Waiver / Reduction of Late Fees and Interest for Taxpayer due to COVID-19

Table of Contents

- Waiver / Reduction of late fees and interest for taxpayer due to COVID-19

- Waiver of late fees with respect to GSTR-1 is as under:-

- Reduction in Late Fees for past returns

- Rate of tax applicable for a person who has opted for composition scheme

- Date Notifying various provisions of Finance Act, 2020

- Section 118 of Finance Act, 2020 amending Section 2(114) of the CGST Act, 2017

- Section 129 of Finance Act, 2020 amending Section 168 of the CGST Act, 2017

- Section 130 of the Finance Act, 2020 amending Section 172 of the CGST Act, 2017

- Read the Copy:

Waiver / Reduction of late fees and interest for taxpayer due to COVID-19

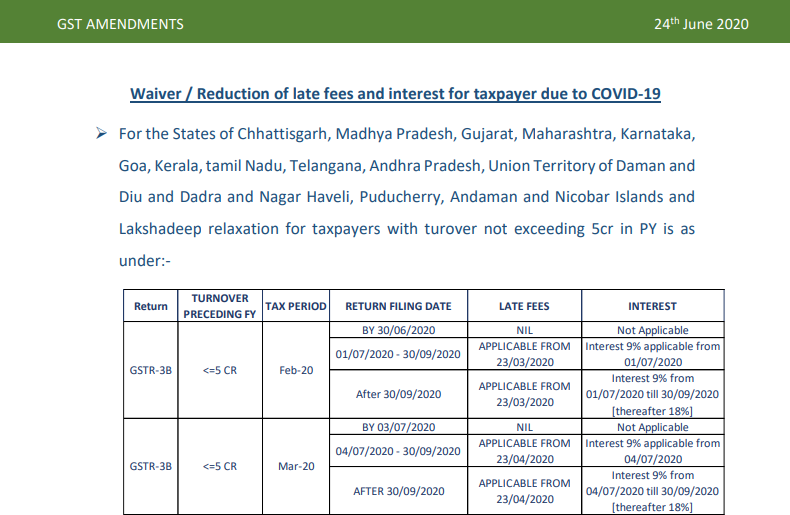

For the States of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, Union Territory of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands and Lakshadeep relaxation for taxpayers with turnover not exceeding 5cr in PY is as under:-

| Return | TURNOVER PRECEDING FY | TAX PERIOD | RETURN FILING DATE | LATE FEES | INTEREST |

| GSTR-3B | <=5 CR | Feb-20 | BY 30/06/2020 | NIL | Not Applicable |

| 01/07/2020 – 30/09/2020 | APPLICABLE FROM 23/03/2020 | Interest 9% applicable from 01/07/2020 | |||

| After 30/09/2020 | APPLICABLE FROM 23/03/2020 | Interest 9% from 01/07/2020 till 30/09/2020 [thereafter 18%] | |||

| GSTR-3B | <=5 CR | Mar-20 | BY 03/07/2020 | NIL | Not Applicable |

| 04/07/2020 – 30/09/2020 | APPLICABLE FROM 23/04/2020 | Interest 9% applicable from 04/07/2020 | |||

| AFTER 30/09/2020 | APPLICABLE FROM 23/04/2020 | Interest 9% from 04/07/2020 till 30/09/2020 [thereafter 18%] | |||

| GSTR-3B | <=5 CR | Apr-20 | BY 06/07/2020 | NIL | Not Applicable |

| 07/07/2020 – 30/09/2020 | APPLICABLE FROM 23/05/2020 | Interest 9% applicable from 07/07/2020 | |||

| AFTER 30/09/2020 | APPLICABLE FROM 23/05/2020 | Interest 9% from 07/07/2020 till 30/09/2020 [thereafter 18%] | |||

| GSTR-3B | <=5 CR | May-20 | BY 12/09/2020 | NIL | Not Applicable |

| 13/09/2020 – 30/09/2020 | APPLICABLE FROM 13/07/2020 | Interest 9% applicable from 13/09/2020 | |||

| AFTER 30/09/2020 | APPLICABLE FROM 13/07/2020 | Interest 9% from 13/09/2020 till 30/09/2020 thereafter 18% | |||

| GSTR-3B | <=5 CR | Jun-20 | BY 23/09/2020 | NIL | Not Applicable |

| 24/09/2020 – 30/09/2020 | APPLICABLE FROM 25/07/2020 | Interest 9% applicable from 24/09/2020 | |||

| AFTER 30/09/2020 | APPLICABLE FROM 25/07/2020 | Interest 9% from 24/09/2020 till 30/09/2020 thereafter 18% | |||

| GSTR-3B | <=5 CR | Jul-20 | BY 27/09/2020 | NIL | Not Applicable |

| 28/09/2020 – 30/09/2020 | APPLICABLE FROM 25/08/2020 | Interest 9% applicable from 28/09/2020 | |||

| AFTER 30/09/2020 | APPLICABLE FROM 25/08/2020 | Interest 9% from 28/09/2020 till 30/09/2020 thereafter 18% | |||

| GSTR-3B | <=5 CR | Aug-20 | BY 01/10/2020 | NIL | Not Applicable |

| AFTER 01/10/2020 | APPLICABLE FROM 02/10/2020 | The interest of 18% from 01/10/2020 |

