Steps to Resolve The Error “Invalid Summary Payload” in GSTR-10.

Table of Contents

Steps to resolve the error “Invalid Summary Payload” in GSTR-10.

In this article, we will see the resolution to resolved the error of “Invalid Summary Payload”. The steps to resolved the error are:

What is Form GSTR-10?

Ans. A taxable person whose GST registration is cancelled or surrendered has to file a return in Form GSTR-10 called Final Return. This is a statement of stocks held by such taxpayer on the day immediately preceding the date from which cancellation is made effective. This return should be filed within three months of the date of cancellation or date of order of cancellation, whichever is later.

Who needs to file Form GSTR-10?

Ans. Form GSTR-10 is required to be filed by every taxpayer except

(i) Input Service Distributor

(ii) Non-resident taxable persons

(iii) Persons required to deduct tax at source (TDS) under section 51

(iv) Persons paying tax under section 10 (Composition Taxpayer)

(v) Persons required to collect tax at source (TCS) under section 52

What is the difference between the Final Return and Annual Return?

Ans. Annual return has to be filed by every registered person under GST.

The annual return is to be filed once a year in Form GSTR-9.

The final return is required to be filed by the persons whose registration has been cancelled or surrendered in Form GSTR-10.

Procedure:

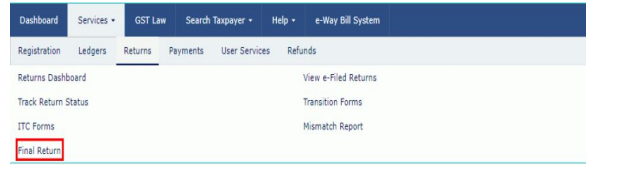

Login > Services > Returns > Final Return.

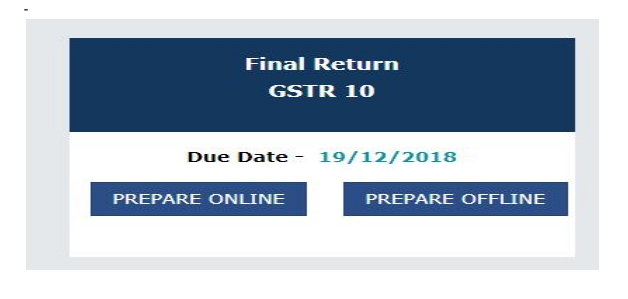

2. After clicking on Final Return, the below-mentioned window will be appearing:

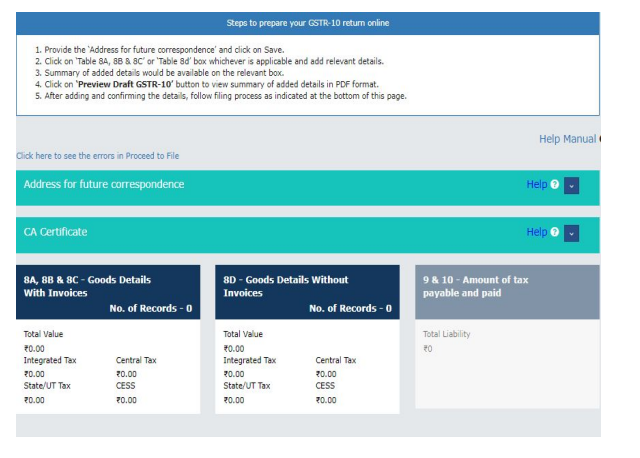

After clicking on Final Return > Prepare Online, the following window will have appeared:

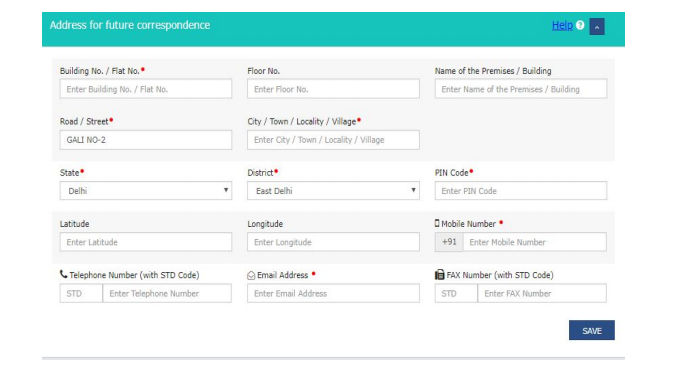

Click on “Address for future correspondence”, then the address will auto-populated. The address would be an editable format, the same would be edited. If the address details are not auto-populated, kindly provide the details as required. Click on ‘Save’ after adding the required details.

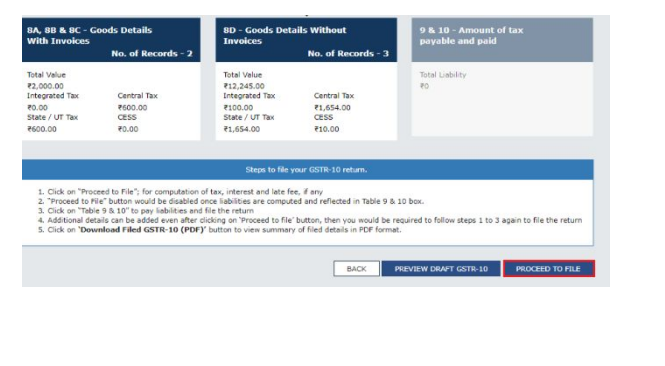

Click on the “PROCEED TO FILE” button and refresh the page.

