Rule 36(4) and Circular No. 123/42/2019-GST, Ultra Vires and Impossible Mathematics!

Table of Contents

- RULE 36(4) AND CIRCULAR NO. 123/42/2019-GST, ULTRA VIRES, AND IMPOSSIBLE MATHEMATICS!

- Abstract:

- Introduction

- Rule 36(4)

- Enabling Section

- How can the Recipient be punished for the Supplier’s mistake?

- Circular 123/2019

- 1) Dynamic nature of GSTR 2A

- 2) Timing Differences in GSTR 2A V/s.GSTR 3B

- Opinion

- Download the copy:

RULE 36(4) AND CIRCULAR NO. 123/42/2019-GST, ULTRA VIRES, AND IMPOSSIBLE MATHEMATICS!

Abstract:

Rule 36(4) was introduced from October 2019 to restrict credit taken by any GST registered person to the amount reflected in his GSTR 2A. The validity of such a restriction will be questioned on the basis of the following arguments:

1) If the power to make this rule comes from Section 43A (and not Section 16(1)), then rule 36(4) is invalid due to the non-operational nature of Section 43A. This is against Article 265 of the Constitution of India and a proven premise that “Rules and Circulars cannot override Act”.

2) Circular No. 123/42/2019- GST dt. 11/11/2019 is mostly vague on how conditions U/s. 16(2) and other challenges in trade are to be complied with.

3) Can onerous burden be placed on assesses to check that supplier files his return U/s 37 and how it violates various court judgements from erstwhile law?

Related Topic:

Circular No. 125/44/2019 – GST

Introduction

With around 600+ notifications passed by the Central Board of Indirect Taxes and Customs (CBIC) under Central Tax, Central Tax (Rate), etc., 137 Circulars (some rescinded), 22 Orders, 11 Removal of Difficulty Orders, 39 Council Meetings and their relevant press releases, 900+ High Court Cases, 1000’s of AAR cases and many AAAR Cases in only 32 months since GST was rolled out for the whole nation, one can opine that GST has been far from a stable law as one would have liked, even after 32 months of GST implementation. Amendments like inserting Rule 86A, retrospective amendment of Rule 61 to negate Gujarat High Court Judgement U/s. 39, multiple deliberations on Section 50(1), etc., show that the law has not been short of controversy since the rollout. Even circulars, which provide guidance to departmental officers and assesses have been subject to heavy scrutiny, for instance, the infamous clarificatory circular passed for applicability of GST on post-sales discount by the impugned Circular No. 105/24/2019-GST dated 28/06/2019 (which was subject to withdrawal later due to the controversy).

In recent times the Government inserted Rule 36(4) to forcefully ensure the quasi matching exercise is carried out by the taxpayer. This comes after a failed attempt by the government to implement matching U/s. 42 and 43 of the Act during GST implementations.

Rule 36(4)

Rule 36(4) was introduced through Notification No. 49/2019- Central Tax with effect from 09/10/2019 and reads as under:

“Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been uploaded by the suppliers under sub-section (1) of section 37, shall not exceed 20 percent of the eligible credit available in respect of invoices or debit notes, the details of which have been uploaded by the suppliers under sub-section (1) of section 37.”

Very simply put an assessee can claim Rs. 10 (even if his supplier didn’t upload the bill in GSTR 1) for every Rs. 100 credit appearing in GSTR 2A. Thus, if GSTR 2A as of 11/03/2020 (due date of return U/s. 37) of an assessee shows Rs. 500,000 credit, eligible credit for the assessee would be Rs. 550,000 (500,000+10%) or actual credit whichever is lower, subject to other conditions stipulated in the Act.

Vide Notification No. 75/2019 the figures and words “20 percent” in Rule 36(4), the figures and words “10 percent” shall be substituted.

This does sound simple but is one of the most complicated rules in the Act. One might argue that the corresponding circular clarifies the implementation of this rule, but I opine that many important questions on how this rule functions, have been left unanswered by CBIC.

Related Topic:

GSTR 2A Vs GSTR 2B – Detailed Comparison of GSTR-2A with GSTR-2B

Enabling Section

Article 265 of the Constitution of India states that “No tax shall be levied or collected except by authority of law”

Thus, a rule cannot be implemented without an enabling section. For eg: Rules 27 to 35 valuation rules are enabled by the powers given under Section 15(4) and 15(5) of the CGST Act 2017. Likewise, all the rules in CGST Rules 2017 come through the powers conferred by the GST Act.

Section 16(1) gives conditions and restrictions which would be prescribed subject to which a taxpayer would be entitled to input credit. Section 16(1) states as under:

“Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.”

The board prescribed Rule 36 sub-clauses (1) to (3) under this section. Thus one could argue that when Rule 36(4) was implemented, it derived its power from Section 16(1).

However, the government had inserted a new Section 43A through the CGST (Amendment) Act, 2018. Prima facie the intention of the insertion of Section 43A is to enable the new return scheme proposed and approved by the GST Council. Section 43A(4) reads as under:

“The procedure for availing input tax credit in respect of outward supplies not furnished under sub-section (3) shall be such as may be prescribed and such procedure may include the maximum amount of the input tax credit which can be so availed, not exceeding twenty percent of the input tax credit available, on the basis of details furnished by the suppliers under the said sub-section.”

Another school of thought that has been seen widely accepted in the tax fraternity is that due to the direct nexus between Section 43A and Rule 36(4), the Board had prescribed rule 36(4) through the powers conferred upon it by Section 43A. This amendment has yet not been notified as required by Section 1(2) of the CGST (Amendment) Act, 2018. Thus, a rule prescribed due to the authority given under a section which is not yet effective is not enforceable.

This will be subject to litigation and judicial scrutiny through cases nationwide and it is for the courts to decide whether Rule 36(4) is a valid law. If it is a valid law then the rule is here to stay and demands a daunting task through compliance by every registered supplier whether it is an MSME or a major undertaking.

I would like to draw your attention to a more detailed article on the legality of Rule 36(4) (with analysis throughout the Constitution of India, Section 43A, Sections 42, 43, etc.) posted by Mr. Jatin Harjai regarding Validity of Rule 36(4) in the CTC Journal – April Edition. The same can be read at ..”https://www.linkedin.com/feed/update/urn:li:activity:6657089083791241216/”. He was kind enough to let me refer to his well-articulated study in this article.

How can the Recipient be punished for the Supplier’s mistake?

Another way this impugned rule will be questioned in the courts of law is whether the placing of an onerous burden on trade to check and ensure their supplier’s file returns U/s. 37 and ensure payment of tax to the government to comply with Section 16(2) valid? Trade is unhappy with this ‘impossible eventuality’ of forfeiting credit for default of supplier that the recipient has no control over whatsoever. This wisdom is found in Gheru Lal Bal Chand v. the State of Haryana (2011) 45 VST 195 (P&H) which was quoted with approval in Arise India Ltd. v. GT&T W.P.(C) 2106/2015 (Del.) while holding that such an ‘impossible eventuality’ is not admissible while dealing with a similar provision in Delhi VAT Act. Trade and learned professionals are of the view that the principle is equally applicable in GST.

Similarly, provisions/ disputes in Central Excise, Service Tax, and VAT have been held to be unreasonable in the past in the following decisions:

a) The Hon’ble Supreme Court in the case of Commissioner of Trade & Taxes, Delhi and others Vs. Arise India Limited and others [TS-2-SC-2018-VAT], has dismissed the Special Leave Petition filed by the Revenue against the decision of the Hon’ble High Court of Delhi in the case of Arise India Limited and others Vs. Commissioner of Trade & Taxes, Delhi, and others [TS-314-HC-2017(Del)-VAT]. The Hon’ble High Court of Delhi held Section 9(2)(g) of Delhi VAT Act to the extent it disallows Input tax credit to the purchaser due to default of supplier in depositing tax, as violative of Articles 14 and 19(1)(g) of the Constitution of India.

b) In Larsen & Toubro vs. CCE (2001 (127) ELT (807), it was held that the assessee should not be penalized by denial of Input credit for the mistake of the recipient of goods.

c) Kay Kay Industries (2013-TIOL-41-SC-CX). (2013-TIOL-41-SC-CX) held that the manufacturer cannot determine whether his supplier has discharged excise duty on the goods which are supplied to the manufacturer by him.

There is in no way an assessee can ensure that the supplier files his return U/s. 37 and ensures proper tax is paid. At most, one can hold the payment of GST till the returns are furnished and taxes are paid by the supplier. However, even this is subject to possible fraud. One can always amend the documents uploaded till the September months return next year. In such a scenario where there is absolutely no chance to ensure that a particular bill is uploaded in GSTR 1 and simultaneously tax is paid on the same by the supplier, this rule is subject to a lot of judicial controversies.

Moreover, Sub Clause (c) of Section 16(2) {Eligibility for claiming credit} states as under:

“subject to the provisions of section 41or section 43A, the tax charged in respect of such supply has been actually paid to the Government, either in cash or through the utilization of input tax credit admissible in respect of the said supply;

“ Thus for a credit to be eligible credit U/s. 16 one has to ensure that the tax has been paid by their supplier. There is no way for anyone to check whether the tax on a particular bill has been paid in the returns filed U/s. 39. The returns filed U/s. 39 merely consists of figures of outward supplies and their respective taxes without any detailed backing as to what that figure represents. One could argue that in cases where GSTR 1 and GSTR 3B match, taxes have been paid for all bills in GSTR 1 (appearing in GSTR 2A of the recipient) through GSTR 3B. But how will the recipient know if the GSTR 3B and GSTR 1 of the supplier are matching?

In such cases of impossible events due to lack of proper infrastructure implementing Rule 36(4) along with Section 16(2)(c) would be harsh on trade.

Circular 123/2019

(Please note vide Notification No. 75/2019 the figures and words “20 percent” in Rule 36(4), the figures and words “10 percent” have been substituted. However, for the purpose of analyzing this circular, I am using examples with 20% for linking with circular. However, in practice, we need to use 10% limits)

To give clarity to the never-ending confusions in Rule 36(4) the CBIC issued a circular no. 123/42/2019- GST dated 11/11/2019. Before the circular was released on 11/11/2019 there were many doubts in the minds of taxpayers and professionals regarding Rule 36(4). The most important doubts were as follows:-

1) Is this 20% to be checked supplier wise or in totality?

2) Is it tax-wise (CGST, SGST, IGST, Cess, UTGST individually) or in totality?

3) Do we have to check this 20% compliance monthly, quarterly, or yearly? Circular 123/2019 clarified the following regarding the aforesaid queries, respectively:

1) In point no. 2 of the circular, the board clearly mentions – “The restriction imposed is not supplier wise. The credit available under sub-rule (4) of rule 36 is linked to total eligible credit from all suppliers against all supplies whose details have been uploaded by the suppliers.”. This is a welcome clarification for the trade. However, in my opinion, if this is not done supplier wise then there is no way to differentiate between genuine and fake credits. To say, the difference 20% taken could be regarding some supplies at the point of filing 3B but they could be used regarding some other supplies during departmental audits for leverage and benefits.

2) This query was not addressed by the circular. However, the word used in Rule 36(4) is “input tax credit”. On a conjoint reading of Section 2(63) and 2(62), input tax credit means the central tax, state tax, integrated tax, and Union territory tax. Since no specific bifurcation has been made in Rule 36(4) it could be said that it has to be seen on the totality. However, this is due to a lot of litigation and contrary views in the future. In my opinion, it is better to check tax-wise to avoid future litigations.

3) This query has again not been answered directly by the circular. However, the circular uses the words “tax period”. Section 2(106) defines tax period – “tax period means the period for which the return is required to be furnished”. Thus, on a conjoint reading of the circular and section 2(106), one can opine that it has to be checked on a monthly basis.

However, the circular has left a lot of loopholes and impossible events of compliance for taxpayers.

1) Dynamic nature of GSTR 2A

One of the queries answered by the circular reads as follows:

“Query: FORM GSTR 2A, being a dynamic document, what would be the amount of input tax credit that is admissible to the taxpayers for a particular tax period in respect of invoices/debit notes whose details have not been uploaded by the suppliers?

Answer: The amount of input tax credit in respect of the invoices/debit notes whose details have not been uploaded by the suppliers shall not exceed 20% of the eligible input tax credit available to the recipient in respect of invoices or debit notes the details of which have been uploaded by the suppliers under subsection (1) of section 37 as on the due date of filing of the returns in FORM GSTR-1 of the suppliers for the said tax period. The taxpayer may have to ascertain the same from his auto-populated FORM GSTR 2A as available on the due date of filing of FORM GSTR-1 under sub-section (1) of section 37.”

Section 2(106) – “tax period” means the period for which the return is required to be furnished;

Thus, as per the circular we need to refer GSTR 2A as on the due date for filing return by the supplier i.e 11th every month. This has to be checked by the recipient of supply while filing every GSTR 3B from the date this circular comes into effect. It is common knowledge that GSTR 2A is a dynamic report and changes every day after the 11th of the succeeding month as and when late filers of GSTR 1 upload their returns. Now in these circumstances, there is no way for the department to verify the accuracy of the GSTR 2A as on the due date of 37(1) unless the taxpayer takes a screenshot mentioning the date of the screenshot for scrutiny purposes on every 11th. If the same is not produced before the department during audit how will the department, taxpayer, and even GST Auditors ensure compliance with Rule 36(4)?

2) Timing Differences in GSTR 2A V/s.GSTR 3B

It is very important to understand that Timing Differences in GSTR 2A and GSTR 3B for a period (hereinafter referred to as “timing differences”). They can occur for the following reasons (let’s assume for FY 20-21):

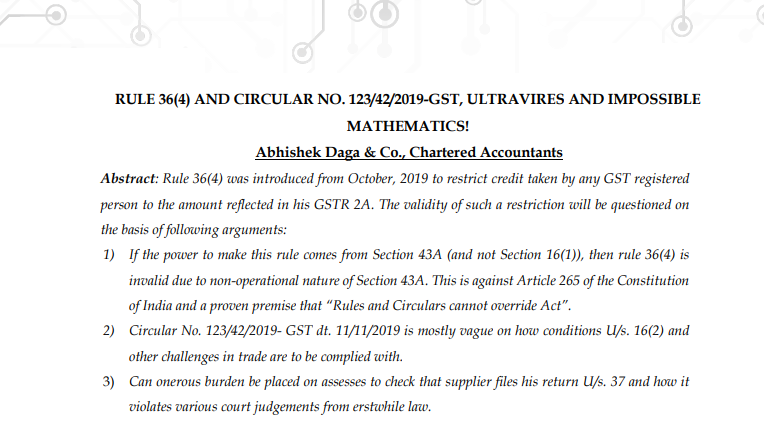

TABLE A:

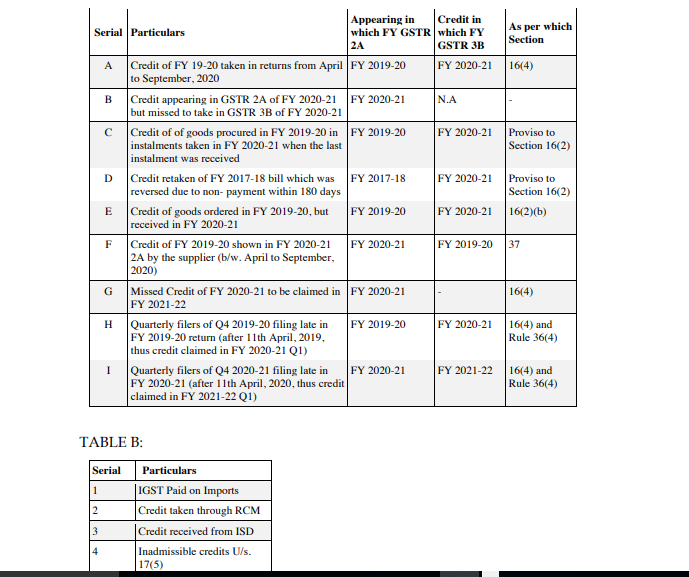

The board has very well addressed the differences arising in Table B stated supra, however, no clarification has been given to timing differences stated in table A

But the most important point here is the following what is mentioned in the third para to circular 123/42/2019– GST

“The conditions and eligibility for the ITC that may be availed by the recipient shall continue to be governed as per the provisions of Chapter V of the CGST Act and the Rules made thereunder “

