Delhi HC in the case of Bharti Airtel Limited Versus UOI

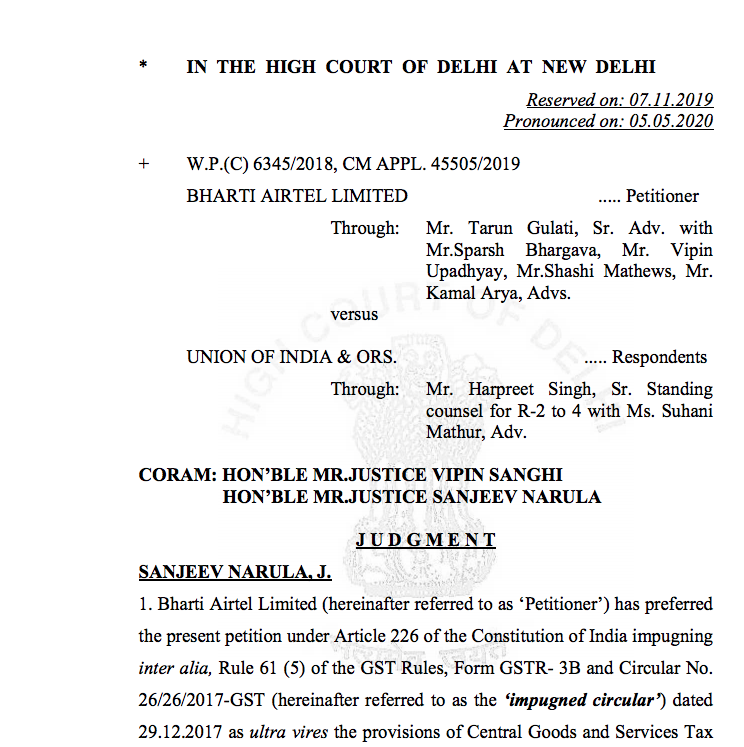

Citations: Article 226 of the Constitution of India Rule 61 (5) of the GST Rules Section 37 of the CGST Act Section 38 of the CGST Act Section 39 of CGST Act Section 77 of the Act Section 168 of the CGST Act Section 54 of the CGST Act Section 17 of the CGST (Amendment) Act, 2018 APP & Company Chartered Accountants V. Union of India Panduranga Stone Crushers v. Union of India Adfert Technologies Pvt. Ltd. v. Union of India & Ors. Lease Plan India Pvt. Ltd. v. Govt. of NCT & Ors Blue Bird Pure Pvt. Ltd v. Union of India & Ors Commissioner of Central Excise, Bolpur vs. Ratan Melting and Wire Industries Dhiren Chemical Industries Case Kalyani Packaging Industry vs. Union of India TATA Teleservices Ltd. Vs. Commissioner of Customs IN THE HIGH COURT OF DELHI AT NEW DELHI Reserved on: 07.11.2019 Pronounced on: 05.05.2020 W.P.(C) 6345/2018, CM APPL. 45505/2019 BHARTI AIRTEL LIMITED ..... Petitioner Through: Mr. Tarun Gulati, Sr. Adv. with Mr.Sparsh Bhargava, Mr. Vipin Upadhyay, Mr.Shashi Mathews, Mr. Kamal Arya, Advs. versus UNION OF INDIA & ORS. ..... Respondents Through: Mr. Harpreet Singh, Sr. Standing counsel for R-2 to 4 with Ms. Suhani Mathur, Adv. CORAM: HON’BLE MR.JUSTICE VIPIN SANGHI HON’BLE MR.JUSTICE SANJEEV NARULA J U D G M E N T SANJEEV NARULA, J. 1. Bharti Airtel Limited (hereinafter referred to as ‘Petitioner’) has preferred the present petition under Article 226 of the Constitution of India impugning inter alia, Rule 61 (5) of the GST Rules, Form GSTR- 3B and Circular No. 26/26/2017-GST (hereinafter referred to as the ‘impugned circular’) dated 29.12.2017 as ultra vires the provisions of Central Goods and Services Tax Act, 2017 (CGST Act) and contrary to Articles 14, 19 and 265 of the Constitution of India. The challenge to the aforenoted provisions is principally for the reason that Petitioner is being prevented from correcting its monthly GST returns, and consequently seeking refund of the excesstaxes paid. Brief Factual Background - Controversy 2. To fully comprehend the tax provisions and circulars that are coming in the way of the Petitioner to correct the errors it has noticed, we would have to advert to the facts of the case and also reflect upon the statutory scheme of the GST filings and also take note of the circumstances that led to this situation. To begin with, let us briefly note the facts - Petitioner is engaged in the business of providing telecommunication services in India, including Delhi, by virtue of license granted by the Department of Telecommunication, Government of India. With the implementation of GST, it took registration in each and every State and Union Territory and now has 50 registrations under GST laws for making payment of CGST, SGST and IGST. Since the compliance regime under the GST laws is significantly different and the statutory provisions provide for a complete electronic model of compliances, Petitioner remoulded its system from the centralized registration under the erstwhile service tax regime, to multiple registrations under GST in order to bring it in conformity with the new laws. This included introduction of the technical changes for enabling filing of the statutory Forms GSTR-1, 2 and 3. However, while putting the new law into practice, Government could not operationalise Forms GSTR-2 and 3 and, as a result a summary scheme of filing Form GSTR- 3B was introduced. The petitioner states that this half-baked step of the Respondents is the root cause in the failure of the system in detecting the errors which in the course of time created the situation wherein the petitioner finds itself. 3. The Petitioner recounts that during the initial phase of the GST regime it was facing issues on the electronic system i.e. Goods and Services Tax Network (GSTN) portal created by the Government as the same was not equipped to handle the transition from the erstwhile regime to GST. In this transition phase, several issues cropped up which had a significant impact on tax paid, the output liability, and the ITC of the Petitioner and led to occurrence of several inadvertent errors. To illustrate a few, invoices were accidently missed while filing Form GSTR-3B; credit notes pertaining to the invoices issued under the erstwhile regime were overlooked and, as a result, the output tax liability was over-reported; certain transactions like stock transfer from one place of business to another under the same GST Registration was reported as supply; in few instances, due to inadvertent error, NIL Form GSTR-3B were filed, though actually there was output tax liability. To sum it up, the paramount grievance of the Petitioner is that during the period from July, 2017 to September, 2017 (hereinafter referred to as ‘the relevant period’), the Petitioner in its monthly GSTR- 3B recorded the ITC based on its estimate. As a result, when the Petitioner had to discharge the GST liability for the relevant period, the details of ITC available were not known and the Petitioner was compelled to discharge its tax liability in cash, although, actually ITC was available with it but was not reflected in the system on account of lack of data. The exact ITC available for the relevant period was discovered only later in the month October 2018, when the Government operationalized Form GSTR-2A for the past periods. Thereupon, precise details were computed and Petitioner realized that