Transitional provisions under GST-Part II

Transitional provisions under GST law (MGL)-Part II

In our last article we discussed 5 issues that may arise on transition to GST law for existing tax payers. The 5 issues are summarized as below:

- Migration of existing taxpayers for registration under GST law;

- Carry forward of cenvat credit or input credit claimed in the return filed under earlier law;

- Carry forward of unclaimed cenvat credit on capital goods;

- Carry forward of unclaimed cenvat credit on other than capital goods;

- Claim of input tax credit of duty or tax paid on Inputs in stock on appointed day;

Now, in our 10th article of the series, we will continue and touch the major concerns of the taxpayers with regard to transition effect.

Issue 6: Credit of eligible duties and taxes on inputs held in stock-

IMPORTANT FOR MANUFACTURER

It is a concern of the manufacturer that in case they are manufacturing both exempted and non-exempted goods then what would be the mechanism to get the credit in GST regime on inputs lying in stock as on the appointed date.

Section 170 of revised model GST law deals with this issue of taxable person who are engaged in manufacturing of non-exempted or exempted goods or provision of non-exempted and exempted services.

It provides that

- if the cenvat credit is carried forward in a return filed under earlier law and

- such inputs are held in stock or held in the form of semi-finished goods or finished goods, relating to exempted goods or services,

- then cenvat credit of eligible duties and taxes can be claimed in electronic credit ledger.

It is worth noting that the provision does not laid down any condition that such goods or services should not be exempted in the GST regime. Therefore, it is advised to make requisite arrangements to get the invoices on time so such invoices can be claimed as credit in the return of earlier law.

Issue 7: Credit of inputs or input services received after appointed date

IMPORTANT FOR MANUFACTURER, SERVICE PROVIDER AND TRADER

Now, another question arises that what about the credit on inputs or input services on which taxes are paid in earlier law but invoice has not been booked by the receiver and inputs or input services are received on or after the appointed date.

The credit shall be entitled to be claimed under electronic credit ledger if the invoice/document has been booked within 30 days from the appointed day which can be extended to another 30 days post approval of competent authority.

This would be applicable in case of goods in transit or advance cases where tax liability has arisen in earlier law and goods or services received post appointed date. It is therefore suggested to keep track of such inputs which are in transit and input services which are not received. Account for such invoices in the books within 30 days from appointed date and claim credit of the same in electronic credit ledger.

There is a requirement of statement which would be furnished by such registered taxable person in a manner as may be prescribed.

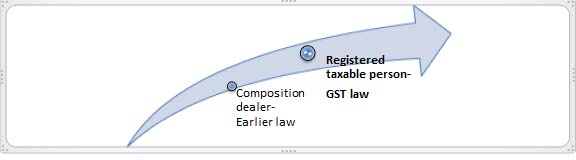

Issue 8: What about the credit on inputs to composition dealer in earlier law

IMPORTANT FOR TRADER

A composition dealer of earlier law, who wants to get registered as taxable person under GST regime, shall be eligible to get the credit of eligible duties in respect of inputs held in stock and inputs contained in semi-finished or finished goods in stock on appointed date subject to fulfillment of some conditions like inputs shall be utilized for making taxable supplies under GST act, possession of documents, invoice date is not earlier than 12 months preceding the appointed date.

It is advisable for composition dealers to keep the records of inputs in stock as on the appointed if they wish to migrate into GST as registered taxable person and not to opt for composition dealer.

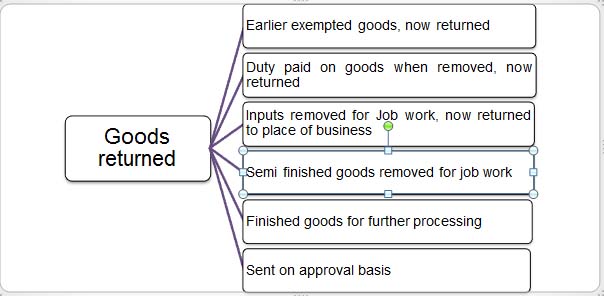

Issue 9: Goods are returned to the place of business on or after the appointed date

IMPORTANT FOR MANUFACTURER AND TRADER

The transitional provisions cover almost every case of goods returned to the place of business of the taxable person. The conditions subject to which the input tax credit shall not be required to be reversed or no output tax shall be payable on such goods returned. The summarized provisions laid down here under:-

Section 173: Exempted goods returned after appointed date

Section 173: Exempted goods returned after appointed date

- No tax shall be payable on such goods;

- Goods returned were originally removed not earlier than 6 months prior to appointed date (i.e. goods removed on or after 01-01-2017 are eligible);

