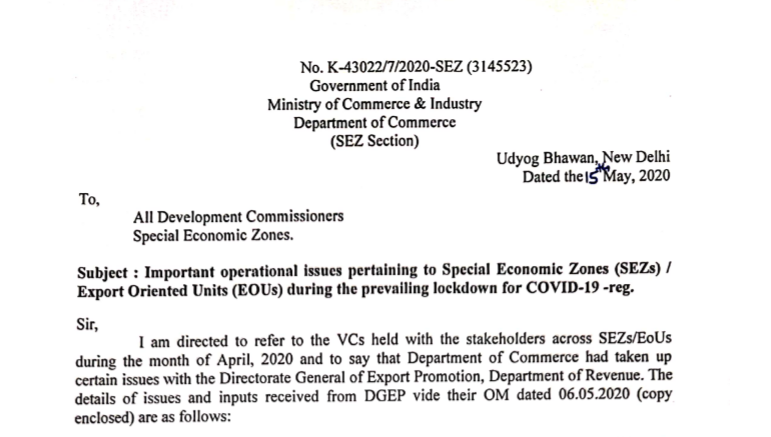

Important operational issues pertaining to Special Economic Zones

To,

All development Commissioners

Special Economic Zones.

Subject: Important operational issues pertaining to Special Economic Zones (SEZs)/ Export Opeiented Units (EOUs) during the prevailing lockdown for COVID 19- reg.

Sir,

I am directed to refer to the CVs held with the stakeholders across SEZs/EOUs during the month of April 2020 and say that the Department of Commerce had taken up certain issues with the Directorate General of Export Promotion, Department of Revenue. The details of issues and inputs received from the DGEP vide their OM dated 06.05.2020 (copy enclosed) are as follows:

| Sl. No. | Details of issues raised by stakeholders and referred to DGEP | Reply from DGEP |

Issues requiring immediate action

| a | Immediate refund of input of GST to the DTA suppliers of SEZ units. Presently, in some of the cases, the refunds are pending for more than six months, thereby, blocking their working capital. | No specific instances of such non-sanctioning of ITC refunds have been provided against supplies made to SEZ developers and units. DGEP has requested to provide a list of such ITC refunds not sanctioned beyond 6 months of filing them with details like name of DTA supplier, GSTIN, invoice details, etc. so that concerned field formations can be flagged for necessary actions. However, CBIC has been issuing clarificatory circulars on refund related issues from time to time with circular no. 135/05/2020-GST dated 31.03.2020 being the latest one. CBIC recently has begun a countrywide special drive to expedite Customs and GST refunds pending as of 7th April 2020. These measures taken by CBIC may be informed to officers for further dissemination to various stakeholders in this regard. |

| b | Extension of timelines fixed for e-way bills in view of the extra time being taken for obtaining permission from designated nodal authorities and in view of the restrictions imposed on the movement of goods due to lockdown. | `The request to extend timelines fixed for e-way bills has already been taken care of by CBIC with the issuance of notification no. 35/2020- Central Tax dated 03.04.2020, wherein if the validity of an e-way bill generated under Rule 138 of the CGST Rules expires during the period 20.03.2020 to 15.04.2020, the validity period of such e-way bill has been extended till 30.04.2020. |

Read the full text here:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.