Taxability of Joint Development Agreement

Table of Contents

- Taxability of Joint Development Agreement

- Joint Development Agreement –Meaning & Benefits

- Taxability under the Income Tax Law

- Taxability of JDA entered till 31.03.2017 (AY 2017-18):

- Taxability of JDA entered on or after 01.4.2017 (AY 2018-19)

- Some contentious issues still unanswered by section 45(5A):

- Taxability under the GST Law

- GST on Landowner

- GST on Developer/ Builder

- GST on Landowner

- GST on Developer/ Builder

- Reverse Charge on TDR-

- Some contentious issues still need legal scrutiny under GST:

- Conclusion:

- Disclaimer:

- Download the copy:

Taxability of Joint Development Agreement

Joint Development Arrangement (JDA) has always been a bone of contention between the assessee and the tax department. The dispute lies is in measuring the correct amount of tax both under Direct and Indirect Taxes. Hence it has always been an area of litigation. But in spite of this fact, JDA is the most common and popular form of arrangement for constructing properties in our Country. It is a preferable form both to the developer and to the Landowner. In this write up the author has tried to put a broad concept of taxability of JDA under Income Tax law and GST law.

Joint Development Agreement –Meaning & Benefits

There is no specific definition of the term ‘Joint Development’ prescribed under the law. But generally in a JDA, a landowner contributes his land for the construction of a real estate project, and the developer undertakes the responsibility for the development of the property, obtaining approvals, performing legal formalities, and marketing the project. The landowner enters into an agreement and gives a General Power of Attorney to the developer, assigning him a duty to obtain the mandatory approvals from various authorities and allowing the developer to enter the land and do all necessary things for undertaking the construction. It will also give the Developer the right to sell and register agreed portions of land with respective undivided shares by way of flats to other buyers. When the construction is completed, the landowner is handed over flats allocated to his share which he will normally keep for personal use or may even rent out or sell outright to the buyers.

The landlord may also get his share at a specified percentage of the sale consideration of the entire project as and when actual collection from customers is made. Sometimes the developer would give a lump sum amount to the landowner as a refundable security deposit on entering into JDA.

Related Topic:

TAXABILITY OF TDR ON OR AFTER 01.04.2019

The key benefits arising out of JDA are:

- A huge investment in purchasing land is saved/minimized by the Developer.

- Payment of stamp duty is avoided for the transfer of land.

- Lucrative offer/consideration for the landlord.

- Speedy construction of property by the developer.

‘Joint Development’ should not be understood as ‘Joint Venture’ because both the terms are quite different having a different meanings, areas of operation, taxability, etc.

Taxability under the Income Tax Law

The income arising to the developer under a JDA, in the form of sale consideration of his share in the developed property is considered as his Business Income and is taxed as per the applicable provisions. On the other hand, the amount received by the landowner either as a percentage of the sales consideration or as a percentage of the built-up area in the developed property is considered as Capital Gain in his hands. But this calculation of Capital Gain is the most controversial part where consideration is in the form of a built-up area. JDA model is generally challenged by the assessing officers due to the lack of clarity in respect of the point of taxation in the hands of the landowner and the determination of the amount of taxable consideration received by the landowner.

Related Topic:

Madras HC in the case of Tvl. Transtonnelstroy Afcons Joint venture

Taxability of JDA entered till 31.03.2017 (AY 2017-18):

Prior to 01.04.2017, the capital gain was chargeable to tax under the provisions of section 45 of the Income Tax Act, 1961 in the year in which the transfer takes place except in certain cases. The definition of ‘transfer’ u/s 2(47) (v), inter Alia, includes any arrangement or transaction whereby any rights are handed over in execution of part performance of a contract of nature referred to in section 53A of the Transfer of Property Act, 1882 (4 of 1882) even though the legal right has not been transferred. In such a case, execution of Joint Development Agreement between the owner of immovable property and the developer triggered the capital gain tax liability in the hands of the owner in the year in which the agreement is entered into and the possession of the immovable property is handed over to the developer for development of a project. The taxing authorities consider this as the point of time u/s 45(1) at which the landlord was supposed to pay the Capital Gain tax as against the fact that the landlord, in reality, never received any consideration at that point in time. Contrary to that, the actual receipts or considerations start accruing only after the property starts developing or developing. So the taxable event was never triggered merely on the signing of the agreement. So it caused genuine hardship to the landowners to pay capital gain tax from his pocket in absence of realization of actual consideration. Not only this, the authorities determined the fair market value of the project including land as deemed consideration u/s 50D for such transfer when the project is just on papers at the time of signing of JDA, with no real existence. The above provision of law as existed till 31.03.2017 was ambiguous and caused several litigations.