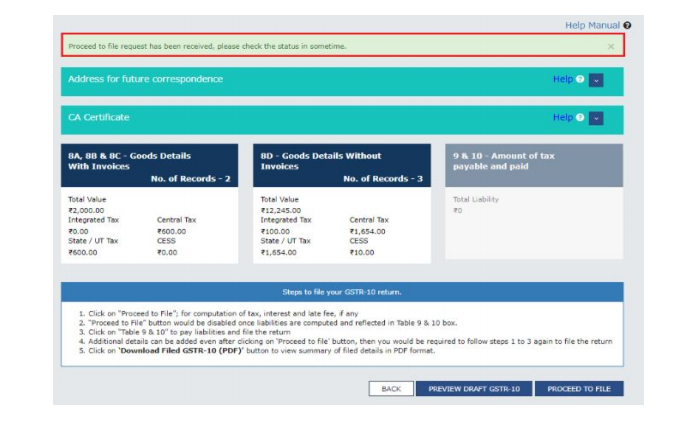

6. The following message is displayed on the top page of the screen that Proceeds to file request has been received. Please check the status in some time. Click on the Refresh button.

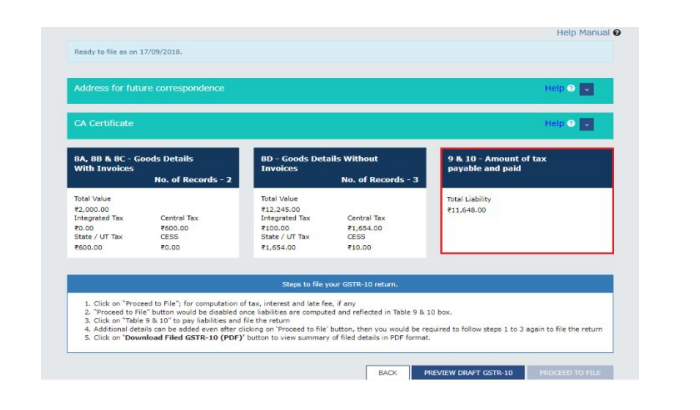

7. Once the status of Form GSTR-10 is Ready to File, 9 & 10 – Amount of tax payable and paid tile gets enabled. Click on 9 & 10 – Amount of tax payable and paid tile.

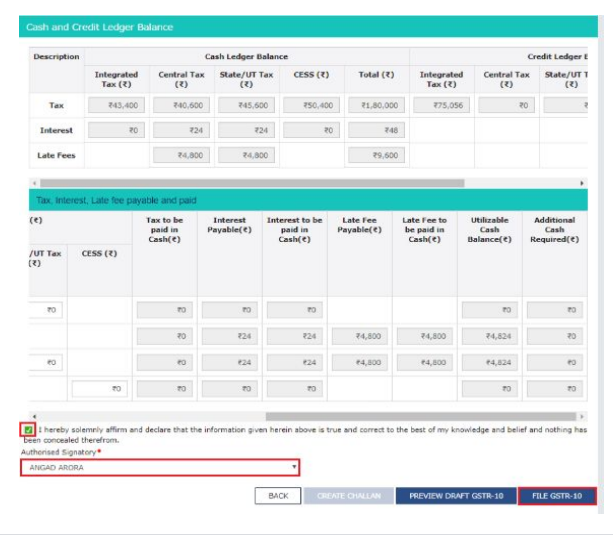

Click on the declaration box, select the authorized signatory then “File Form GSTR-10 with DSC/ EVC” will enable.

Click on the declaration box, select the authorized signatory then “File Form GSTR-10 with DSC/ EVC” will enable.

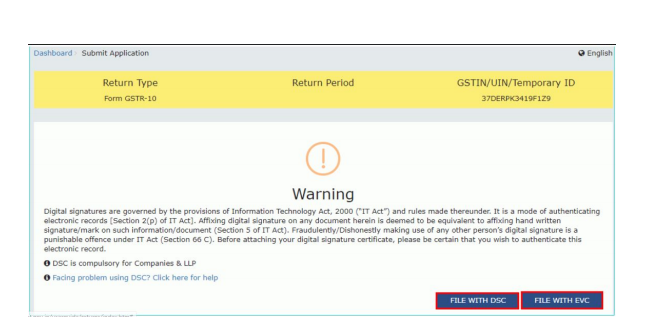

The Submit Application page is displayed. Click the FILE WITH DSC or FILE WITH EVC button.

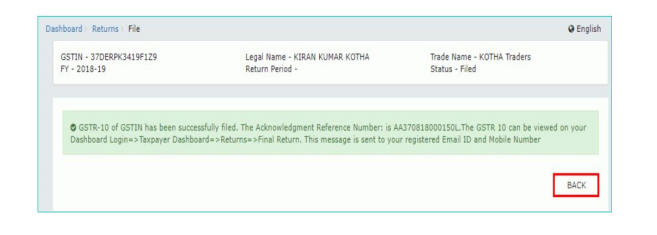

The success message is displayed and ARN is displayed after filing the return.

Read the copy:

CS Shashank Kothiyal

CS Shashank Kothiyal

Honesty Speaks Itself.

East Delhi, India

Company Secretary (Certfied GST Professional) with more than 2.5 years of experience in GST Related Work.