GST Input Tax Credit availment relaxation due to Covid-19 Outbreak by CA Yashwant Kasar

Table of Contents

- GST Input Tax Credit availment relaxation due to Covid-19 Outbreak

- Background

- Rule 36(4) of the CGST Rules, 2017

- Reduction of 20% limit to 10% (effective from 1st January 2020)

- Important points while computing the restricted credit

- Corona Relief provided to taxpayers by non-application of Rule 36(4) for seven tax period/months (Feb to August 2020)

- Rule 36(4) deferred and not scrapped

- Whether interest will be applicable in case ITC is required to reverse based on the cumulative computation of restriction in the month of September

- Download the copy:

GST Input Tax Credit availment relaxation due to Covid-19 Outbreak

Background

The government has temporarily lifted restrictions imposed on businesses to avail GST credit for February to August, a move that would help businesses tide over tight economic conditions following the outbreak of the novel coronavirus.

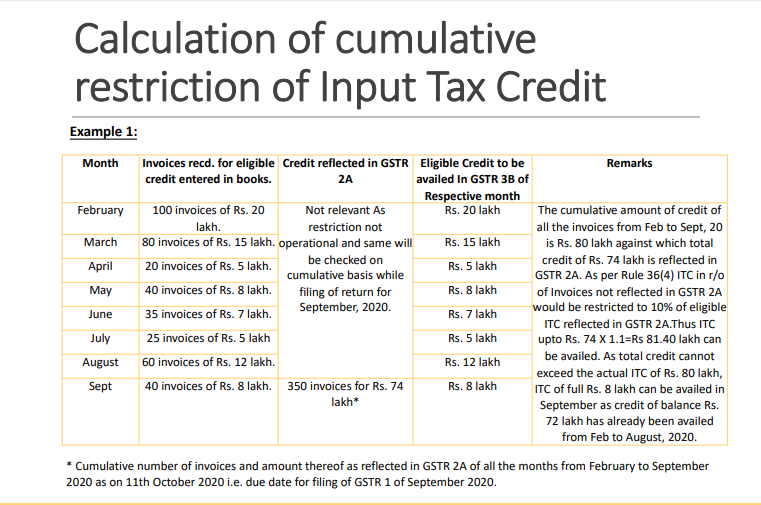

The condition to avail credit in excess of 10 percent of the invoices uploaded for February to August, according to a government notification, will have to be cumulatively adjusted in GSTR-3B returns for September.

In order to nudge taxpayers to timely file their statement of outward supplies (GSTR-1), restrictions on availing of the input tax credit by the recipients were imposed by inserting subrule (4) to Rule 36 of the CGST Rules vide Notification No. 49/2019 Central Tax, dated 09- 10-2019. The above sub-rule was amended vide Notification No. 75/2019 – Central Tax 26- 12-2019 wherein the restriction was further tightened w.e.f. 01-01-2020.

Further said sub-rule has witnessed another change in light of COVID-19 Outbreak according to which this sub-rule will not apply while filing of returns for the period February to August 2020 and will be applicable on a cumulative basis for these months while filing of return for September 2020.

Rule 36(4) of the CGST Rules, 2017

Originally inserted as Rule 36(4) of the CGST Rules, 2017. For ready reference, the said Rule is reproduced as below:-

(4) Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been uploaded by the suppliers under sub-section (1) of section 37, shall not exceed 20 percent. of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded by the suppliers under sub-section (1) of section 37.”.

In simple words, the input tax credit availed by a registered person shall comprise of eligible credit as uploaded by the supplier in its GSTR 1 (statement of outward supply) which is then auto-populated in the GSTR 2A of the recipient. Further, in regard to invoices not uploaded by suppliers and thus not reflected in GSTR 2A of the recipient, such recipient can at maximum avail input tax credit up to 20% of eligible credit as uploaded by supplier and reflected in its GSTR 2A. Needless to mention here that the restriction is applicable to a registered person, as only such a person is eligible for availing input tax credit as per Section 16(1) of the CGST Act, 2017. Thus only the invoices of B2B supplies are relevant in the current context.