Taxability of JDA entered on or after 01.4.2017 (AY 2018-19)

But with the view to minimize the genuine hardship which the owner of land may face in paying capital gains, it was proposed in the Union Budget 2017 to insert a new subsection (5A) in section 45. The same was made effective from 01.04.2017 onwards i.e. from the F.Y.2017-18 onwards. Let us understand the new provisions of section 45(5A) of the Income Tax Act 1961.

According to this new provision, the individuals/ HUF who enter the registered Joint Development Agreement with the builder/developer are liable to capital gains in the year in which the certificate of completion for the whole or part of the project is issued by the competent authority. Therefore, the tax liability is postponed from the year of transfer of land to the year of completion of the project. Further, the Stamp Duty Value (SDV) of land or building or both, of the landowner’s share in the project, on the date of issue of said certificate, as increased by the consideration received in cash, if any, shall be deemed to be the full value of consideration.

However, in the case where the landowner transfers his share in the project on or before the date of the issue of said certificate, the capital gains shall be deemed to be the income of the previous year in which such transfer takes place. Also, the provision of section 45(5A) shall not be applicable in such cases, and thus the recourse to other normal provisions of section 45 as applicable prior to insertion of the new section has to be made. Also, consequential amendment in section 49 was made so as to provide that the cost of acquisition of the share in the project being land or building or both, in the hands of the landowner shall be the amount which is deemed as the full value of consideration under the said provision of section 45(5A).

Thus the key points of the newly inserted sub-section 5A can be summarized as follows:

- Applicable in respect of JDA entered on or after 01.04.2017.

- Applicable only to the Individual and HUF assessments.

- Land or building is held or treated as a capital asset by the landowner.

- Not applicable where entire sale consideration is received/receivable by the landowner in monetary terms.

- Applicable only where a registered agreement/deed is executed.

- Not applicable where the share is transferred before completion.

The author feels that though the liability of landowners in terms of the newly inserted sub-section is postponed till the completion of the project still has to be very careful in drafting the JDA. A small slip may give an impression to the AO that there is a ‘transfer’ on the date of the agreement itself as per section 2(47) read with section 53A of the Transfer of Property Act, 1882. So the various clauses of the agreement should be drafted as per the spirit of the law so that one may not unnecessarily interpret it to be ‘transfer’ within the four walls of section 2(47).

Related Topic:

GST Changes – Joint Development Agreement

Some contentious issues still unanswered by section 45(5A):

- Why has the Govt. has not extended the benefit of this section to the assessees other than the Individual and HUF?

- Whether the indexation will be given up to the date of the Joint Development Agreement or to the date of completion certificate or to the date of registration of constructed flats?

- When will be the time limit to make investment u/s? 54 and 54F will be reckoned- From the date of the Joint Development Agreement or from the date of completion certificate?

- Whether reference to the valuation officer u/s 50C is permissible in case the SDV is higher than FMV?

- Whether capital gain on entire land shall be attracted in the year in which certificate of completion for even part of the project is issued or in such a situation capital gains on land should be attracted on a proportionate basis in the ratio of the land utilized for the part of the project for which certificate of completion has been issued?

- In case agricultural land, not covered within the definition of capital asset u/s 2(14) is contributed for joint development – Whether capital gain liability shall be attracted?

- Whether section 45(5A) can be applied retrospectively?

Provision of TDS introduced w.e.f.01.04.2017 for JDA:

A new section 194IC has been inserted whereby deduction of tax at source (TDS) @ 10% is made applicable by the developer on any monetary consideration paid/payable to the resident individual /HUF landowner. Further, no threshold limit is provided meaning thereby it is applicable irrespective of quantum of payment.

So the above-discussed provisions are presently governing JDA arrangements under the Income Tax Act.