for the relevant period ITC had been under reported. The Petitioner alleges that there has been excess payment of taxes, by way of cash, to the tune ofapproximately Rs. 923 crores. This was occasioned to a great degree due to non-operationalization of Forms GSTR-2A, GSTR-2 and GSTR-3 and the system related checks which could have forewarned the petitioner about the mistake. Moreover, since there were no checks on the Form GSTR-3B which was manually filled up by the Petitioner, the excess payment of tax went unnoticed. Petitioner now desires to correct its returns, but is being prevented from doing so, as there is no enabling statutory procedure implemented by the Government. Impugned Circular- Existing Framework 4. On 01.09.2017, by the Circular No. 7/7/2017-GST, the Government provided for system based reconciliation of information furnished in Form GSTR-1 and Form GSTR-2 with Form GSTR-3B. Paragraph 6 of this circular specifically reiterated the fact that any differences in the details of outward supplies and ITC will be corrected in that particular month to which the details pertain 5. However, on 29.12.2017, by issuing Circular No. 26/26/2017-GST, the Government kept the Circular No. 7/7/2017-GST in abeyance due to . Paragraph 9 of this circular further provided that where the eligible ITC recorded in the GSTR-3B is less than the ITC shown in GSTR-2, then the ITC will be correctly reflected in the GSTR-3 of that very month. Thus, the Circular provided for reconciliation between the information furnished in the Form GSTR-3B with that reflected in Form GSTR-1 and Form GSTR-2. It also provided that if the details of eligible ITC have been reported incorrectly, the same maybe reported correctly in the Form GSTR-2 for the concerned tax period. 5. However, on 29.12.2017, by issuing Circular No. 26/26/2017-GST, the Government kept the Circular No. 7/7/2017-GST in abeyance due tocontinuing extension of time lines to file Form GSTR-1, 2 and 3 and nonavailability of facility to file Form GSTR-2. As a matter of fact, Para 3.2 of the impugned circular states that since Form GSTR-2 and 3 could not be operationalized, the Circular dated 07.07.2018 is kept in abeyance till such time these two returns are operationalized. Thereafter, para 4 of the impugned circular states that Form GSTR-3B can be corrected only in the month in which the errors were noticed. 6. In the above background, Petitioner’s grievance is that there is no rationale for not allowing rectification in the month for which the statutory return has been filed. This is also totally contrary to the statutory scheme of the CGST Act - which provides that the data filled by a registered person will be validated in that month itself, and thereafter any unmatched details be rectified in the month in which it is noticed. Accordingly, Petitioner impugns Rule 61 (5) From GSTR-3B and Circular No. 26/26/2017-GST dated 29.12.2017 as ultra vires the provisions of CGST Act to the extent, they do not provide for the modification of the information to be filled in the return of the tax period to which such information relates. The aforesaid provisions are also impugned on the ground that they are arbitrary, in violation of Articles 14, 19(1)(g), 265 and 300A of the Constitution of India. Submissions of Learned Counsel 7. Mr. Tarun Gulati, learned Sr. Counsel for the Petitioner argued that impugned circular is ultra vires the CGST Act and the Rules. He submits that as per the Sections 37 to 43 of the CGST Act, a scheme for filling details of outward supplies, inward supplies, return of inward or outwardsupplies, ITC availed, tax paid, was to be followed. In these terms, the Petitioner has a statutory right to fill all the necessary details, when the aforesaid provisions of the Act became enforceable. He submits that the inability of the Respondents to run their IT system as per the structure provided under the CGST Act cannot prejudice the rights of a registered person. Mr. Gulati explains that on account of major shift from the single service tax registration regime, to GST, it resulted in Petitioner having to collate crores of transactions both on the output side and input side. Besides, registrations were to be obtained in 29 States and 7 Union Territories. This required enormous compilation of data and was a humongous task. The possibility of error in compilation of data cannot be ruled out especially since the inbuilt self-check mechanism contemplated under the CGST Act had not been activated. Elaborating further, Mr. Gulati submits that Form GSTR-3B, prescribed under Rule 61 (5) is only a summary return that has been introduced by the Government in absence of Form GSTSR-2 and 3 being made operational. This Form is filled in manually and, therefore, has no inbuilt checks and balances that could ensure that the data uploaded by the Petitioner was accurate, verified and validated. The summary scheme introduced by Rule 61 (5) being in complete variance with the machinery originally contemplated under the GST Scheme, stifled the rights of the Petitioner by not permitting the validation of the data prior to the same being uploaded. In absence of such validation, the chances of incorrect data being uploaded cannot be eliminated. This resulted in adverse consequences in the nature of imposition of interest and penalty under the provisions of CGST Act. 8. Mr. Gulati further argued that the delay in operationalizing Form GSTR2A, a process which was statutorily mandated, cannot defeat the rights of the Petitioner to take and use credit in the month in which it was due. Since the statutory scheme originally envisaged under the Act could not be implemented and a summary scheme has been adopted, the Government should allow the assessees to exercise their rights available under the provisions of the Act. Mr. Gulati, placed reliance upon the judgment of the Gujarat High Court in the case of APP & Company Chartered Accountants V. Union of India, 2019-TIOL-1422-HC-AHM-GST and submitted that the Court has observed that Form GSTR-3B was not a return required to be filed under Section 39 of CGST Act and was only a temporary facility and as such delay in claiming credit cannot delay the period for which the same is claimed i.e. the last date for filing the Form GSTR-3B. Reliance was also placed upon the decision of Andhra Pradesh High Court in the case of Panduranga Stone Crushers v. Union of India, 2019-TIOL-1975-HC-APGST and also upon the decision of Punjab & Haryana High Court in the case of Adfert Technologies Pvt. Ltd. v. Union of India & Ors., 2019-VIL-537- P&H. It was further submitted that this Court has also in plethora of cases including Lease Plan India Pvt. Ltd. v. Govt. of NCT & Ors. [order dated 13.09.2019 - W.P. (C) 3309/2019] and Blue Bird Pure Pvt. Ltd v. Union of India & Ors., [order dated 22.07.2019 - W.P.(C) 3798/2019] , observed that GST is still in a “trial and error” phase and has permitted the assesses to rectify/revise the returns. Lastly, it was argued that the revision of Form GSTR-3B is revenue neutral since the Respondents have already realised the tax leviable under the law. Moreover, the eligibility of the Petitioner in respect of the ITC claimed under the rectified/amended returns can beverified prior to rectification. 9. Per contra, Mr. Harpreet Singh, learned Sr. Standing counsel on behalf of the GST department submitted that the impugned circular in the present petition does provide for the rectification of mistakes pertaining to earlier tax period in any subsequent tax period. He submitted that such changes have to be incorporated in the return for the tax period in which the error is noted. The assessee cannot, however, reflect the change in Form GSTR-3B of the original tax period. The rationale behind such a restriction was sought to be explained by referring to sub-section (9) of Section 39 of the CGST Act, 2017. 10. Mr. Singh, further submitted that vide Section 17 (c) (i) of the CGST (Amendment) Act, 2018, certain amendments have been carried out in the aforesaid provision. He clarified that the amended provisions have not been made operational yet, since notification No. 02/2019-Central Tax dated 29.01.2019 clearly provides that Section 17 of the CGST (Amendment) Act, 2018 shall not come into force. Nevertheless, even if this amendment would eventually come into effect, it shall apply prospectively from a future date and would not apply to the tax period from July, 2017 to September, 2017, which is the relevant period in question. 11. Mr. Singh submitted that it is not that as if the Act does not provide for rectification at all. In respect of particulars furnished for an earlier tax period, made at a later date in Form GSTR-3B, rectification shall get reflected in the return in the earlier tax period. In this manner, the originalreturn shall not get amended in light of the corrections made post-facto. The Circular No. 26/26/2017-GST dated 29.12.2017 clarifies the same, and is aligned with the provisions of the statute. In this regard, it is to be noted that GST, being an indirect tax is levied along the entire supply chain. The tax paid on outward supplies entitles the recipient of such supplies to avail ITC for the same. Thus, if changes made to particulars furnished by the supplier are allowed to be reflected in the relevant previous tax period (Form GSTR3B for which return has already been filed), it would require modification of the particulars furnished in Form GSTR-3B (of such earlier tax period) by the recipient. For example- if the supplier reduces tax liability for an earlier tax period (for which Form GSTR-3B has already been filed), this would require modification of the recipient’s Form GSTR-3B (which has already been filed) by way of commensurate reduction in ITC availed by him. This would enhance the compliance burden for the recipient. Another complexity would arise if such recipient is an exporter and claims refund of unutilized ITC under section 54(3) of CGST Act, 2017 read with rule 89 (4) of CGST Rules, 2017. In cases where refund has already been sanctioned and disbursed, the reduction of available ITC by recipient would make it a fit case for erroneous refund, thereby inviting demand under section 73 of the CGST Act, 2017. Thus, in order to ward of such complexities, the impugned circular and the provisions provide for rectification of GSTR-3B in the period subsequent to when the error etc. is noticed by an assessee and not for the period to which such error etc. pertains to. Analysis 12. The controversy in the present case actually lies in a narrow compass.The grievance of the Petitioner pertains to the rectification of Form GSTR3B for the period from July to September, 2017. This is the tax period/month in which the error has crept in. Though, the question before us is a short one, however, since the same concerns the scheme of the CGST Act, we would have to delve into the