Reduction of 20% limit to 10% (effective from 1st January 2020)

CBEC through Para No 2 of Notification No. 75/2019 – Central Tax dated 26.12.2019 has reduced the 20% to 10%, which states that:

“….In the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as the said rules), with effect from the 1st January 2020, in rule 36, in sub-rule (4), for the figures and words “20 percent.”, the figures and words “10 percent.” shall be substituted….”

Accordingly, taxpayers are restricted to 10% excess input credit of what is reflecting in GSTR-2A while filing the GSTR-3B return.

This meant that the ITC cushion available towards availing of credit in respect of invoices not uploaded by the supplier in its GSTR-1 was reduced from 20% to 10% of the eligible invoices reflected in GSTR-2A.

Related Topic:

GSTR 2A Vs GSTR 2B – Detailed Comparison of GSTR-2A with GSTR-2B

Important points while computing the restricted credit

(a) Calculation based upon invoices eligible for the credit

The restriction of 20%/10% is to be computed on the total amount of invoices of eligible credit as uploaded by the supplier. Accordingly, invoices on which ITC is not available under any of the provisions (say under section 17(5)) would not be considered for calculating the restricted credit.

(b) Invoices/debit notes on which restriction is applicable

Restriction @ 20% applicable on the invoices/debit notes on which credit is availed after 09-10-2019 (no restriction of ITC prior to said date). Further restriction of 10% will apply on the invoices/debit notes on which credit is availed on or after 01-01-2020.

(c) Whether restriction will be imposed through the portal

The restriction is not imposed through the common portal and it is the responsibility of the taxpayer that credit is availed in terms of the said rule and therefore, the availing of restricted credit in terms of Rule 36(4) shall be done on a self-assessment basis by the taxpayers.

(d) Restriction applicable on which invoices/debit notes

The restriction of availment of ITC is imposed only in respect of those invoices/debit notes, details of which are required to be uploaded by the suppliers under section 37(1) and which have not been uploaded. Therefore, taxpayers may avail full ITC in respect of IGST paid on import, the self invoice issued for payment of tax under reverse charge mechanism, credit received from ISD, etc, which are outside the ambit of section 37(1), provided that other eligibility conditions for availment of ITC are met in respect of the same.

(e) The restriction is to be calculated supplier wise or on a consolidated basis

The restriction imposed is not supplier wise and thus is on a consolidated basis. The credit available under Rule 36(4) is linked to total eligible credit from all suppliers against all supplies whose details have been uploaded by the suppliers.

(f) Restriction to be derived from GSTR 2A of which date

The taxpayer may have to ascertain the same from his auto-populated FORM GSTR 2A as available on the due date of filing of FORM GSTR-1. Accordingly, while filing of GSTR 3B says for the month of January 2020, the registered person shall calculate the ITC restriction on the basis of GSTR 2A as auto-populated as on 11-02- 2020, which is the due date of filing of GSTR 1 by suppliers for the month of January 2020.

(g) Availing of restricted ITC in subsequent months

The balance ITC may be claimed by the taxpayer in any of the succeeding months provided details of requisite invoices are uploaded by the suppliers. He can claim proportionate ITC as and when details of some invoices are uploaded by the suppliers provided that credit on invoices, the details of which are not uploaded (section 37(1)) remains under 20%/10% of the eligible input tax credit, the details of which are uploaded by the suppliers.

The taxpayer may avail full ITC in respect of a tax period, as and when the invoices are uploaded by the suppliers to the extent, Eligible ITC(as reflected in GSTR 2A)divided by 1.20/1.10, as the case may be 1.20 being applicable for invoices for period 09-10-2019 to 31-12-2019 and 1.10 for invoices dated 01-01-2020 onwards.

Corona Relief provided to taxpayers by non-application of Rule 36(4) for seven tax period/months (Feb to August 2020)

Recently vide Notification No. 30/2020 – CT dated 03-04-2020 the following proviso has been inserted in Rule 36(4) which reads as under:

“Provided that the said condition shall apply cumulatively for the period February, March, April, May, June, July and August 2020 and the return in FORM GSTR-3B for the tax period September 2020 shall be furnished with the cumulative adjustment of the input tax credit for the said months in accordance with the condition above.”.