Taxability under the GST Law

Under a Joint development agreement, the landowner normally transfers development right or permits activities on his land, and the developer/builder, in turn, construct the building on the land owned by the landowner. In consideration, the builder gives certain built-up area or flats as agreed upon to the landowner and the remaining area or flats is to be sold by the builder to the buyers. The landowner may keep his share of built-up areas or flats for his own use or he may also sell such areas or flats to the buyers. So this type of arrangement has got the following limbs:

i. Transfer of development rights from the landowner to the builder.

ii. Service provided by the builder to the landowner in the form of transfer of constructed area or flats in lieu of land development right given.

iii. Sale of under-construction areas or flats to the ultimate buyer by the builder.

iv. Sale of an under-construction area or flat by the landowner to the buyer out of his own share.

Before discussing the GST impact on the above transactions (i) to (iv) let us first understand the provision of law for the sake of clarity.

Under the GST, the term ‘supply’ is defined u/s 7 in a very wide term which also includes barter/ exchange of goods or services whereas the term ‘services’ is defined to be anything other than goods. Further, entry no. 5 of Schedule III

of the CGST Act, 2017, excludes the sale of land from the scope of supply. There is still a debate regarding the taxability of transfer of development rights under JDA, as to whether the same is liable to GST or not. The argument advanced is that the transfer of development right is as good as the sale of immovable property and thus should be out of the GST purview. However, time and again the Govt. has clarified its intention and made it clear through notifications/ FAQs, etc. that the transfer of development rights from the landowner to a developer is a taxable service. Further the same was also clarified by AAR Maharashtra Ruling in the case of Vilas Chandanmal Gandhi dt. 15.01.2020 and also by the AAR Karnataka in the case of Marq Spaces Pvt. Ltd. (order no. KAR ADRG/199/2019).

The GST provision in respect of the real estate sector has undergone a sea change w.e.f.01.04.2019 onwards. Prior to 01.04.2019, there were higher rates of tax and further lack of clarity in respect of some areas. So in order to get a clear idea of the taxability we have divided our discussion into two parts viz: taxability prior to 01.04.2019 and taxability after 01.04.2019.

Taxability of JDA under GST up to 31.03.2019:

GST on Landowner

Liability to pay tax –

The landowner is liable to charge 18% of GST on the supply of development rights. [S.No. 16(iii) of Notification No. 11/2017-CT(R) dt. 28.06.2017]

In cases where the landowner further sells his share of constructed area or flats allotted by the builder and he receives any amount as advance from the prospective buyers during the construction stage then the landlord will be liable to pay GST on it. No GST is applicable if such sales are made after the completion of construction.

Time of supply-

Liability to pay tax shall arise at the time when the said builder, transfers possession or the right in the constructed complex, building, or civil structure, to the person supplying the development rights by entering into a conveyance deed or similar instrument. [Notification No. 4/2018-CT(R) dt. 25.01.2018]

In case of further sales of constructed area/flats, the landowner will be liable to pay GST on receipt of advance /booking amount from the customers against sales as per the provision of section 13.

Value of supply-

The value of TDR shall be equal to the amount charged by the promoter for similar apartments from the independent buyers booked on the date that is nearest to the date on which such development rights or FSI is transferred by the landowner to the promoter.

As against sales of constructed area/flats, the actual sales value realizable from buyers as per transaction value will be the value of supply.

GST on Developer/ Builder

Liability to pay tax-

The builder is required to charge GST on the supply of flats @12% (18% less 1/3 value of land).

ITC on tax paid to landowner & another ITC on materials etc. consumed is available.

However, No GST is required to be charged on the supply of constructed flats after obtaining the completion certificate.

Time of supply-

At the time of sale or receipt of advance against the sale as per section 13. [Notification No. 4/2018 C.T.(R) 25.01.2018]

Value of supply-

Sale Value of the project (Including transfer of flats against development rights to Land Owner)

Let us take an example:

| Total Sale Value of the project | = 30 Crore |

| Share of Land owner’s value | = 12 Crore |

| Other sales to buyers | = 18 Crore |

| ITC on materials claimed by the builder | = 1 Crore |

Assumed: Area/Flats are sold before completion

| GST liability of the Landowner | = On 12 Crore @ 18% | = 2.16 Crore |

| GST liability of the Builder | = On 30 Crore @ 12% | = 3.60 Crore |

| Less: ITC available: | ||

| Paid to Landowner | = 2.16 Crore | |

| Other ITC | = 1.00 Crore | 3.16 Crore |

| Net Liability of the Builder | = 0 .44 Crore |

TDR in between 01.07.2017 to 31.03.2019 but actual allotment after 31.03.2019

In the case where the Development rights are supplied by the Landowner to the Builder, under an area/flat sharing arrangement between 01.07.2017 and 31.03.2019, but the allotment of constructed area in an ongoing project is made by the Builder to the Landowner on or after 01.04.2019, the Tax liability on service by way of transfer of development rights prior to 01.04.2019 is required to be discharged in terms of Notification No. 4/2018-CentralTax (Rate) dated 5.01.2018 i.e in the old manner only.

