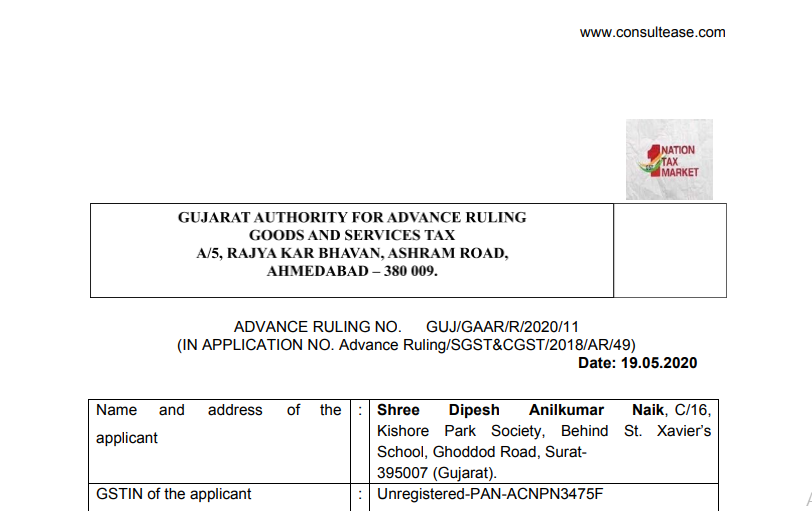

Gujarat AAR in the case of Shree Dipesh Anilkumar Naik

Table of Contents

Case Covered:

Shree Dipesh Anilkumar Naik

Facts of the case:

The applicant has submitted that he is having a vacant land outside the municipal area of the town on which he has some proposed business activity. The applicant is having all the necessary approvals for the proposed project from the Plan Passing Authority (i.e. Zilla Panchayat).

2. The applicant has further submitted that as per the Plan Passing Authority, the seller of land is required to develop the primary amenities like Sewerage and drainage line, Waterline, Electricity line, Land levelling for road, Pipeline facilities for drinking water, Street lights, Telephone line etc..

3. The applicant further submitted that they will sell the individual plots to different buyers without any construction on the same but by providing the primary amenities as mentioned above, which are a mandatory requirement of the approved Plan Passing Authority (i.e. Zilla Panchayat).

4. In view of the above, the applicant has sought an advance ruling in respect of the following question:

Whether GST is applicable on sale of a plot of land for which, as per the requirement of approved by the respective authority (i.e. Zilla Panchayat), Primary amenities such as, Drainage line, Waterline, Electricity line, Land levelling etc. are to be provided by the applicant?

Observations:

We find that the plotted development is a scheme which involves forming land into layout after obtaining necessary plan approval from the Development Authority, get all other permission required to take up, commence and complete what would be the layout, comprised of individual sites. In the activity of plot development, the following are done-levelling the land, construction of boundary wall, construction of roads, laying of underground cables and water pipelines, laying of underground sewerage lines with sewer treatments plant, development of landscaped gardens, drainage system, water harvesting system, demarcation of individual plots, construction of overhead tanks, other infrastructure works. Further common amenities like garden, community hall, etc. are also offered in some schemes. Sale of such sites is done to end customers who may construct houses/villas in the plots.

The sellers charge the rates on the super built-up basis and not the actual measure of the plot. The super built-up area includes the area used for common amenities, roads, the water tank and other infrastructure on a proportionate basis. Thus, in effect, the seller is collecting charges towards the land as well as the common amenities, roads, water tank and other infrastructure on a proportionate basis. In other words, such common amenities, roads, the water tank and other infrastructure is an intrinsic part of the plot allotted to the buyer.

The above indicates that the sale of the developed plot is not equivalent to the sale of land but is a different transaction. Sale of such plotted development tantamount to the rendering of service. This view has also been taken by the Supreme Court in the case of M/s Narne Construction P Ltd. reported at 2013 (29) STR 3 (SC).

In the present case, we also find that the applicant is the owner of the land, who develops the land with infrastructure such as Drainage line, Waterline, Electricity line, Land levelling etc. as per the requirement of the approved Plan Passing Authority (i.e. Zilla Panchayat). After this development of the land, the sales developed land as plots. His sales price includes the cost of the land as well as the cost of common amenities, Drainage line, Waterline, Electricity line, Land levelling charges, etc. on a proportionate basis.

Ruling:

Ques.1: Whether GST is applicable on sale of a plot of land for which, as per the requirement of approved by the respective authority (i.e. Zilla Panchayat), Primary amenities such as, Drainage line, Waterline, Electricity line, Land levelling etc. are to be provided by the applicant?

Answer: Answered in the Affirmative, as discussed above.

Read & Download the full decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.