For the states of Himachal Pradesh, Punjab, Uttrakhand, Haryana, Rajashthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Orissa, Jammu and Kashmir, Ladakh, Chandigarh and Delhi relaxation for taxpayers with turnover not exceeding 5 cr in PY is as under:

|

Return |

TURNOVER PRECEDING FY | TAX PERIOD | RETURN FILING DATE | LATE FEES |

INTEREST |

| GSTR-3B | <=5 CR | Feb-20 | BY 30/06/2020 | NIL | Not Applicable |

| 01/07/2020 – 30/09/2020 | APPLICABLE FROM 25/03/2020 | Interest 9% applicable from 01/07/2020 | |||

| After 30/09/2020 | APPLICABLE FROM 25/03/2020 | Interest 9% from 01/07/2020 till 30/09/2020 [thereafter 18%] | |||

| GSTR-3B | <=5 CR | Mar-20 | BY 05/07/2020 | NIL | Not Applicable |

| 06/07/2020 – 30/09/2020 | APPLICABLE FROM 25/04/2020 | Interest 9% applicable from 10/07/2020 | |||

| AFTER 30/09/2020 | APPLICABLE FROM 25/04/2020 | Interest 9% from 04/07/2020 till 30/09/2020 [thereafter 18%] | |||

| GSTR-3B | <=5 CR | Apr-20 | BY 09/07/2020 | NIL | Not Applicable |

| 10/07/2020 – 30/09/2020 | APPLICABLE FROM 25/05/2020 | Interest 9% applicable from 10/07/2020 | |||

| AFTER 30/09/2020 | APPLICABLE FROM 25/05/2020 | Interest 9% from 10/07/2020 till 30/09/2020 [thereafter 18%] | |||

| GSTR-3B | <=5 CR | May-20 | BY 15/09/2020 | NIL | Not Applicable |

| 16/09/2020 – 30/09/2020 | APPLICABLE FROM 15/07/2020 | Interest 9% applicable from 16/09/2020 | |||

| AFTER 30/09/2020 | APPLICABLE FROM 15/07/2020 | Interest 9% from 16/09/2020 till 30/09/2020 thereafter 18% | |||

| GSTR-3B | <=5 CR | Jun-20 | BY 25/09/2020 | NIL | Not Applicable |

| 26/09/2020 – 30/09/2020 | APPLICABLE FROM 25/07/2020 | Interest 9% applicable from 26/09/2020 | |||

| AFTER 30/09/2020 | APPLICABLE FROM 25/07/2020 | Interest 9% from 26/09/2020 till 30/09/2020 thereafter 18% | |||

| GSTR-3B | <=5 CR | Jul-20 | BY 29/09/2020 | NIL | Not Applicable |

| 30/09/2020 – 30/09/2020 | APPLICABLE FROM 25/08/2020 | Interest 9% applicable on 30/09/2020 | |||

| AFTER 30/09/2020 | APPLICABLE FROM 25/08/2020 | Interest 9% on 30/09/2020 thereafter 18% | |||

| GSTR-3B | <=5 CR | Aug-20 | BY 03/10/2020 | NIL | Not Applicable |

| AFTER 03/10/2020 | APPLICABLE FROM 04/10/2020 | The interest of 18% from 03/10/2020 |

Related Topic:

Composition late fees waiver- 5 things to know

For the category of taxpayers whose turnover is more than Rs. 5 crores in the preceding financial year, the following dates have been notified:

|

Return |

TURNOVER PRECEDING FY | TAX PERIOD | RETURN FILING DATE | LATE FEES |

INTEREST |

| GSTR-3B | >5 CR | Feb-20 | BY 04/04/2020 | NIL | Not Applicable |

| FROM 05/04/2020 TO 24/06/2020 | NIL | The interest of 9% applicable from 05/04/2020 | |||

| AFTER 24/06/2020 | APPLICABLE FROM 21/03/2020 | Interest 9% from 05/04/2020 till 24/06/2020 [thereafter 18%] | |||

| GSTR-3B | >5 CR | Mar-20 | 05/05/2020 | NIL | Not Applicable |

| FROM 06/05/2020 TO 24/06/2020 | NIL | The interest of 9% applicable from 05/05/2020 | |||

| AFTER 24/06/2020 | APPLICABLE FROM 21/04/2020 | Interest 9% from 06/05/2020 till 24/06/2020 (thereafter 18%) | |||

| GSTR-3B | >5 CR | Apr-20 | BY 04/06/2020 | NIL | Not Applicable |

| FROM 05/06/2020 TO 24/06/2020 | NIL | Interest 9% applicable from 04/06/2020 | |||

| AFTER 24/06/2020 | APPLICABLE FROM 21/05/2020 | Interest 9% from 05/06/2020 till 24/06/2020 [thereafter 18%] |