concepts of filing of returns and the statutory provisions governing the same. The Scheme of filing of returns as envisaged by the CGST Act is explained herein below: a) Section 37(1) of the CGST Act provides that a registered person is required to file a return (Form GSTR- 1) containing details of his outward supply for the tax period i.e. a month. These details of outward supplies of a registered person are communicated to the recipients in an auto-populated return (Form GSTR-2A) under Section 37(1) read with Section 38(1) of the CGST Act. b) Section 38(1) of the CGST Act provides that a registered person shall verify, validate, modify or delete such details of inward supplies communicated under Section 37(1) of the CGST Act in the Form GSTR-2A. Thereafter, under Section 38(2) of the CGST Act the recipient files a return (Form GSTR-2) containing details of his inward supplies based on Form GSTR 2A. These details are then communicated to the suppliers under Section 38(3) of the CGST Act and suppliers can accept or reject the details under section 37(2) and Form GSTR-1, shall stand amended accordingly. It is important to note that the details of inward supplies provided in Form GSTR-2 are auto-populated in the ITC ledger of the recipient of such supplies on submissions of this form c) Section 38(5) of the CGST Act and 39(9) of the CGST Act provide that details that have remained unmatched shall be rectified in the return to be furnished for the month during which such omission or incorrect particulars are noticed. d) Section 39 of the CGST Act provides that every registered person shall furnish a return (From GSTR-3) of inward and outward supplies, ITC, tax payable, tax paid and such other particulars as may be prescribed. 13. On a plain reading of the above provisions, it clearly emerges that the statutory scheme, as envisaged under the Act provided a facility for validation of monthly data through the IT System of the Government wherein the output of one dealer (Form GSTR-1), becomes the input of another dealer and gets auto-populated in Form GSTR-2 (Inward Supplies). These details had to be electronically populated in Form GSTR-3 (Monthly Return) and tax had to be paid based on this return. The CGST Act and the CGST Rules as envisaged provided for verification, validation, modification and deletion of information for each period by interaction, over the IT System, between the supplier and the recipient so as to reflect the correct details pertaining to the tax period in that particular tax period itself (i.e. a month). In short, the CGST Act contemplated a self-policing system under which the authenticity of the information submitted in the returns by registered person is not only auto-populated but is verified by the supplier and confirmed by the recipient in the same month. The statutory provisions, therefore, provided not just for a procedure but a right and a facility to a registered person by which it can be ensured that the ITC availed and returns can be corrected in the very month to which they relate, and the registeredperson is not visited with any adverse consequences for uploading incorrect data. 14. Now, let us also examine the rectification scheme under the Act. The statute provides for a 2-stage rectification procedure by which the errors or omissions can be rectified by a registered person. a) The 1st stage of rectification can happen under Section 37(1) read with Sections 38 (1), 38 (3) and 37 (2) of the CGST Act wherein a registered person could rectify the errors or omissions pertaining to a tax period in the return to be furnished for such tax period itself through a self-policing and auto-populated interaction on the system. b) The 2nd stage of rectification is provided under Section 38 (5) and 39 (9) of the CGST Act wherein, in respect of only unmatched details - which could not be corrected at the first stage, rectification could be done in the return to be furnished for the month during which such omission or incorrect particulars were noticed. 15. While the GST regime envisaged the filing process and recording of ITC and payment of taxes as above, admittedly, due to system issues and under preparedness with regard to the extent of data to be processed, Form GSTR-2, and 3 were not made operational; and have been now completely done away with. Form GSTR-2A was made operational only in September 2018 by the Government. This Form is also valid in respect of the past periods commencing July 2017. The Respondents do not dispute that the statutory scheme envisaging the filing of return GSTR-2 and 3 could not beput into operation and has been indefinitely deferred. This makes it abundantly clear that neither the systems of the Government were ready, nor were the systems of the suppliers all across the country geared up to handle such an elaborate electronic filing and reconciliation system introduced for the first time. 16. Since Forms GSTR-2 and 3 could not be operationalized by the Government, the Government introduced Rule 61(5) (which was amended vide Notification No. 17/2017-Central Tax, dated 27.07.2017) and the Rule 61(6) in the CGST Rules, and provided for filing of monthly return in Form GSTR-3B which is only a summary return. Mr. Singh appearing for the Revenue does not controvert the submission of Mr. Gulati that Form GSTR3B is filled in manually by each registered person and has no inbuilt checks and balances by which it can be ensured that the data uploaded