Reliance Industries Vs state of Gujarat: Section 84A of the GVAT Act is ultra vires

Table of Contents

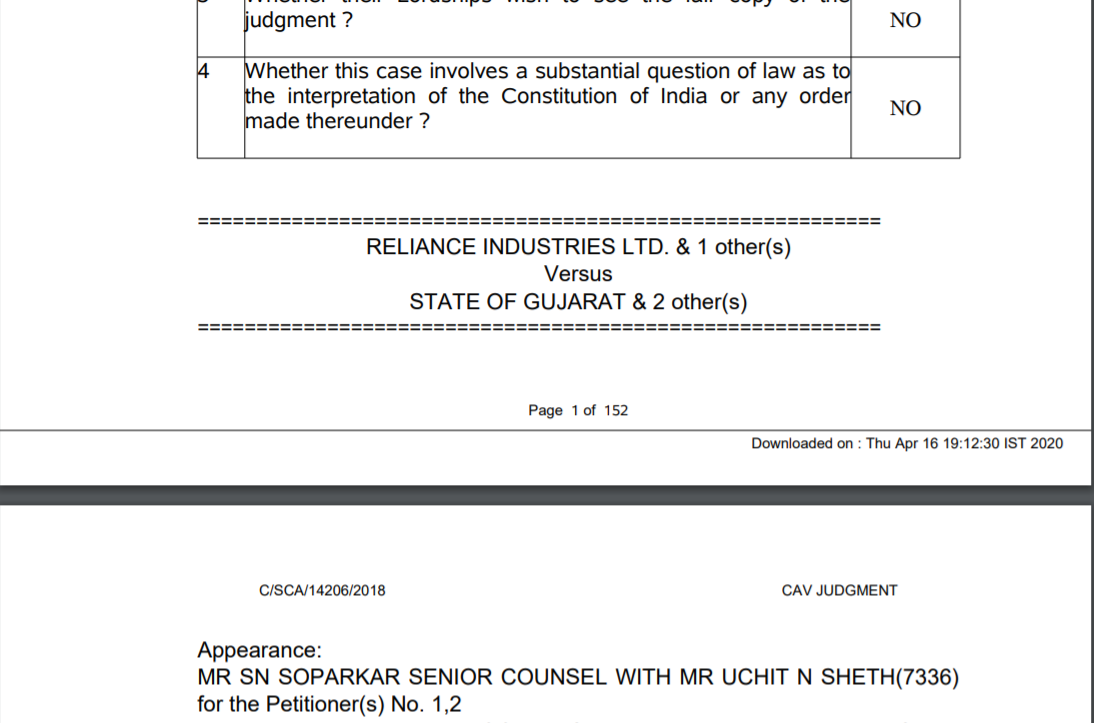

Parties to the case:

Reliance Industries Vs state of Gujarat

Appeals:

R/SPECIAL CIVIL APPLICATION NO. 14206 of 2018 With R/SPECIAL CIVIL APPLICATION NO. 13405 of 2018 With R/SPECIAL CIVIL APPLICATION NO. 13407 of 2018 With R/SPECIAL CIVIL APPLICATION NO. 14207 of 2018 With R/SPECIAL CIVIL APPLICATION NO. 15916 of 2018 With R/SPECIAL CIVIL APPLICATION NO. 15917 of 2018 With R/SPECIAL CIVIL APPLICATION NO. 20196 of 2018

The Issue to decide:

whether after the repeal of the Entry in the legislative list, the laws made in pursuance of such legislative powers can be saved.?

(i) Whether Section 84A of the GVAT Act is ultra vires and beyond the legislative competence of the State under Entry 54 of List II of the seventh schedule to the Constitution of India?

(ii) Whether by virtue of Article 246A read with Article 366(12A) of the Constitution of India, the Union and the State Legislatures, both have the power to make laws with respect to any tax on supply of goods or services or both, except taxes on the supply of the alcoholic liquor for the human consumption? . In other words, whether by virtue of Article 246A of the Constitution of India, the power to make laws with respect to “intra-state’ sale or purchase of goods still exists with the State Legislature even after the enactment of the 101st Amendment Act of 2016.

(iii) Whether Section 84A of the GVAT Act is manifestly arbitrary and violative of the Articles 14 and 19(1)(g) of the Constitution of India?

(iv) Whether the retrospective insertion of Section 84A with effect from 01.04.2006 makes the provision exceedingly arbitrary and unreasonable?

(v) Whether Section 84A of the GVAT Act is a validating Act?