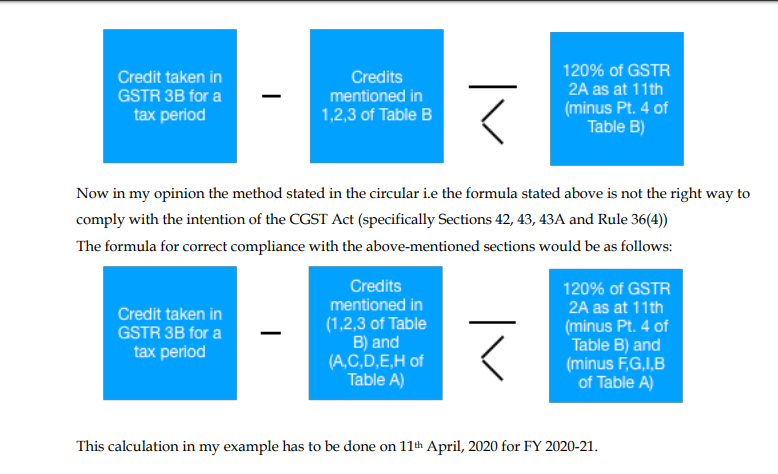

Thus rule 36(4) obviously cannot override chapter V of the CGST Act. Chapter V talks about section 16 to 21. Thus, Section 16 has to be complied with and all the timing differences mentioned in Table A above have to be taken into account while computing the required 20%

To say, the formula the Government prescribed in Circular (via Point 1 of the Circular) for complying with Rule 36(4) is as follows:

For once, let’s assume that all these Rule 36(4) calculations after complying with clarifications have to be done on an annual basis (Although I believe it has been checked on a monthly basis, supporting attached below). In our case as at 11th April 2020 (as per circular due date of return U/s. 37 has to be seen) to compute the 20% of the amount appearing in GSTR 2A to comply with Rule 36(4) all the above-mentioned ‘timing differences have to add and subtracted respectively. The most important part here is the impugned circular hasn’t given any clarity whatsoever in the treatment of timing differences stated supra. Also, no clarity is there for the treatment of reversal of credits U/r. 42/43 of CGST Rules, 2017. Firstly, to arrive at that figure one has to have 100% (without any clerical error) GSTR 2A vs GSTR 3B reconciliation of invoices as well as credit notes. That is my humble opinion is as good as picking a needle from a haystack. In such cases where even assessee can not compute the 20% figure of eligible credit, how will department check?

In cases of trouble, many chose to ignore the complications and proceed. Ignoring the timing differences (either by department or the assessee) will have a catastrophic impact on analyzing and complying with Rule 36(4). In the Circular the department has wisely chosen to ignore the timing differences. If the computation of 20% is done without considering timing differences the rule 36(4) and Circular is ultra vires the Act (to the sections mentioned in the table above).

Another major point is, in the above we assumed Rule 36(4) to be checked on an annual basis. I did that to ease the point. However, the words carefully used in the circular explaining the rule is “tax period”. Section 2(106) defines tax period – “tax period means the period for which the return is required to be furnished. Thus this checking and compliance of Rule 36(4) have to be done on a monthly basis. The same is the reason why the government is rumoured to be removing the option of filing quarterly statements in GSTR 1, to avoid 3 months delay in claiming credit.

In annual compliance of Rule 36(4) we were dealing with timing differences in FY 2019-20, FY 2020-21, and FY 2021-22 only. That is only 3 periods and done only once in 12 months. Although the same is very tough but not tougher than monthly, as there would be unlimited differences every month. In the actual system, the department wants us to check rule 36(4) on a monthly basis i.e these natural timing differences have to be found out every month, reconciled, and carried forward every month. Imagine the impossibility of the task in hand. Basically what was asked of the GSTN through Sections 42 and 43 of the GST Act, has been thrown on at the assessee.

Now let’s assume this timing difference as stated in Table A of appearing in GSTR 2A and claiming in GSTR 3B is to be ignored. That is what all has been said about the tough computations and reconciliations above have to be ignored and we merely have to check 20% of what is appearing in GSTR 2A as of 11th of every month. The following events will follow for many taxpayers:

1) Section 16(2)(b) states that credit for any goods can be taken only when the goods have been received by the registered person. Thus, if an invoice has been raised let’s say on 25/02/2020 but the goods have been received on 03/03/2020 then as per section 16(2)(b) credit should be taken in march when goods are received and not in February. However, the lacuna here is that the supplier of the goods has already processed the invoice in his GSTR 1 and thus it is reflecting in the GSTR 2A of ours in the month of February. But due to inadmissibility in February U/s. 16(2)(c) the credit can be taken only in march and at that time as per the circular credit can only be taken up to 20% of the eligible input tax as uploaded by the suppliers till 11th April being the due date for GSTR 1 of March. Thus the credit, which is the right by all means of the assessee would be blocked trying to force Rule 36(4) and with the clarifications issued in the circular. This is definitely not the intent of the law, but due to the matching of supplies on a monthly basis and restricting credit only to 20% of the tax period as at the due date of filing of return U/s. 37 by the supplier this genuine transaction becomes a suspicious one in the eye of the law. Thus Rule 36(4) contradicts Section 16(2)(b) in this case.