by each registered person is accurate, verified and validated. Therefore, the design and scheme of the Act as envisioned has not been entirely put into operation as yet. In these circumstances we find merit in the submission of Mr. Gulati that if the statutorily prescribed form i.e. GSTR-2 & 3 had been operationalized by the Government - as was envisaged under the scheme of the Act, the Petitioner with reasonable certainty would have known the correct ITC available to it in the relevant period, and could have discharged its liability through ITC, instead of cash. We also find force in the submission of Mr. Gulati that since Form GSTR-2 & 2A were not operationalized - and because the systems of various suppliers were not fully geared up to deal with the change in the compliance mechanism, the Petitioner perhaps did not have the exact details of the input tax creditavailable for the initial three months i.e. the relevant period. In this situation, since Petitioner’s ITC claim was based on estimation and the exact amount for the relevant period was not known, Petitioner discharged the GST liability for the relevant period in cash, although, in reality, ITC was available with it (though it was not reflected in the system on account of lack of data). Indisputably, if the statutorily prescribed returns i.e. GSTR 2 and GSTR 3 had been operationalized by the Government, the Petitioner would have known the correct ITC amount available to it in the relevant period, and could have discharged its liability through ITC. As a consequence, the deficiency in reporting the eligible ITC in the months of July - September 2017 in the form GSTR- 3B has resulted in excess payment of cash by the Petitioner. 17. Now that the correct figures are known to the Petitioner, and limited rectification of returns is permissible, why is Petitioner’s grievance not redressed? The answer lies in the refund provisions that we shall now allude to briefly. These provisions are the stumbling block for the petitioner to remedy the situation. ITC is taken on the basis of the invoices issued to a registered person providing input/output services. This ITC is credited to the electronic credit ledger [Section 2 (46) of the CGST Act] under section 49(2) of the CGST Act. The output tax liability of the supplier can be paid through utilization of ITC available in the electronic credit ledger, or by utilization of the amount available in the electronic cash ledger [Section 2(43) of the CGST Act] under section 49 (1) of the CGST Act. Section 54 (1) of the CGST Act provides for the refund of the amount of excess paid tax. The said provision read with Circular dated 29.12.2017, deals with therefund of excess tax paid. Under the proviso to section 54 (1) read with Section 49(6), refund of excess input tax credit is allowable only in two situations – where there is zero (0) rated tax, or inverted duty structure. Further, refund of cash is allowed in case of excess balance in electronic cash ledger in accordance with Section 46 (6) of CGST Act. Refund can also be claimed if tax is paid on supply which is not provided, either wholly or partially, and for which invoice has not been issued. Furthermore, refund can be given under Section 77 of the Act which deals with tax wrongfully collected and paid to Central Government or State Government. Therefore, the above provisions would not entirely remedy the situation for the Petitioner. For this reason, we cannot countenance the stand of the Respondents as stated in their additional affidavit. Respondents are unreasonably harping on the mistake on the part of the Petitioner for not utilizing of input tax credit on account of erroneous reporting. While the Respondents may be correct in stating that the case of the Petitioner may not qualify as “payment of excess tax”, but one cannot ignore the circumstances narrated above. In the first instance, the Petitioner has made payment of taxes in cash, only because the extent of input tax credit could not be computed. In terms of para 4 of Circular No. 26/26/2017-GST, adjustment of tax liability of input tax credit is permissible in subsequent months. For the months of September/October, 2018, the output liability for the said months was adjusted by following the procedure as provided in the said circular. However, Mr. Gulati has explained, the output tax liability has substantially reduced on account of low tariff in the telecom sector. As a result, the input tax credit which has accumulated on account of erroneous reporting, cannot be fully utilized in the prevailing tariff structure. Thesurplus input tax credit is expected to grow, for the later months as well, and there would be further inflow of input tax credit. In these circumstances, the adjustment of the tax liability in subsequent tax period would not recompense the Petitioner. Mr. Gulati has drawn our attention to the tabulations placed on record to illustrate his point. Moreover, even if there is a possibility to adjust the accumulated ITC in future, that cannot be a ground to deprive the Petitioner the option to fully utilize the input tax credit which it is statutorily entitled to do so. 18. While arriving at this conclusion we also have to take into account that the Respondents have absolutely failed in operationalizing the forms that were originally envisaged under the Act. The scheme of the CGST Act as introduced, contemplated validation and verification of data which was to be uploaded vide Form GSTR-2 & 3. However, in absence of such statutory forms being operationalized on account of lack of technical infrastructure, Form GSTR-3B was introduced and it was required to be filled in manually. There cannot be any dispute that Form GSTR-3B has been brought into operation instead of Form GSTR-2 and GSTR-3. This Form GSTR-3B as introduced by Rule 61 (5) being at variance with the other statutory provisions does not permit the data validation before it is uploaded. As per the Respondents, Form GSTR-3B is a return not in addition to GSTR-3, but in place of it, till such time GSTR-3 gets operationalized. Form GSTR-3B which has been brought into operation by virtue of Section 168 of the CGST Act, in comparison with Form GSTR-3 is a truncated version. Thus, we find merit in the submission of Mr. Gulati that with this change brought in by the Respondents, the form originally contemplated got fundamentally altered.As a result, the checks and balances which were prescribed in the original forms got effaced and it cannot be ruled out that this possibly caused inaccuracies to creep in the data that is required to be filled in. 19. Acknowledging the fact that manual filling of forms can result in errors, Respondents permitted rectification by way of the Circular No. 7/7/2017– GST issued by CBEC, relevant portion whereof reads as under: “3. As per the provisions of sub-rule (5) of rule 61 of the Rules, the return in FORM GSTR-3B was required to be furnished when the due dates for filing of FORM GSTR-1 and FORM GSTR-2 have been extended. After the return in FORM GSTR-3B has been furnished, the process of reconciliation between the information furnished in FORM GSTR-3B with that furnished in FORM GSTR-1 and FORM GST-2 would be carried out in accordance with the provisions of sub-rule (6) of rule 61 of the Rules. 4. x x x 5. x x x 6. Correction of erroneous details furnished in FORM GSTR3B: In case the registered person intends to amend any details furnished in FORM GSTR3B, it may be done in the FORM GSTR1 or FORM GSTR-2, as the case may be. For example, while preparing and furnishing the details in FORM GSTR-1, if the outward supplies have been under reported or excess reported in FORM GSTR-3B, the same maybe correctly reported in the FORM GSTR-1. Similarly, if the details of inward supplies or the eligible ITC have been reported less or more than what they should have been, the same maybe reported correctly in the FORM GSTR-2. This will get reflected in the revised output tax liability or eligible ITC, as the case may be, of the registered person. The details furnished in FORM GSTR-1 and FORM GSTR-2 will be auto-populated and reflected in the return in FORM GSTR-3 for that particular month.” (emphasis supplied) The portion of the said circular underlined above, provided for reconciliation and restatement of tax liability based on the amended ITC of the relevant month. Later, Respondent introduced the impugned circular No. 26/26/2017- GST dated 29.12.2017, whereby the earlier Circular No. 7/7/2017–GST has been kept in abeyance. Para 3 of the said Circular provides for amendment/ rectification of errors, para 4 imposes a restriction on the same and stipulates that the rectification of errors can be done concurrently in the month in which the error is noticed, and not in the month to which the data relates. The relevant portion of the said circular is reproduced hereinbelow: “ 3. Amendment / corrections / rectification of errors: 3.1 Various representations have been received wherein registered persons have requested for clarification on the procedure for rectification of errors made while filing their FORM GSTR-3B. In this regard, Circular No. 7/7/2017-GST dated 1st September 2017 was issued which clarified that errors committed while filing FORM GSTR – 3B may be rectified while filing FORM GSTR-1 and FORM GSTR-2 of the same month. Further, in the said circular, it was clarified that the system will automatically reconcile the data submitted in FORM GSTR-3B with FORM GSTR-1 and FORM GSTR-2, and the variations if any will either be offset against output tax liability or added to the output tax liability of the subsequent months of the registered person. 3.2 Since, the GST Council has decided that the time period of filing of FORM GSTR-2 and FORM GSTR -3 for the month of July 2017 to March 2018 would be worked out by a Committee of officers, the system based reconciliation prescribed under Circular No.7/7/2017-GST dated 1st September 2017 can only be operationalized after the relevant notification is issued. The said circular is therefore kept in abeyance till such time. 3.3 The common errors while submitting FORM GSTR-3B and the steps needed to be taken to rectify the same are provided in the table annexed herewith. The registered person needs to decide at which stage of filing of FORM GSTR-3B he is currently at and also the error committed by him. The corresponding column in the table provides the steps to be followed by him to rectify such error. 4. It is clarified that as return in FORM GSTR-3B do not contain provisions for reporting of differential figures for past month(s), the said figures may be reported on net basis alongwith the values for current month itself in appropriate tables i.e. Table No. 3.1, 3.2, 4 and 5, as the case may be. It may be noted that while making adjustment in the output tax liability or input tax credit, there can be no negative entries in the FORM GSTR-3B. The amount remaining for adjustment, if any, may be adjusted in the return(s) in FORM GSTR- 3B of subsequent month(s) and, in cases where such adjustment is not feasible, refund may be claimed.(emphasis supplied)