The above proviso is of much relief for the taxpayers in these difficult times wherein all are grappling with COVID-19 pandemic.

As a consequence of the above amendment, GST registered persons can avail full eligible input tax credit on the basis of their books viz invoice towards goods or services or both received for business purposes/taxable outward supplies, even if the same is not reflected in its GSTR 2A.

Rule 36(4) deferred and not scrapped

It is important to note here that Rule 36(4) has not been scrapped for the months February to August 2020 but rather has been postponed, as it has specifically been stated in the proviso that there will be a cumulative adjustment of input tax for the months February to August 2020 in the return for the month of September, 2020.

Accordingly, a taxpayer is not scot-free towards input tax credit availed for said period and rather it should be ensured by the recipient that its supplier files its GSTR-1 for the period February to August 2020 on a timely basis.

In case some delay is there then also it should be ensured that GSTR-1 for all these months is filed by supplier up to September 2020 as this will ensure that all the invoices are reflected in GSTR 2A of the recipient as on 11-10-2020, which shall be used for computing restriction of credit cumulatively for the period February to September 2020. In case all invoices are reflected there will be no credit impediment and GSTR 3B for September 2020can be filed without any need for any ITC reversal.

Whether interest will be applicable in case ITC is required to reverse based on the cumulative computation of restriction in the month of September

In case cumulative ITC as per Rule 36(4) is computed in Sept 2020 and the same falls short of the ITC already availed from February to August 2020 such excess ITC availed will be required to be reversed in the GSTR 3B of Sept 2020. An issue that may arise in this case is whether interest would be payable on this reversal or not and if payable how the same will be computed.

In my view, as provisions towards the restriction of ITC has been made inoperative during months of February to August 2020 and the cumulative restriction is to be computed in September 2020 only and once computed, if ITC is found to have been availed in excess and is duly reversed in GSTR 3B for the month of Sept 2020, there should not be any interest implication.

However, in order to extinguish the doubt, the Government may in due course issue a clarification in this regard.

Download the copy:

Example 2:

Suppose in example 1, cumulative ITC as reflected in GSTR 2As for months Feb to September 2020 is Rs. 67 lakhs towards 310 invoices.

In this case cumulative ITC up to Rs. 67 x 1.1=Rs 73.70 lakh can be availed for period Feb to Sept. 2020. As credit of Rs. 72 lakhs has already been availed from Feb to August 2020. Thus balance credit of Rs. 1.70 lakh (Rs 73.70 lakh minus Rs. 72 lakh) can be availed in the GSTR 3B for the month of September 2020.

Example 3:

Taking issue further, suppose in example 1, cumulative ITC as reflected in GSTR 2As for months Feb to September 2020 is Rs. 50 lakh towards 250 invoices. Thus ITC up to Rs. 50 X 1.1= Rs. 55 lakh can be availed for period Feb to Sept 2020. As credit of Rs. 72 lakhs has already been availed from Feb to August 2020.

Thus credit will be required to be reversed in the GSTR 3B for September 2020 of Rs. 17 lakh (Rs 72 lakh minus Rs. 55 lakh). As discussed supra interest on such reversal should not be applicable.

The relaxation in regard to non-levy of Rule 36(4) while availing ITC for the months February to August 2020 is a welcome move and would be a sign of relief for the taxpayers in such tough times.

However as discussed, the relief provided is temporary as cumulative computation of restriction of ITC as per Rule 36(4) for the months February to August 2020 needs to be made by the taxpayer while filing its GSTR-3B for the month of September 2020.

Accordingly, it is advisable that in order to be safe from rigors of Rule 36(4), the recipients should ensure that they follow up with their suppliers to file their GSTR 1 and deposit the consequential tax well within time.

Such follow up may be made starting from suppliers from which bulk supplies are received and GST paid is high. This will keep the restriction of ITC at bay as technically in case invoices totaling 91% of the eligible ITC amount for a month are uploaded by suppliers/reflected in GSTR 2A, the recipient will be able to avail the entire eligible ITC for that particular month.

CA Yashwant J.Kasar

CA Yashwant J.Kasar