Taxability of JDA under GST w.e.f. 01.04.2019:

GST on Landowner

Liability to pay tax –

GST is though applicable to the supply of development rights, w.e.f.01.04.2019 the responsibility to pay tax is no more in the hands of the landowner, rather it is shifted to the builder under reverse charge mechanism (RCM). It is immaterial whether the landowner is registered under GST or not. So it can be construed that transfer of development right is not taxable in the hands of landowner w.e.f.01.04.2019. [Notification No. 13/2017-CT (R) dt. 28.06.2017 as amended by Notification No. 05/2019-Central Tax (Rate)] Dated: 29th March 2019]

In cases where the landowner further sells his share of constructed area or flats allotted by the builder and he receives any amount as advance from the prospective buyers during the construction stage then the landlord will be liable to pay GST on it. No GST is applicable if such sales are made after the completion of construction.

Rate of tax –

In case of further sales of area/flats by the landowner, he will be liable to pay tax @ 1% or 5% depending on the nature of the residential apartments viz: affordable or non-affordable category. However, if the developer opted for the existing system of 8%/12% then the landowner has also to opt for the same. (Refer FAQs dated: 14.05.2019). Further, he is also entitled to claim ITC charged by the builder in both the situation (old rates and new rates) on the consideration value against the transfer of development right inland.

Time of supply-

The landowner will be liable to pay GST on receipt of advance /booking amount from the customers against sales as per provisions of section 13.

Value of supply-

The actual sales value is realizable from buyers as the transaction value will be the value of supply.

GST on Developer/ Builder

Liability to pay tax /Rate of Tax-

New GST rates (1% and 5% without ITC) effective from 01-04-2019 are applicable to the construction of residential apartments in a project which commences on or after 01-04-2019. [Notification No. 03/2019-Central Tax (Rate) 29/03/2019]

1% GST — It is applicable to the Affordable housing project.

5% GST — It is applicable to the project in which the carpet area of the commercial apartments is not more than 15 % of the total carpet area of all the apartments in the project.

The new tax rates shall be available subject to the following conditions,-

(a) The input tax credit shall not be available and GST liability to be discharged in cash only,

(b) 80% of inputs and input services (other than capital goods, TDR/ JDA, FSI, long term lease (premiums), electricity, high-speed diesel, motor spirit, natural gas) shall be purchased from registered persons. On shortfall of purchases from 80%, the tax shall be paid by the builder @ 18% on RCM basis u/s 9(4). However, Tax on Cement purchased from unregistered persons shall be paid @ 28% under RCM, and on capital goods under RCM at applicable rates only.

Reverse Charge on TDR-

Supply of TDR or FSI or long-term lease of land used for the construction of residential apartments in a project that is booked before the issue of completion certificate or first occupation is exempt vide S.N. 41A of notification number 12/2017-CT(Rate) dated 28.06.2017.

Supply of TDR or FSI or long term lease of land, on such value which is proportionate to the construction of residential apartments that remain un-booked on the date of issue of completion certificate or first occupation, would attract GST at the rate of 18%, but the amount of tax shall be limited to1% or 5% of the value of apartment (un-booked) depending upon whether the residential apartments for which such TDR or FSI is used, in the affordable residential apartment category or in other than an affordable residential apartment.

TDR or FSI or long-term lease of land used for the construction of commercial apartments shall attract a GST of 18%. However, the same has to be paid by the builder on a reverse charge basis u/s 9(3). [S. No. 16(iii) of Notification No.

11/2017-CT(R) dt. 28.06.2017 as confirmed by AAR Maharashtra Ruling in the case of Vilas Chandanmal Gandhi dt. 15.01.2020]

Thus builder is liable to pay GST @18% on TDR or floor space index supplied on or after 01-04-2019 on a reverse charge basis and can take ITC thereof.

Time of supply-

The liability to pay GST on development rights shall arise on the date of completion or first occupation of the project, whichever is earlier. Therefore, the builder shall be liable to pay tax on a reverse charge basis, on the supply of TDR on or after 01-04-2019, which is attributable to the residential apartments that remain un-booked on the date of issuance of the completion certificate, or first occupation of the project. The same is applicable both in the case of monetary and non-monetary consideration given for residential complexes.