20. The earlier circular has not been rescinded by the impugned circular dated 29.12.2017, but only kept in abeyance. Be that as it may, we see no reason as to why the rectification/adjustment is being allowed in the month subsequent to when such errors relate, and the Respondents have restricted the mechanism of rectification to the same tax period, in which they were noticed and sought to be rectified. In our view, para 4 of Circular No. 26/26/2017-GST dated 29.12.2017 is not in consonance with the provisions of CGST Act, 2017. The impugned circular expressly states that the time period for filing of Form GSTR-2 and GSTR-3 for the months of July, 2017 to March, 2018 would be worked by a committee, as system-based Where adjustments have been made in FORM GSTR-3B of multiple months, corresponding adjustments in FORM GSTR-1 should also preferably be made in the corresponding months.”reconciliation can only be operationalized after the relevant notification is issued. Thus, the impugned circular, in unequivocal terms, recognizes the concept of system-based reconciliation of ITC and output liability for the same tax period as per the statutory provisions. We, therefore, do not find any cogent reasoning behind the logic for restricting rectification only in the period in which the error is noticed and corrected, and not in the period to which it relates. There is no provision under the Act that has been brought to our notice which would restrict such rectification. In fact, the Respondents’ contention is to the effect “thus, the Act does not provide that the data filled by a registered person has to be validated in that month itself. Accordingly Circular No. 26/26/2017-GST dated 29.12.2017 was issued providing that rectification of errors can be done, concurrently in that month in which the errors is known and not in the month to which the data relates” is palpably flawed. The restriction if any, that can be introduced by way of a circular, has to be in conformity with the scheme of the Act and the provisions contained therein. In fact, as noticed above, the earlier Circular No. 7/7/2017-GST does recognize that the reconciliation is based on amended ITC of the relevant month. This is in terms of provisions of CGST Act and the Respondents’ contention is contrary to the same. Thus, the constraint introduced by para 4 of the impugned circular, is arbitrary and contrary to the provisions of the Act and, therefore, we have no hesitation in declaring it to be so. It is trite proposition of law that circular issued by the Board cannot be contrary to the Act and the Government cannot impose conditions which go against the scheme of the statutory provisions contained in the Act. The subordinate legislation must conform to the statute under which it is made, and they cannot whittle down the benefits granted under statutory provision.The Respondents have failed to fully enforce the scheme of the Act, and cannot take benefit of its own wrong of suspension of the Statutory Forms and deprive the rectification/amendment of the returns to reflect ITC pertaining to a tax period to which the return relates to. Petitioner has a substantive right to rectify/adjust the ITC for the period to which it relates. The rectification/ adjustment mechanism for the months subsequent to when the errors are noticed is contrary to the scheme of the Act. The Respondents cannot defeat this statutory right of the Petitioner by putting in a fetter by way of the impugned circular. Since the Respondents could not operationalize the statutory forms envisaged under the Act, resulting in depriving the Petitioner to accurately reconcile its input tax credit, the Respondents cannot today deprive the Petitioner of the benefits that would have accrued in favour of the Petitioner, if , such forms would have been enforced. The Petitioner, therefore, cannot be denied the benefit due to the fault of the Respondents. 21. In this regard, we may note the views of the Supreme Court in some of the judgments. In the case of Commissioner of Central Excise, Bolpur vs. Ratan Melting and Wire Industries, (2008) 13 SCC 1, a reference was made by a bench of three Judges in Ratan Melting & Wire Industries Case, (2005) 3 SCC 57 to a bench of five judges to determine the issue of what is the binding effect of a judgment of Supreme Court vis-à-vis CBEC circulars. The reference was necessitated in the backdrop of a confusion created on account of the view expressed by a five judge bench of the Supreme Court in para 11 of Dhiren Chemical Industries Case, (2002) 2 SCC 127 which states that “…regardless of the interpretation that we have placed on the saidphrase, if there are circulars which have been issued by the Central Board of Excise and Customs which place a different interpretation upon the said phrase, that interpretation will be binding upon the revenue.” In order to elucidate the position in this respect, the five judge bench in Commissioner of Central Excise, Bolpur vs. Ratan Melting and Wire Industries (supra) referred to its earlier decision in Kalyani Packaging Industry vs. Union of India (2004) 6 SCC 719 and observed that Para 11 of Dhiren Chemical Industries (supra) was rightly clarified therein. In this background, the Court