Waiver of late fees with respect to GSTR-1 is as under:-

|

Return |

TURNOVER PRECEDING FY | TAX PERIOD | RETURN FILING DATE |

LATE FEES |

| GSTR-1 | NA | Mar-20 | BY 10/07/2020 | NIL |

| AFTER 10/07/2020 | APPLICABLE FROM 11/07/2020 | |||

| GSTR-1 | NA | Apr-20 | BY 24/07/2020 | NIL |

| AFTER 24/07/2020 | APPLICABLE FROM 25/07/2020 | |||

| GSTR-1 | NA | May-20 | BY 28/07/2020 | NIL |

| AFTER 28/07/2020 | APPLICABLE FROM 29/07/2020 | |||

| GSTR-1 | NA | Jun-20 | BY 05/08/2020 | NIL |

| AFTER 05/08/2020 | APPLICABLE FROM 06/08/2020 | |||

| GSTR-1 | NA | Jan-20 to March-20 | BY 17/07/2020 | NIL |

| AFTER 17/07/2020 | APPLICABLE FROM 18/07/2020 | |||

| GSTR-1 | NA | April-20 to June-20 | BY 03/08/2020 | NIL |

| AFTER 03/08/2020 | APPLICABLE FROM 04/08/2020 |

(Notification 51 to 54- Central Tax dated 24th June 2020)

Reduction in Late Fees for past returns

If any person has not yet filed any GSTR 3B for the period July 2017 to January 2020, then they get a further opportunity to file their return between 1st July 2020 to 30th September 2020 with reduced / late fees as below:

- Where there is no tax liability – NIL late fees

- If there is any tax liability – Rs. 500 per return

It should be noted that this reduction is not for those persons who have already filed their returns before 1st July 2020.

(Notification 52/2020- Central Tax dated 24th June 2020)

Rate of tax applicable for a person who has opted for composition scheme

| Relevant Section of CGST Act, 2017 | Category of taxable Persons | Rate of Tax (CGST) | Rate of Tax (SGST) |

| 10(1)&(2) | Manufacturer and Trader of Goods | 0.5% | 0.5% |

| 10(1)&(2) | Restaurants/ Catering not serving Alcohol | 0.5% | 0.5% |

| 10(2A) | Other composition taxpayers having Turnover not exceeding 50 Lakhs | 3% | 3% |

(Notification No. 50/2020- Central Tax Dated 24th June 2020)

Date Notifying various provisions of Finance Act, 2020

The Central Government notifies 30th June 2020 as the date on which the following provisions of Finance Act, 2020 shall come into force:-

Section 118 of Finance Act, 2020 amending Section 2(114) of the CGST Act, 2017

The definition of Union Territory now recognizes ‘Ladakh’ as a separate Union Territory in the CGST Act 2017. ‘Dadra and Nagar Haveli and Daman and Diu’ have been combined in the definition of Union Territory as they are now considered as part of the same Union Territory Section 125 of Finance Act, 2020 amending Section 109 of the CGST Act, 2017 The provisions for Appellate Tribunal and its benches thereof have been made applicable in the Union Territories of Jammu and Kashmir.

Section 129 of Finance Act, 2020 amending Section 168 of the CGST Act, 2017

Allowing the jurisdictional Commissioners to exercise the following powers which could earlier be exercised by the Commissioner in Board

(i) The expenses of the examination and audit of records under Special Audit including the remuneration of Chartered Accountant is to be determined and paid by the Commissioner.

(ii) The period of one year for inputs and three years for capital goods may on sufficient cause being shown be extended by a further period not exceeding one year and two years respectively by the Commissioner

Related Topic:

Composition late fees waiver- 5 things to know

Section 130 of the Finance Act, 2020 amending Section 172 of the CGST Act, 2017

The time period for issuance of removal of difficulties order was only prescribed up to three years from the commencement of the Act. This has now been extended up to 5 years. Thereby, the Government has the power to issue Removal of Difficulties order up to 30th June 2022 (earlier it was up to 30th June 2020 only) (Notification No. 49/2020- Central Tax dated 24th June 2020)

This publication contains information for general guidance only. It is not intended to address the circumstances of any particular individual or entity. Although the best endeavor has been made to provide the provisions in a simpler and accurate form, there is no substitute for detailed research with regard to the specific situation of a particular individual or entity. S. Khaitan & Associates or any of its officials do not accept any responsibility for loss incurred by any person for acting or refraining to act as a result of any matter in this publication

Read the Copy:

Shubham Khaitan

Shubham Khaitan

Kolkata, India