However, liability to pay tax shall arise immediately if such FSI is relatable to the construction of commercial apartments. [Press Release 07/05/2019]

In case of sales of constructed area/flats to the buyer by the builder, the time of supply shall be the time of sale or receipt of advance against such sale.

Value of supply-

The value of TDR shall be equal to the amount charged by the builder for similar apartments from the independent buyers booked on the date that is nearest to the date on which such development rights or FSI is transferred by the landowner to the builder. [Press Release 07/05/2019]

In the case of sales of constructed area /flats to buyers, the actual sale price of flats to the buyers as transaction value will be the value of supply.

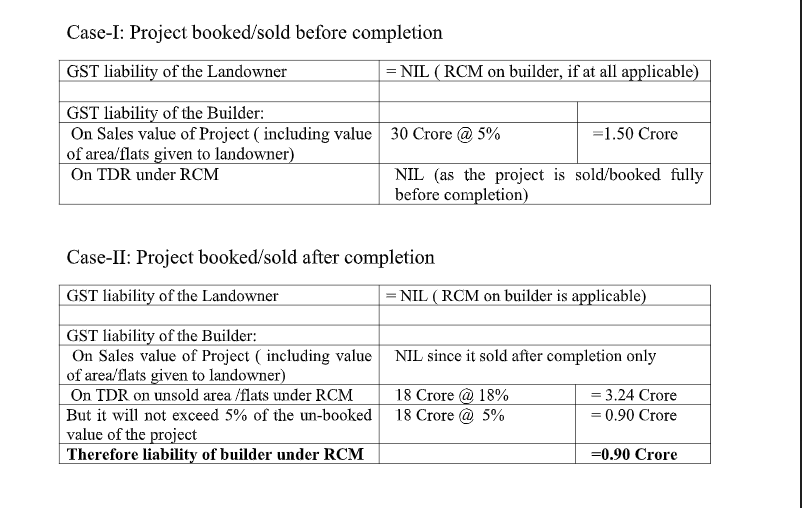

Let us take an example:

| Total Sale Value of the non-affordable residential project | = 30 Crore |

| Share of Land owner’s value | = 12 Crore |

| Other sales to buyers | = 18 Crore |

Case-I: Project booked/sold before completion

Some contentious issues still need legal scrutiny under GST:

- Whether transfer of rights in land/TDR (being immovable property) really liable to GST?

- Whether 1/3 rd deduction on account of the land value and thereby deeming cost of construction equals to 2/3 rd is mandatory in nature?

- The three-tier taxing system in the form of ITC denial, Output Tax, and Stamp Duty is justifiable?

- Applicability of RCM on the supply from unregistered vendors in the case where the project is fully sold after completion may cause disputes.

Conclusion:

The above discussion reveals that both the laws were earlier recognizing the date of agreement /deed/conveyance as the date of transfer of property in development rights. It was the biggest problem for assessees as well as the tax debt. and causing litigations after litigations. However, the Govt. has made efforts from time to time to streamline, synchronize, and simplify the law. Further various definitions and provisions under GST law are also linked to RERA Act 2016. It is evident from the fact that the point of taxation and taxable value under IT & GST laws are now more or less synchronized.

Under Income Tax law, the point of taxation u/s 45(5A) is on completion of the project only. Similarly, post 01.04.2019 the GST liability of the landowner on account of transfer of development right is shifted on the builder under the reverse charge mechanism. Further, the point of taxation of the same is also made on completion of the project only. The taxable value under Income Tax law for transfer of development rights is the stamp duty value adopted for constructed area/flat. Moreover, the draft ICDS on Real Estate transactions issued by Income Tax/CBDT also talks about Fair value in case of giving up rights over existing structures or open land. In the same line, the consideration for such transfer under GST is now equated to the amount charged by the builder for similar apartments from the independent buyers. So it gives the impression that the Govt. has tried to adopt a Fair Market Value based on Stamp duty valuation and sales price of similar apartments.

Disclaimer:

The above-expressed views are purely the personal views of the author. The possibility of other views on the subject matter cannot be ruled out. So the readers are requested to check and refer to relevant provisions of a statute, latest judicial pronouncements, circulars, clarifications, etc before acting on the basis of the above write-up. The author is not responsible in any way.