reduced through Amendments

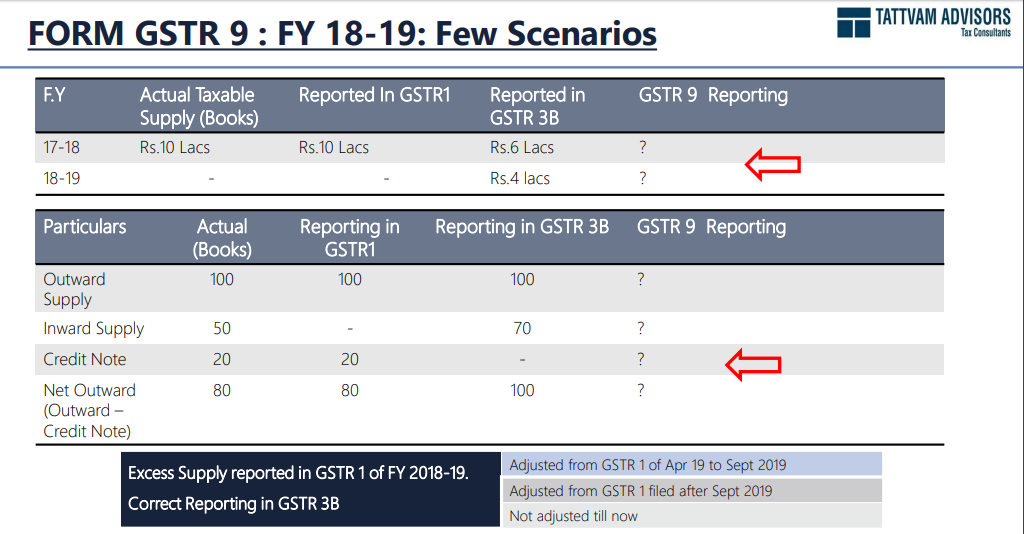

- Note: Reconciliation of GSTR1, GSTR 3B and Books important before filling of information in above tables

Inward Details

- Table 6: Details of ITC Availed

- Table 7: Details of ITC reversed

- Table 8: Reconciliation of ITC availed with GSTR 2A

- Table 12 &13: Details of ITC availed/reversed through Amendments

- Note: Reconciliation of GSTR2A, GSTR 3B and Books important before filling of information in above tables

Others

- Basic Details, Details of Taxes Paid, Details of Demands and Refunds

- Information on supplies received from composition taxpayers, deemed supply under section 143 and goods sent on approval basis.

- HSN wise summary of inward and outward supplies

Few Clarifications issued by Department

| Particulars | Details |

| GSTR 9A | The taxpayers under composition scheme may at their option file Form GSTR9A before due date |

| Payment of any unpaid tax | If a taxpayer has not paid, short paid or has erroneously obtained/been granted refund or has wrongly availed or utilized input tax credit then before the service of a notice by any tax authority, the taxpayer may pay the amount of tax with interest through Form GST DRC 03. In such a case, penalty shall be waived |

| Primary data source for declaration in annual return | If the information in GSTR1, GSTR3B and books does not match, two cases are possible. Either tax was not paid or excess paid. The same shall be declared in annual return and tax should be paid through DRC 03 or refunded though RFD 01, as the case maybe. |

| Premise of Table 8D/8J of Annual Return | ITC in Table 8D/8J is the credit which was available to the taxpayer but not availed by him. There is no question of lapsing of such credit as this credit never entered the electronic credit ledger. |

| Information in Table 5D (exempted) / 5E (Nil rated) of Annual Return | Since there is overlap between supplies that are classifiable as exempted and nil rated, such overlap shall not be viewed adversely provided the same is explainable |

| Table 5F | This shall include alcoholic liquor for human consumption, motor spirit, high speed diesel, aviation turbine fuel, petroleum crude, natural gas and transactions specified in Schedule III |

| Reverse charge in respect of FY 17-18 paid during FY 18-19 | Since the payment was made in FY 18-19, ITC with respect to the same would have been availed in FY 18-19 only. Therefore such details will not be declared in Annual return of FY 17-18 but of FY 18- 19 |

| Turnover for eligibility of filing of reconciliation statement | Aggregate Turnover i.e. turnover of all the registrations having the same PAN is to be used for determining the requirement of filing of reconciliation statement. |

| Treatment of credit/debit notes issued during FY 18-19 for FY 17-18 | The same shall be declared in Part V of Annual return. Further, such debit notes shall also be declared in Table 5O of GSTR9C |

| Duplication of information in Table 6B and 6H | Label in Table 6H clearly states that information declared in Table 6H is exclusive of Table 6B. |

| Reconciliation of ITC availed on expenses | Only those expenses are to be reconciled where ITC has been availed. Further, the list of expenses given in Table 14 is a representative list of heads under which ITC may have been availed. The taxpayer has the option to add any head of expenses. |

| Outward Supplies in Part II and Part V | If tax on supply was paid through Form GSTR3B between April 2018 to March 2019, then such supply shall be declared in Part II. If particulars of transaction of FY 18-19 were declared and paid in next year, then such supply shall be declared in Part V. Any outward supply not declared in GSTR1 or GSTR3B shall be declared in Part II and additional liability computed in Part IV |

| Filing GSTR 9 | While filing GSTR 9 ‘Proceed to File’ button will be enabled only if ‘Compute Liability’ is clicked. This button is meant for computation of late fees only |

Reason for difference between Table 8A of GSTR 9 and GSTR 2A

| S.no | Table 8A |

| 1 | Figures in Table 8A auto populated only on the basis of filed GSTR1 while in 2A it is auto populated on filed/saved/submitted GSTR1 |

| 2 | Figures in Table 8A auto populated only for those GSTR1 filed by 1st November 2019 |

| 3 | In Table 8A only latest values have been auto populated taking into account all amendments made |

| 4 | In Table 8A, ITC, related to those invoices, where POS lies in state other than that of recipient, have been excluded . These figures will be shown in GSTR2A |

| 5 | Table 8A do not contain ITC for the period during which the recipient taxpayer was under composition scheme |

| 6 | In GSTR 2A, credit notes shown as positive figure. Same needs to be checked |

| 7 | GSTR 2A contains details based on filing period. Invoice pertaining to FY 17-18 filed by vendor in 18-19 shall be reconciled for arriving at figure getting reflected in Table 8A |

Legal Audit

• Taxability of Business Transaction

• Classification / Exemptions/ abatements

• Mechanism of availing, reporting and utilising input tax credit in books & GST returns.

• Reversal of input tax credit

• Analyse adjustment made in other FY

• Transitional credit

• Impact of Advance Rulings/ ongoing litigations

• Supplies without consideration/Related Party Transactions/Transaction with employees

• Valuation / Discounts

• Documentation/Returns/Waybill

• Determination of Place of supply and Time of Supply

• Reverse Charge Applicability

• Exports / Deemed Exports / SEZ etc

• Reconcile return back working with books

Download the copy:

CA Tushar Aggarwal

CA Tushar Aggarwal