(vi) Whether by virtue of Section 84A of the GVAT Act, it is permissible to the Department to reopen the assessments which have already attained finality before such amendment came into force?.

(vii) Whether the provisions of the Gujarat Vat Act stand repealed qua all the goods except the six items enumerated in the Entry 54 of List Ii of the seventh schedule of the Constitution of India?. In other words, whether the provisions of the VAT Act more particularly, Section 75 of the Act still operates and the other provisions cannot be said to be repealed?.

Submissions on behalf of the State Government;

It was never the intention of the Parliament to take away the power of the State legislature to enact laws with respect to intra-state sale or purchase of goods. However, the intention as discernible from the language of the above Article 246A, clearly appears to confer simultaneous powers on the Union and the State legislatures to make laws for levying tax simultaneously on every transaction of supply of goods or services or both. In the aforesaid context, Mr. Trivedi seeks to rely upon the decision of the Supreme Court in the case of Union of India vs. Mohit Mineral Pvt. Ltd., reported in (2019) 2 SCC 599.

Mr. Trivedi would submit that the term “goods and services tax’, used in the afore-quoted Article 246A of the Constitution of India, is defined under Article 366(12A) of the Constitution, which means “any tax” on “supply of goods” which necessarily occurs on the sale of goods.

According to Mr. Trivedi, by virtue of Article 246A read with Article 366(12A) of the Constitution of India, the Union and the State legislatures,. both have power to make laws with respect to any tax on supply of goods. or services or both except taxes on the supply of the alcoholic liquor for human consumption. At this stage. it Is worthwhile to note that, undisputedly, the term “supply includes ‘sales/purchases.

It is submitted that by enacting Section 84A in the VAT Act, the State Legislature has not proposed to levy any fresh tax, but merely allowed the department to enlarge the period of limitation under the provisions of Section 75 of the VAT Act, if permissible, so as to collect the legitimate tax already levied, but was not collected in view of pendency of litigation before the Apex Court.

ANALYSIS:

The Entry 54 in List II in Schedule VII of the Constitution of India was amended to extinguish the power of states to levy taxes on sale or purchase of goods except taxes on the sale of petroleum products and alcoholic liquor for human consumption. Therefore, the power to amend any law with respect to levy of tax on the sale or purchase of goods such as “Gujarat VAT Act” could be said to have been abolished with the aforesaid amendment in the Entry 54 in List II in Schedule VII of the Constitution of India.

Para 89: Having given our earnest consideration to all the relevant aspects of the matter, we have reached to the conclusion that Article 246A of the Constitution of India does not save Section 84A of the VAT Act from being declared invalid or ultra vires. As noted above, Article 246A of the Constitution was inserted by the 101st Constitution Amendment Act with the sole or rather the precise object of subsuming multiple indirect taxes and to confer concurrent power to the Parliament and State Legislature to impose “Goods & Services Tax” in accordance with the recommendations of the Goods & Services Tax Council statute under Article 279A of the Constitution of India.

Para 90: Further Section 18 to the Constitution Amendment Act provides for compensation to the States for the loss of revenue arising on account of the implementation of the goods and services tax for a period of 5 years. Thus the entire scheme of the Constitution Amendment Act recognizes imposition of only “goods and services tax” under Article 246A of the Constitution of India. The phrase the “goods and services tax” is defined under Article 366(29A) to mean any tax on supply of goods or service or both except taxes on the supply of alcoholic liquor for human consumption. Such “supply” cannot be fragmented into different components by the State legislature and assume power to impose independent tax on the sale of goods without

The decision by Honourable Gujrat High court : Section 84A ultra vires

(i) Section 84A of the Gujarat VAT Act is ultra vires and beyond the legislative competence of the State Legislature.

(ii) Section 84A of the Gujarat VAT Act is manifestly arbitrary, unreasonable and therefore, violative of the Articles 14 and 19(1)(g) of the Constitution of India.

(iii) Section 84A of the Gujarat VAT Act is not a validating Act.