held in paragraph 7 as under : “7. Circulars and instructions issued by the Board are no doubt binding in law on the authorities under the respective statutes, but when the Supreme Court or the High Court declares the law on the question arising for consideration, it would not be appropriate for the court to direct that the circular should be given effect to and not the view expressed in a decision of this Court or the High Court. So far as the clarifications/circulars issued by the Central Government and of the State Government are concerned they represent merely their understanding of the statutory provisions. They are not binding upon the court. It is for the court to declare what the particular provision of statute says and it is not for the executive. Looked at from another angle, a circular which is contrary to the statutory provisions has really no existence in law.” (emphasis supplied) 22. Besides, in the case of TATA Teleservices Ltd. Vs. Commissioner of Customs, (2006) 1 SCC 746, the question before the Supreme Court was whether the telephone LSP 340 imported would be entitled to the benefit of the exemption granted by Notification No. 21/2002-Cus. dated 1.03.2002 to cellular telephones. The controversy arose because CBEC issued a circular being Circular No. 57/2003 dated June 2003 which defined the phrase“cellular phones” and clarified that a telephone would not be considered as a cellular phone, merely because it works on cellular technology. The basic fact was that LSP 340 utilized cellular technology and was mobile, although within a limited range. Contrary views were taken by different High Courts and, therefore, the matter came up in appeal before the Supreme Court. The Court while deciding this question, held as under: “10. We are of the view that the reasoning of the Bombay Bench of the Tribunal as well as that of the Andhra Pradesh High Court must be affirmed and the decision of the Delhi Tribunal set aside insofar as it relates to the eligibility of LSP 340 to the benefit of the exemption notification. The Andhra Pradesh High Court was correct in coming to the conclusion that the Board had, in the impugned circular, predetermined the issue of common parlance that was a matter of evidence and should have been left to the Department to establish before the adjudicating authorities. The Bombay Bench was also correct in its conclusion that the circular sought to impose a limitation on the exemption notification which the exemption notification itself did not provide. It was not open to the Board to whittle down the exemption notification in such a manner…” (emphasis supplied) 23. We would also like to add that the Respondents have also not been able to expressly indicate the rationale for not allowing the rectification in the same month to which the Form GSTR-3B relates. The additional affidavit filed by the Respondents as per the directions of this Court, also skirts this question and has only attempted to give some explanation which is not convincing and lacks objectivity and rationality. Respondents have admitted that the facility of Form GSTR-2A was not available prior to 2018 and, as such, for the months of July, 2017 to September, 2017 the scheme as envisaged under the CGST Act was not implemented. Respondents havealso clearly acknowledged that there could be errors in Form GSTR-2A which may need correction by the parties and have, in fact, permitted the rectification, clearly reinforcing the stand of the Petitioner. The refund of excess cash balance in terms of Section 49 (6) read with Section 54 of the CGST Act does not effectively redress Petitioner’s grievance. Therefore, the only remedy that can enable the Petitioner to enjoy the benefit of the seamless utilization of the input tax credit is by way of rectification of its annual return i.e. GSTR-3B. The hypothetical situations canvassed by Mr. Singh, would not deter us from granting the relief sought by the Petitioner. Each case would have to turn on its own facts. As and when a situation is brought to our notice, we would have to test the legality of the provision at that stage. Merely if there is any fanciful or absurd outcome in a given situation, as illustrated by Mr. Harpreet Singh, it does not mean that the Petitioner should not be given the benefit of rectification if the same is genuine. The correction mechanism is critical to sustaining successful implementation of GST 24. Thus, in light of the above discussion, the rectification of the return for that very month to which it relates is imperative and, accordingly, we read down para 4 of the impugned Circular No. 26/26/2017-GST dated 29.12.2017 to the extent that it restricts the rectification of Form GSTR-3B in respect of the period in which the error has occurred. Accordingly, we allow the present petition and permit the Petitioner to rectify Form GSTR-3B for the period to which the error relates, i.e. the relevant period from July, 2017 to September, 2017. We also direct the Respondents that on filing of the rectified Form GSTR-3B, they shall, within a period of two weeks, verify the claim made therein and give effect to the same once verified. In view of the fact that the final relief sought by the Petitioner has been granted and the petition is allowed, no separate order is required to be passed in the application seeking interim relief. Accordingly, the said application is disposed of as such.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.