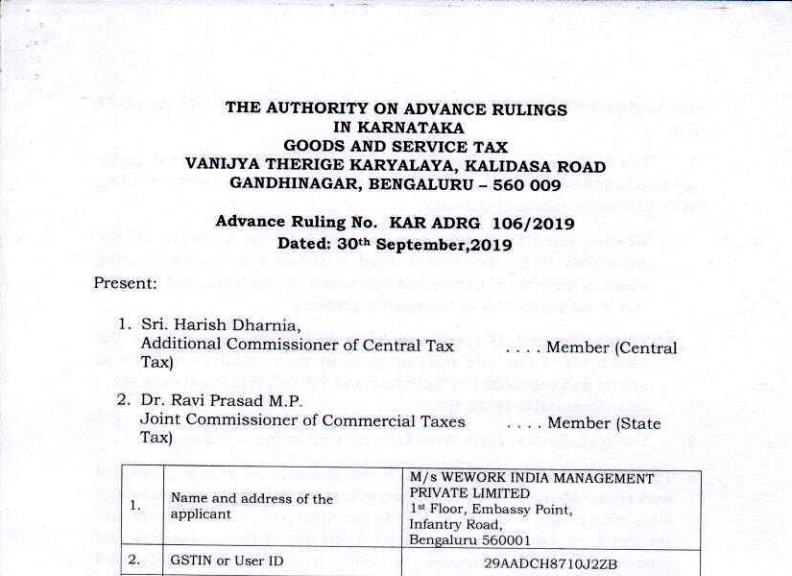

Karnataka AAR in the case of M/s. WeWork India Management Private Limited

Table of Contents

Case Covered:

M/s. WeWork India Management Private Limited

Facts of the Case:

The applicant is a Private Limited Company and is registered under the Goods and Services Act, 2017. The applicant has sought an advance ruling in respect of the following question:

a) Whether input GST credit can be availed by the applicant on the detachable 14mm Engineered Wood with Oak top Wooden Flooring which is movable in nature and capitalized as “furniture and fixture”, and is not capitalized as “immovable property”?

b) Whether input GST credit can be availed by the applicant on the detachable sliding and stacking glass partition which is movable in nature and capitalized as “furniture and fixture”, and is not capitalizes as an immovable property?

Observations:

Coming to the next issue of fixing of 14mm Engineered wood with Oak top wooden flooring, the applicant states that the wood used for flooring is attached by using a foam called polished streap foam and at ground level, a cementitious bare panel is erected using pedestals and thereafter, foam is used to lay the wood. The wooden flooring in this case can be easily detached and reused. This only adds to the value to the building and is not the sine qua nor for the office space, unlike the partitions. It is also pertinent to note that the wooden flooring which is detachable can be removed and replaced without affecting the office space. Further, there is no permanence involved in this fastening nor any damage is done to the property, either to the building or to the wooden flooring at the time of detachment of this flooring and hence it cannot be covered under addition or alterations to the immovable property in the strict sense and would not be covered under “construction of immovable property”.

Ruling:

- The input tax credit of GST can be availed by the applicant on detachable 14mm Engineered wood with Oak top wooden flooring which is movable in nature and capitalized as “furniture” and

- The input tax credit of GST is not available on the detachable sliding and stacking glass partitions.

Read & Download full decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.