Download the copy of the decision:

TS-225-HC-2020(GUJ)-VAT-Reliance_Industries_Ltd (1)

Citations:

A. Hajee Abdul Shukoor & Co. vs. State of Madras, (1964) 15 STC 719 (SC)

State of Punjab vs. Shereyas Industries Ltd., (2006)

Shayara Bano vs. Union of India,

Rai Ramkrishna vs. State of Bihar, AIR 1963 SC 1667

Epari Chinna Krishna Moorthy vs. State of Orissa

R.C. Tobacco (P) Ltd. vs. Union of India,

Jayam & Co. vs. Assistant Commissioner

Filco Trade Centre Pvt. Ltd. vs. Union of India, (2008) 57 GSTR 204 (Guj.);

Avani Exports vs. Commissioner of Income Tax

K.M. Sharma vs. Income Tax Officer

Tata Teleservices vs. Union of India

,Amarendra Kumar Mohapatra vs. State of Orissa, (2014)

Assistant Commissioner, Commercial Taxes vs. LIS (Registered),

Nestle India Ltd. vs. Deputy Commissioner of Commercial Tax, (2016)

OCL India Ltd. vs. State of Orissa,

Malaviya Bros. & Co. vs. Sales Tax Officer,

Union of India vs. Mohit Mineral Pvt. Ltd

Golden Jewels (India) Pvt. Ltd. vs. State Tax Officer, 2019

Commercial Tax Officer Vs. Biswanath Jhunjhunwalla

Keshavan Madhava Menon v. State of Bombay

Mohan Raj Vs. Dimbeswari Saikia & Anr

Kolhapur Canesugar Works Ltd v. Union of India – 2000

Bhagat Ram Sharma v. Union of India,

Fibre Boards (P) Ltd v. CIT Bangalore, 2015 (8) TMI 482 – SC,

Shree Bhagwati Steel Rolling Mills v. Commir. Of Central Excise, 2015

South India Corporation v. Secretary, Board of Revenue, 1964

Ram Krishna Ramanath v. The Janpad Sabha, Gondia, 1962

Union of India & Anr. vs. Mohit Mineral Private Limited,

U.P.Bhoodan Yagna Samiti, U.P. Vs. Braj Kishore and Ors

M/s.Opac Engineering Pvt. Ltd. vs. The State Tax Officer (Works Contract) & Ors

Sheen Golden Jewels (India) Pvt. Ltd. v. State Tax Officer & Ors. – [2019 (27) KTR 119 (Ker)]

Hoechst Pharmaceuticals Ltd. vs. State of Bihar

Asst. Commissioner, Commercial Tax vs. LIS (Registered), (2018) 15 SCC 283

Nestle India Ltd vs. Deputy Commissioner of Commercial Tax, (2016) 89 VST 56 (Guj.)

K.C.Gajapati Narayan Deo v. State of Orissa (AIR 1953 SC 375),

Bhairabendra Narayan Bhup v. State of Assam (AIR 1956 SC 503),

Gullapalli Nageswara Rao v. Andhra Pradesh State Road Transport Corpn. (AIR 1959 SC 308)

R.S. Joshi etc v. Ajit Mills Ltd. (AIR 1977 SC 2279).

Assistant Commissioner, Commercial Taxes and others vs. LIS (Registered) reported in (2018) 15 SCC 283

Commissioner of Sales Tax, Uttar Pradesh v. Modi Surgar Mills, 1961

Shri Prithvi Cotton Mills Ltd vs. Broach Borough Municipality, 1969

Cotton Mills Ltd vs. Broach Borough Municipality, 1969

Amrendra Kumar Mohapatra vs. State of Orissa, (2014)

Shri P.C. Mills Vs. Broach Municipality, 1970

D. Cawasji and Co. Vs. State of Mysore 1984 (supp). SCC 490

Krishnamurthi & Co. Etc vs State of Madras 1972 AIR 2455,

Indian Aluminium Co. and others v. State of Kerala and others, (1996) 7 SCC 637

Bhikaji Narain Dhakras v. State of M.P.

Sundaramier and Co. v. State of Andhra Pradesh (AIR 1958 SC 468)

R.C. Tobacco Pvt. Ltd. Vs. Union of India

Rai Ramkrishna vs. State of Bihar, reported in AIR 1963 SC 1667

Epari Chinna Krishna Moorthy vs. State of Orissa

E.P. Royappa v. State of T.N.

D.S.Nakara v. Union of India

Maneka Gandhi v. Union of India

Babita Prasad v. State of Bihar,

The State of Jammu & Kashmir vs. Triloki Nath Khosa and ors

State of A.P. And ors vs. Macdowell and Co. and ors reported in (1996) 3 SCC 709

R.K.Garg vs. Union of India and ors

Tata Motors Ltd vs. State of Maharashtra and ors reported (2004) 5 SCC 783

Commissioner of Income Tax vs. Vatika Township

Government of India & Ors. v. Indian Tobacco Association

Vijay v. State of Maharashtra & Ors

Kruse vs. Johnson (1895-90) All ER 105

Mafatlal Industries Ltd. vs. Union of India

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.