Bhargava Motors Vs Union of India

Table of Contents

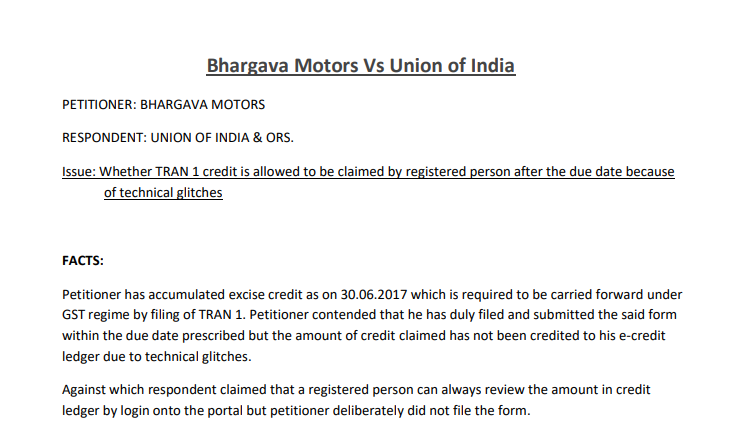

Bhargava Motors Vs Union of India

PETITIONER: BHARGAVA MOTORS

RESPONDENT: UNION OF INDIA & ORS.

Issue:

Whether TRAN 1 credit is allowed to be claimed by a registered person after the due date because of technical glitches

FACTS:

Petitioner has accumulated excise credit as on 30.06.2017 which is required to be carried forward under the GST regime by the filing of TRAN 1. Petitioner contended that he has duly filed and submitted the said form within the due date prescribed but the amount of credit claimed has not been credited to his e-credit ledger due to technical glitches. Against which respondent claimed that a registered person can always review the amount in credit ledger by login onto the portal but petitioner deliberately did not file the form.

HELD:

There is no option that has been provided to the petitioner to review and save the data before filing due to which the petitioner is not able to review before filing the form. GSTIN is a new software is undergoing various technical glitches. Many other cases have been referred to wherein the department has been ordered to allow the petitioner to claim ITC either electronically or manually. Thus, relief should be allowed to the petitioner.