Basic Principle of Appeal

Table of Contents

Basic Principle of Appeal

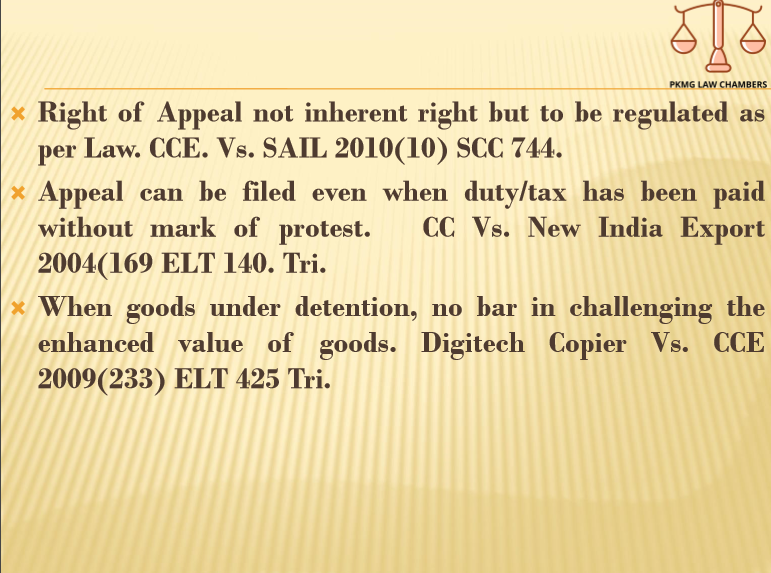

- Right of Appeal not inherent right but to be regulated as per Law. CCE. Vs. SAIL 2010(10) SCC 744.

- An appeal can be filed even when duty/tax has been paid without a mark of protest. CC Vs. New India Export 2004(169 ELT 140. Tri.

- When goods under detention, no bar in challenging the enhanced value of goods. Digitech Copier Vs. CCE 2009(233) ELT 425 Tri.

Appeal Is Continuation of Original Proceedings.

- In Tax Law, the appeal is a continuation of assessment proceedings and is entirely different than the provisions of CPC. It was held that the “C” form could be submitted at the appellate stage. State of AP Vs. Hyderabad Asbestos Cement Pro. Ltd AIR 1994 SC 2364

- The appellate Authority is duty-bound to correct all errors of facts and law in the proceedings under appeal and to issue, if necessary, appropriate directions to the authority against whose decision appeal has been filed. Kapurchand Shrimal Vs. CIT 1981 (131) ITR 450. Utpadak Kendra Vs. Dy. CST 1981(48) STC 248. SC.

- In case Deptt seek re-assessment, the assessee is free to claim any deductions, revision in value, or seek change in classification and rather whole proceedings are open. Lili Foam Industries Ltd Vs. CCE 1990 (46) ELT 462.

Related Topic:

Draft appeal to appellate authority

Adjudication, First and Second Appeal are Part of Legal Proceedings

- The appeal before authorities of Income Tax is a continuation of proceedings and if any beneficial circular has been issued by the Department, it will be looked into by the appellate authority. Mathew M Thomas Vs. CIT AIR 1999 SC 999.

The doctrine of Merger.

- The doctrine means when the original order has been challenged and an appeal is decided, then the appellate order exists and because the original order merges with the appellate order. The logic is that there cannot be two orders concurrently. S S Rathore Vs. State of MP MANU/SC0425/1988.

Refusal oF SLP

A short non-speaking order refusing leave to appeal does not operate as resjudicata. Medley Pharma Vs. CCE 2011(263) ELT 641 SC.

Read the copy:

Advocate Pradeep Kumar

Advocate Pradeep Kumar

PK Mittal BCom Delhi university 1975 LLB Delhi University 1978 FCS Fellow Member of ICSI 1992 1982 to 1992 as CS in Corporate Head Legal Apollo Tyres Ltd 1986 to 1992 1993 onwards Advocate in Delhi High Court CESTAT NCLT = Practcising Indirect Tax and Corporate laws 1993 to till date. Written more than 100 Article on Company Law and Corporate laws Indirect Tax Speaker on Indirect Tax Co Law and IBC in various Seminars Workshop organised by ICAI ICSI and ICMA and other organisations Convenor Core Group on GST of ICSI