2) Another similar instance where the rule contradicts the act and its relevant circular is to comply with the second proviso to Section 16(2) where reversal of Input Credit along with Interest is demanded in cases where the full value of consideration has not been paid to the supplier. In this case, the supplier of the goods will input the invoice in the month of filing GSTR 1 pertaining to the tax period of the invoice. On non-payment, within 180 days the recipient will reverse the input. Now the third proviso to Section 16(2) permits the recipient to reclaim the credit when the full value of consideration is paid to the supplier. In that month again, the recipient by virtue of Rule 36(4) is restricted to his rightful credit U/s 16(2) and its proviso’s to only 20% of the amount of credit that month. Thus, Rule 36(4) is contradicting the proviso to Section 16(2) and is ultra vires to the act in this case.

The intention of the law is very clear. It is to ensure no credit is passed to the assessee unless the bill does not appear in GSTR 2A. However, the way the circular and rules have been drafted only gives rise to litigation. In fact, the GSTIN will enable Artificial Intelligence and use data analytics to catch situations where a month’s credit in GSTR 3B exceeds 1.2 times the credit appearing in GSTR 2A as on the 11th of every month. This will lead to unnecessary litigation to the taxpayers as those with genuine timing differences will receive notices and demands even if the government and the CBIC didn’t mean to block credits.

Another Lacuna that was not addressed by the circular was cases when the GSTR 1 of the supplier files the return late i.e after the due date mentioned in 37(1). In this case, there is a natural timing difference for the appearance of credit in GSTR 2A. Thus, when the GSTR 2A is checked on 11th such late filers credit is not reflected in that month. Let’s say if the supplier files before recipients GSTR 3B due date i.e 20th then one can take the credit however it will be bad in law as Rule 36(4) allows taking credit appearing only on the due date of Section 37 return. But this would be only theoretical and as mentioned earlier there is no way for the department to know the figures of 2A on the 11th and on the 3B filing due date. Thus, the reliance on the same will be placed by the documentary evidence held by the recipient if any.

The most famous lacuna among taxpayers and professionals once this circular was released was due to timing differences arising due to returns filed on a quarterly basis by certain suppliers. This pushed the claiming of eligible credit by 3 months and created working capital issues for businesses. All due to an ill framed circular without giving clarity on the major and genuine timing differences.

Thus, in my opinion like in the case of Circular 105/24/2019 where the council made it void ab initio the department should either revise the circular no. 123/42/2019 or consider changing the tax period for the purposes of this circular to an annual basis (at least to ease the compliance). This would ensure no major timing differences (as stated earlier) happen and ensures easier compliance and remove the if not impossible, the Herculean task of matching credit and reconciling the same without proper infrastructure on a monthly basis.

Opinion

The most important part of GST Law is the matching concept. This ensures Government plugs revenue leakages through frauds and circular trading i.e passing the benefit of the input tax credit in GST without any genuine movement of goods. We all must have seen the number of cases busted by GST Intelligence in the last 32 months w.r.t fake input credits. It could be said that the concept of matching invoices is widely appreciated by the trade and the country in large as this would ensure higher tax collections and faster economic growth.

However, it is a must for the government to ensure that this does not come at the cost of genuine taxpayers. Thus, implementing a draft rule 36(4) without proper infrastructure as originally devised by returns mentioned U/s. 43A would not be right. Also, even if the new returns come into picture in the foreseeable future, how can one blame someone on an event (non-uploading of bills and not paying taxes on his inward supply by the supplier) when he has no control on this event whatsoever. At the most, the recipient can give the complete list of bills not uploaded by his suppliers during the audit by department so that the department which has all the powers conferred upon it by the GST Acts to follow up and recover taxes with the supplier regarding the discrepancies. This concept would be subject to a lot of judicial pronouncements and changes before we see a settled law in this respect.