GST Implication on Healthcare Sector

Table of Contents

GST Implication on Healthcare Sector

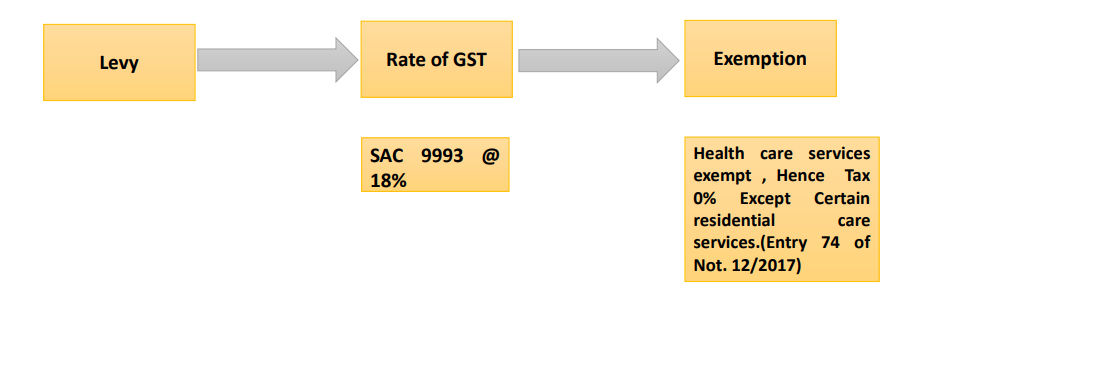

Levy & Rate of tax

Section 9(CGST):- Levy & collection Section 5 (IGST Act)

(1) Subject to the provisions of sub-section (2), there shall be levied a tax called the central goods and services tax on all intra-State supplies of goods or services or both, except on the supply of alcoholic liquor for human consumption, on the value determined under section 15 and at such rates, not exceeding twenty percent, as may be notified by the Government on the recommendations of the Council and collected in such manner as may be prescribed and shall be paid by the taxable person,

Thus from the above section, it is clear that section 9 covers within its ambit all the supplies of goods or services or both. Lawmakers had exempted certain supply of services by mentioning those supplies in GST Exemption notification 12/2017 CT Rate.

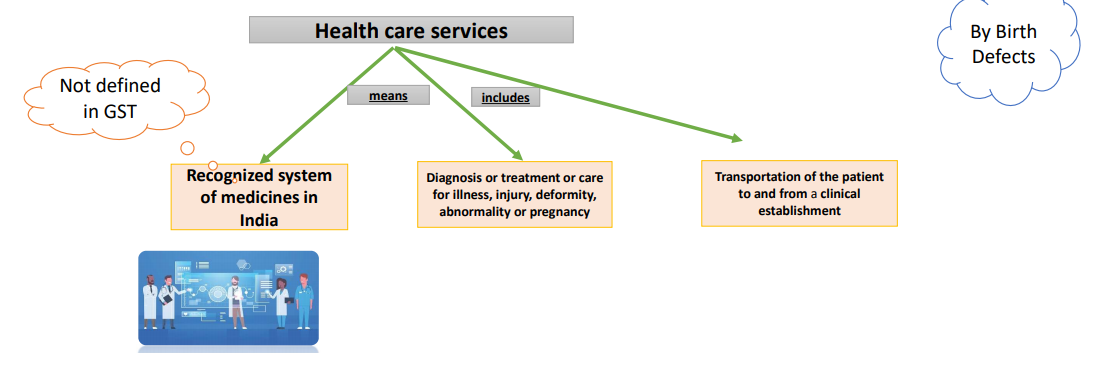

Meaning of Healthcare services

As per definition (zg) of Notification No. 12/2017- CT Rate

“Health Care Services” means

- any service by way of diagnosis or treatment or care for illness, injury, deformity, abnormality or pregnancy

- in any recognized system of medicines in India and

- includes services by way of transportation of the patient to and from a clinical establishment,

- but does not include hair transplant or cosmetic or plastic surgery,

- except when undertaken to restore or to reconstruct anatomy or functions of the body affected due to congenital defects, developmental abnormalities, injury or trauma;

Clinical Establishment

As per definition 2(s) of notification No. 12/2017- Ct Rate

“clinical establishment” means

- a hospital, nursing home, clinic, sanatorium or any other institution by, whatever name called,

- that offers services or facilities requiring diagnosis or treatment or care for illness, injury, deformity, abnormality or pregnancy in any recognized system of medicines in India,

- or a place established as an independent entity or a part of an establishment to carry out diagnostic or investigative services of diseases; Covers diagnostic centers

Related Topic:

GST Implication on High Sea Sales

2(k) “Authorised medical practitioner” means

- a medical practitioner registered with any of the councils of the recognized system of medicines established or recognized by law in India and

- includes a medical professional having the requisite qualification to practice in any recognized system of medicines in India as per any law for the time being in force;

Para medics are not defined in GST Law. But as per general meaning paramedics are trained health care professionals. Eg. Nursing staff, physiotherapists, technicians, lab assistants, etc.

Read & Download the full copy in pdf:

CA Aanchal Kapoor

CA Aanchal Kapoor

Amritsar, India

CA Aanchal Kapoor qualified in first attempt as chartered accountant in 2009 and is a practising chartered accountant for past 10 years in the field of direct and indirect taxes. With special focus on GST she has done extensive study on the subject with many certified courses and GST is one of her core competency areas. Since inception of her academics, she has been placed in the merit list at various levels as a rank holder in CA and Gold medalist in graduation. In pursuing her professional career in GST she is practically into this field and has delivered various seminars on GST in Punjab, Delhi and Mumbai to profession as well as industry.