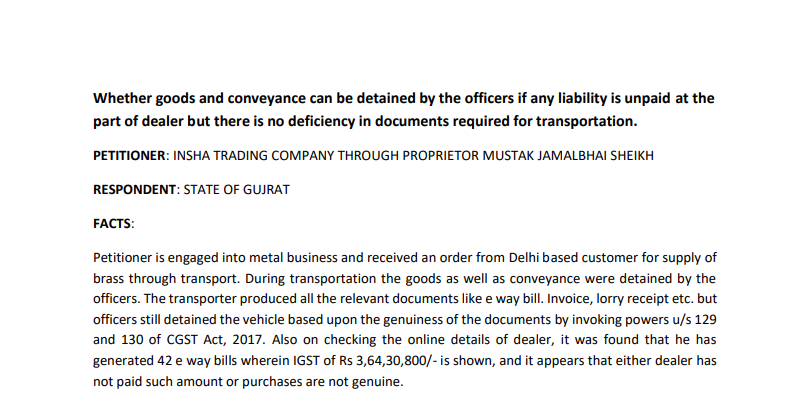

Whether goods and conveyance can be detained by the officers if any liability is unpaid at the part of the dealer but there is no deficiency in documents required for transportation.

PETITIONER: INSHA TRADING COMPANY THROUGH PROPRIETOR MUSTAK JAMALBHAI SHEIKH

RESPONDENT: STATE OF GUJRAT

FACTS:

The petitioner is engaged into metal business and received an order from Delhi based customer for the supply of brass through transport. During transportation, the goods, as well as conveyance, were detained by the officers. The transporter produced all the relevant documents like e way bill. Invoice, lorry receipt, etc. but officers still detained the vehicle based upon the genuineness of the documents by invoking powers u/s 129 and 130 of CGST Act, 2017. Also on checking the online details of the dealer, it was found that he has generated 42 e way bills wherein IGST of Rs 3,64,30,800/- is shown, and it appears that either dealer has not paid such amount or purchases are not genuine.

HELD:

Since all the proper documents as prescribed are being carried by the transporter, the officer is not authorized to detain the vehicle. Where liability to pay IGST persists, the officer is allowed to carry out recovery proceedings as may be prescribed. An order has been passed to release the goods along with the vehicle.

DOWNLOAD THE COPY: