Maharashtra AAR in the case of Security Printing and Minting Corporation of India Limited

Table of Contents

Case Covered:

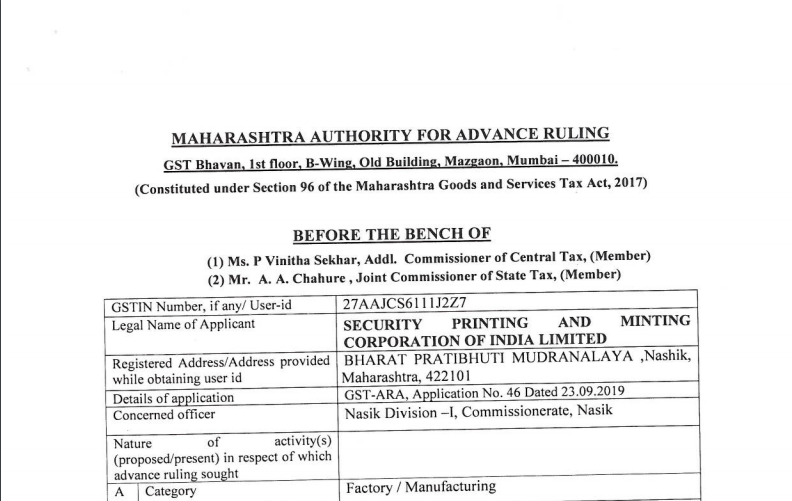

Security Printing and Minting Corporation of India Limited

Facts of the case:

The present application has been filed under Section 97 of the Central Good and Services Tax Act, 2017, and Maharashtra Good and Services Tax Act, 2017 [hereinafter referred to as the “CGST Act and MGST Act” respectively] by M/s. Security Printing and Minting Corporation of India Limited, the applicant, seeking an advance ruling in respect of the following questions.

Determination of application HSM code for the material ‘Heat Activated Ultra-Violet (HAUV) Polyester Film with Adhesive Coating and UV Printing.

Observations:

We find that the applicant wants to ascertain the correct classification of the said goods between two classifications submitted by them i.e. Chapter Heading 3919 and Chapter Heading 4911 of the GST tariff. The applicant has not given details of their products, etc. to support any contention. It is seen that the application is very curt and the request made by the applicant is to only classify the above-mentioned product.

During the course of the hearing, the applicant orally submitted that the said product is being imported by them under the Heading 3919 and the duties under Customs Act are discharged accordingly. However, the applicant wants to know whether the said goods can be sold by them under Heading 4911. The only reason for their application appears to be the lower rate of GST i.e. 12% under Heading 4911.

The description of goods under Heading 3919 of the GST Tariff, (Heading under which the subject goods are imported) is as follows:- “Self-Adhesive plates, sheets, film, foil, tape, strip, and other flat shapes, of plastics, whether or not in rolls.”

Order:

For reasons as discussed in the body of the order, the questions are answered thus-

Question. Determination of application HSM code for the material ‘Heat Activated Ultra-Violet (HAUV) Polyester Film with Adhesive Coating and UV Printing.

Answer:- The said product is classifiable under Chapter 3919 of the GST Tariff.

Read & Download the full order in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.