GST Amendments Notified on 27.06.2020

Table of Contents

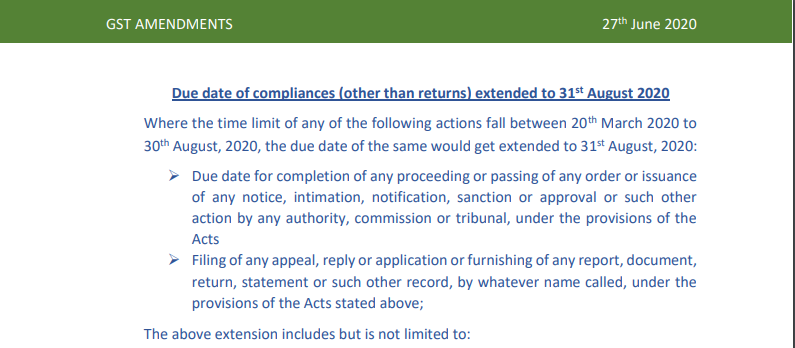

Due date of compliances (other than returns) extended to 31 st August 2020

Where the time limit of any of the following actions falls between 20th March 2020 to 30th August 2020, the due date of the same would get extended to 31 st August 2020:

➢ The due date for completion of any proceeding or passing of any order or issuance of any notice, intimation, notification, sanction or approval or such other action by any authority, commission or tribunal, under the provisions of the Acts

➢ Filing of any appeal, reply or application or furnishing of any report, document, return, statement or such other record, by whatever name called, under the provisions of the Acts stated above;

The above extension includes but is not limited to:

➢ Filing of refund claims and other refund-related compliances which fall due between 20th March 2020 to 30th August 2020

➢ Intimation for withdrawal from Composition Scheme under CMP-04

➢ Amendment, Cancellation, and Revocation of Cancellation of Registration

➢ Filing of Form ITC-01 (Exemption / Composition to Normal Scheme/ITC upon new registration), Form ITC-02 (Transfer of ITC upon transfer of business) and Form ITC-03 (Normal to Exemption Scheme)

➢ Filing of form ITC-05, ITC-06, ITC-07 and ITC-08.

➢ Filing of Form ITC-04 (Intimation by the principal for job work) for the period January – March 2020 and April -June 2020.

➢ Assessment related forms including the issuance of the notice, furnishing of reply, passing of the order

➢ Departmental audit and Special Audit related compliances

➢ Advance ruling compliances

➢ Appeal provisions including the filing of the appeal, cross objection, etc.

➢ Search and seizure forms including the order of seizure, bond for the release of seized goods, order for the release of seized goods, etc.

➢ Demand and recovery forms including the issuance of show cause notice, reply to show cause notice, the passing of the order, payment of demand under the order, etc.

Due dates which have not been extended

➢ Date, when the liability to pay tax, arises in terms of the time of supply

➢ Date when the composition scheme lapses due to crossing of the threshold limit of turnover

➢ Provisions relating to new registration including date of liability for registration

➢ Provisions for the casual taxable person and the non-resident taxable person

➢ Date of issuance of tax invoice, bill of supply, receipt voucher, self-invoice, payment voucher, revised tax invoice, etc.

➢ Arrest provisions still applicable

➢ Due date of intimation to the Commissioner by retiring partner from a partnership firm

➢ Generation, validation, and Verification of e-waybill (except as provided above) and Detention, seizure, and release of goods and conveyance in transit

(Notification No. 55/2020 -CT dt. 27.06.2020)

Due date of passing of refund order extended to 31st August 2020

Where the due date for the passing of refund order was falling between 20th March 2020 to 30th August 2020 the time limit for issuance of such order shall be extended to later of the two:

(i) 15 days after the receipt of reply under RFD-09

(ii) 31st August 2020.

(Notification No. 56/2020 -CT dt. 27.06.2020)

This publication contains information for general guidance only. It is not intended to address the circumstances of any particular individual or entity. Although the best endeavor has been made to provide the provisions in a simpler and accurate form, there is no substitute for detailed research with regard to the specific situation of a particular individual or entity. S. Khaitan & Associates or any of its officials do not accept any responsibility for loss incurred by any person for acting or refraining to act as a result of any matter in this publication

Read the copy:

Shubham Khaitan

Shubham Khaitan

Kolkata, India