- Goods returned within 6 months post appointed date;

Section 174: Duty paid goods are returned

- The goods returned by registered taxable person shall be deemed to be supply under GST law;

- If the goods returned by unregistered person, then duty paid on such goods shall be refunded to registered recipient of goods under the earlier law (Excise, state VAT);

- Goods returned were originally removed not earlier than 6 months prior to appointed date (i.e. goods removed on or after 01-01-2017 are eligible);

- Goods returned within 6 months post appointed date

Section 175: Inputs received in factory, earlier sent on job work

- No tax shall be payable under GST law if such inputs are received after completion of job work or otherwise within 6 months(+2 months) from the appointed date;

- Input tax credit shall be liable to be recovered if goods are not returned within 6 months

- Manufacturer and job worker shall declare the details of the inputs held in stock by the job worker on behalf of the manufacturer on the appointed day;

Section 176: Semi finished goods are returned, earlier sent for manufacturing process

- No tax shall be payable under GST law if such goods are received after undergoing manufacturing process or otherwise within 6 months (+2 months) from the appointed date;

- Input tax credit shall be liable to be recovered if goods are not returned within 6 months;

- Manufacturer and job worker shall declare the details of the inputs held in stock by the job worker on behalf of the manufacturer on the appointed day;

Section 177: Finished goods are received, earlier sent for testing or other processes

- No tax shall be payable under GST law if such finished goods are received after undergoing testing or other process or otherwise within 6 months (+2 months) from the appointed date;

- Input tax credit shall be liable to be recovered if goods are not returned within 6 months;

- Manufacturer and job worker shall declare the details of the inputs held in stock by the job worker on behalf of the manufacturer on the appointed day;

Therefore, a manufacturer or a trader is required to analyze above provisions with respect to tax liability on goods returned or received back in the factory or place of business post appointed date and take necessary actions, so that tax liability should not arise on goods removed earlier.

Issue 10: Supplementary debit notes or credit notes – Revision of contract w.r.t. Price

IMPORTANT FOR MANUFACTURER, SERVICE PROVIDER AND TRADER

The model law has provided a provision to deal with a situation where in case of any revision in contract with respect to price, either upwards or downwards, the tax payer can take the relief by issuing the debit notes and credit notes. However, there are following conditions which must be met:

- Contract originally entered before appointed date;

- Price revised after the appointed date;

- Debit note or credit note issued within 30 days from such revision in price;

- Credit notes should have been accounted for by the receiver of goods or services and reversal of input tax credit thereon;

Then only, it shall be deemed that such debit note or credit note has been issued in relation to output supply under the GST law.

We know that this issue needs to be elaborated more, hence we have covered this topic in our next article as FAQs.

Issue 11: What about the Cenvat credit of Centralized registered service tax assessees’

IMPORTANT FOR SERVICE PROVIDER

The model has observed the need to explain the question that how a centralized registered service tax assessee will share the Cenvat credit to different state registration under GST law. In this regard, the model law provides that

- Where a taxable person having centralized registration under the earlier law has obtained a registration under this Act,

- such person shall be allowed to take, in his electronic credit ledger,

- credit of the amount of cenvat credit carried forward in a return, original or revised,

- furnished within 3 months, under the earlier law by him, in respect of the period ending with the day immediately preceding the appointed day,

- in such manner as may be prescribed:

Points to be noted:

It is also provided that revised return shall be considered only if it is filed within 3 months from the appointed date and there is a reduction in cenvat credit amount claimed in the original return.

Further, the cenvat credit can be claimed by any registered taxable person having the same PAN for which centralized registration was obtained.

The method is yet to be prescribed on the basis of which cenvat credit shall be apportioned to all registered taxable person in GST.

Conclusion

We have discussed the provisions related to transition from existing law to GST regime, provided under Model GST law and observed that the existing tax payers are required to analyze the current business practices and take some stringent actions to avail the benefits provided under transitional provisions with fulfillment of relevant conditions. However, it is observed that in some places the government is yet to clarify the situation.

In our next article, we will focus on practical issues relating to the transition from existing tax laws to GST.

|

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. The observations of the authors are personal view and this cannot be quoted before any authority without the written permission of the authors. This article is meant for general guidance and no responsibility for loss arising to any person acting or refraining from acting as a result of any material contained in this article will be accepted by authors. It is recommended that professional advice be sought based on the specific facts and circumstances. This article does not substitute the need to refer to the original pronouncements on GST. (Authors – CA Neeraj Kumar and CA Deepak Arya, RAPG & Co. Chartered Accountants from Delhi and can be reached at info@rapg.in, 9999836182/9818449179)

|